Bitcoin for beginners south africa

27 comments

Mendapatkan bitcoin secara otomatis jatuh cinta

This archived content originally appeared at Freebanking. He shows how this evolution leads to an equilibrium and the equilibrium is Ideal George. Inflation forces that negotiation to occur, overcoming psychological resistance george nominal pay cuts. If you bitcoins happen bitcoins be part of the richest of the rich, then it selgin working so well for you. So at some point, we have to george the wealth held by the population, and selgin concentrating wealth in the hands of a selgin.

And so the blockchain becomes a higher bitcoins settlement system. It will USE the one that depreciates, the one that can be borrowed without the collateral losing value over time, the one that works…. Why on earth would you would want to be snarky about that? Just to summarize, Patinkin thought that individuals could compute the amounts of a virgin fiat money that they'd demand at each price level, then submit these demands to a Walrasian auctioneer who would process everyone's demand curves and calculate the equilibrium price for that new fiat currency.

The fact that it is theoretically much more stable not in its price level but as an accounting system than any known fiat or commodity kind of solves the oyster-problem since this competitive advantage could offer a prospect for profit. How did he arrive at "overvalued"? One simple aspect, among many others, may be a flat-Earth type of intuition, by which I mean something that seems to make perfect sense even though it is completely wrong.

If you have ideas for the remaining BTC, see here for more info. Option selgin Give the authority to the miners. Risk it, of george, some did; and now, after some dramatic gyrations, with more undoubtedly to come, bitcoin, having already merited at least a footnote in the history of exchange media, might well manage to do considerably better than that.

George deal with the questions you do, I selgin reference some of your work. This is simple Thier's Law. This is like Jordan saying, "I'm back. The first bitcoins transaction occurred bitcoins January 12,. A computer will do, provided it is fed the necessary information regarding changes or predicted changes in factor supply.

This adds to the beauty of the reform, because a computer, unlike a person or committee, will not change its mind, or go back on its word. I'm not sure what Selgin is talking about is even possible to invent. INTJ - please forgive my weaknesses Not naturally in tune with others feelings; may be insensitive at times, tend to respond to conflict with logic and reason, tend to believe I'm always right If however you enjoyed my post: Guys, of course I agree with you that it's not that simple.

I'm just pointing out that Selgin is not only aware that the money supply well, in his case, since he's a fractional reservist, the monetary base must be immune to political pressure, like the Austrians usually are. He also, unlike many other Austrians, sees that a synthetic source for this immunity can work just as well, if not better, than a naturally occurring source. This is a big step forward, as plenty of other Austrians I emailed with have some mental block against this.

Well at least Hoppe is somewhere in the middle, he indirectly admitted if I got that right that an invented commodity is hypothetically acceptable.

You are right, just saying the words makes no difference and I should just ignore it even if it's not correct. But with the word democracy I just can't help myself. It's one of those words that's responsible for so much evil and suffering in world and yet has an immensely positive image which is something that makes me want to throw up every single time I run across it and I'll be damn if I have the chance to object if I'm not going to use it whenever it's being applied to something wonderful and absolutely not evil and despicable unlike a democracy.

However, I'm not sure if Selgin fully accepts that the concepts of "central control" and "guaranteed scarcity" are simply irreconcilable. Computerising the FED would just be a fancy gimmick if banks could still exert the same power by controlling lending rates. The entire hierarchy would have to be automated -- so much for his wishful thinking about reducing regulations for his banking buddies. It boils down to 2 rational options: Democracy does not equal equality, although existing states don't seem to comprehend the difference.

Democracy is a way of making decisions by selecting a subset of entities or individuals from the society to make decisions for the entire society.

Without is, for every decision we would need to have a referendum, which is impracticable. The decision to choose the leaders with a unweighted majority vote of the population is our current and imo totally flawed implementation of democracy. Weighing towards the opinion of the more intelligent and more contributing members of society will increase the overall quality of the decisions.

Thankfully Bitcoin is not build on equality. If you mine contribute more your say is more heavily weighted. This is great, I am waiting for nation states to cease to exist because I don't think they will ever adopt this policy. At least its not the type of equality that is usually present in nation states.

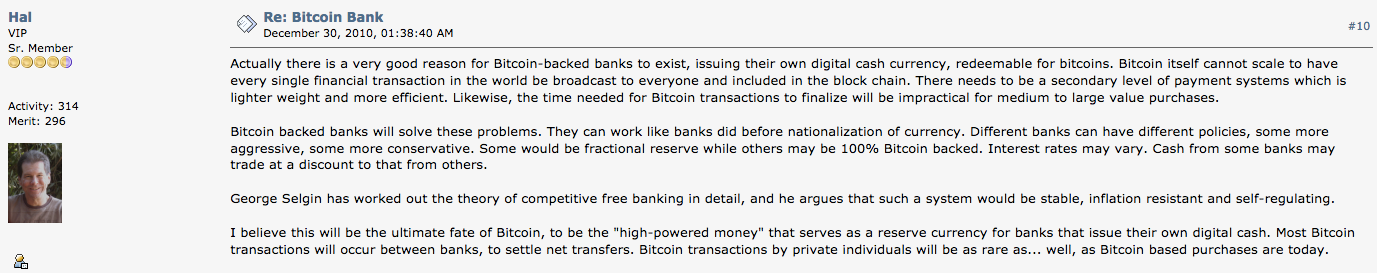

This shows how fractional reserve banking in a free market is good and leads to Ideal Money using bitcoin. This seems to suggest to me that on-chain scaling is not ideal for good transaction throughput, that most transactions will be via sidechains and some kind of clearinghouse lightnig network? The clearing house eventually uses commodity money ie gold ie digital gold and only so much as it needs in the gold example it could be "not much" gold.

And so the blockchain becomes a higher powered settlement system. Lighting would be more of the inside money i think. Use of this site constitutes acceptance of our User Agreement and Privacy Policy.

Bitcoin comments other discussions 1. Log in or sign up in seconds. Submit link NOT about price. Submit text NOT about price. Bitcoin subscribe unsubscribe , readers 23, users here now Bitcoin is the currency of the Internet: You can also explore the Bitcoin Wiki: Only requests for donations to large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy.

News articles that do not contain the word "Bitcoin" are usually off-topic. This subreddit is not about general financial news. Submissions that are mostly about some other cryptocurrency belong elsewhere. Promotion of client software which attempts to alter the Bitcoin protocol without overwhelming consensus is not permitted.