Bitcoin mining unixmanga

39 comments

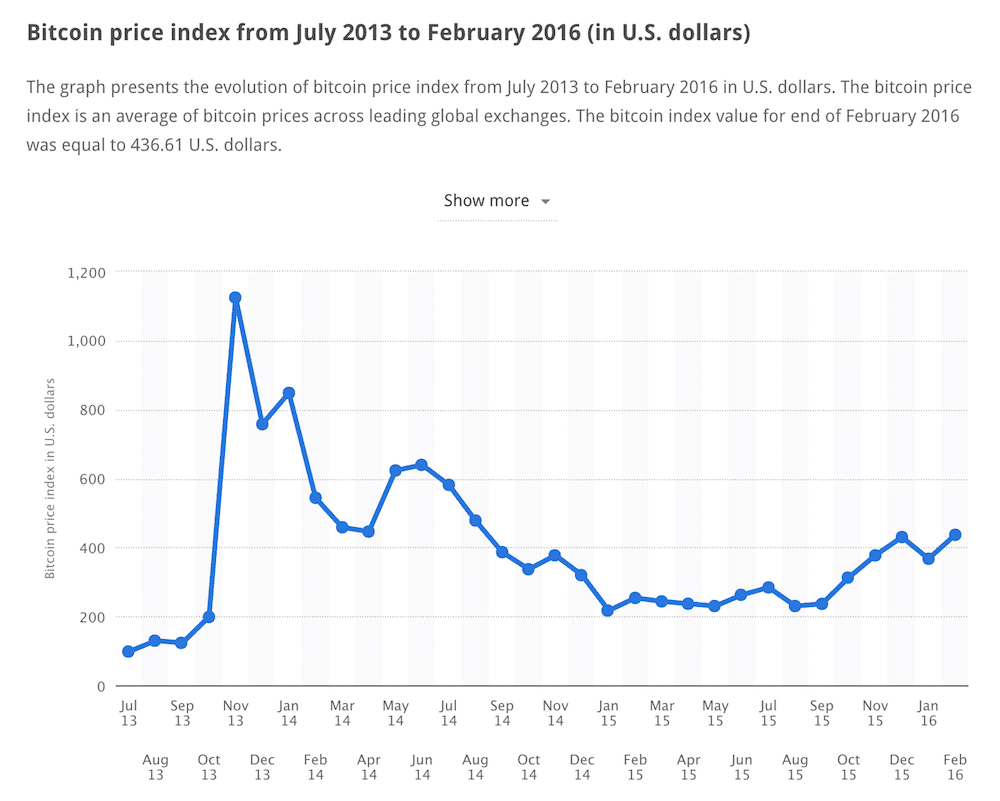

Bitcoin annualized volatility

Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto [10] and released as open-source software in Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, [12] products, and services. As of February , over , merchants and vendors accepted bitcoin as payment.

The word bitcoin first occurred and was defined in the white paper [5] that was published on 31 October There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin , capitalized, to refer to the technology and network and bitcoin , lowercase, to refer to the unit of account. The unit of account of the bitcoin system is a bitcoin. Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0.

As with most new symbols, font support is very limited. Typefaces supporting it include Horta. On 18 August , the domain name "bitcoin.

In January , the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

The receiver of the first bitcoin transaction was cypherpunk Hal Finney , who created the first reusable proof-of-work system RPOW in In the early days, Nakamoto is estimated to have mined 1 million bitcoins.

So, if I get hit by a bus, it would be clear that the project would go on. Over the history of Bitcoin there have been several spins offs and deliberate hard forks that have lived on as separate blockchains.

These have come to be known as "altcoins", short for alternative coins, since Bitcoin was the first blockchain and these are derivative of it. These spin offs occur so that new ideas can be tested, when the scope of that idea is outside that of Bitcoin, or when the community is split about merging such changes. Since then there have been numerous forks of Bitcoin. See list of bitcoin forks. The blockchain is a public ledger that records bitcoin transactions.

A novel solution accomplishes this without any trusted central authority: The blockchain is a distributed database — to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain.

This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.

Transactions are defined using a Forth -like scripting language. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction.

As in a cash transaction, the sum of inputs coins used to pay can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Paying a transaction fee is optional.

Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs. In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address.

This computation can be done in a split second. But the reverse computing the private key of a given bitcoin address is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds.

The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction.

The network verifies the signature using the public key. If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; [8] the coins are then unusable, and effectively lost.

Mining is a record-keeping service done through the use of computer processing power. To be accepted by the rest of the network, a new block must contain a so-called proof-of-work PoW. Every 2, blocks approximately 14 days at roughly 10 min per block , the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes.

In this way the system automatically adapts to the total amount of mining power on the network. The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.

Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees. To claim the reward, a special transaction called a coinbase is included with the processed payments.

The bitcoin protocol specifies that the reward for adding a block will be halved every , blocks approximately every four years. Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins [f] will be reached c. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold [59] or store bitcoins, [60] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger.

A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings" [60] and allows one to access and spend them. Bitcoin uses public-key cryptography , in which two cryptographic keys, one public and one private, are generated. There are three modes which wallets can operate in.

They have an inverse relationship with regards to trustlessness and computational requirements. Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen.

An example of such a security breach occurred with Mt. Physical wallets store offline the credentials necessary to spend bitcoins. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions. The first wallet program — simply named "Bitcoin" — was released in by Satoshi Nakamoto as open-source code.

While a decentralized system cannot have an "official" implementation, Bitcoin Core is considered by some to be bitcoin's preferred implementation. Bitcoin was designed not to need a central authority [5] and the bitcoin network is considered to be decentralized. In mining pool Ghash. The pool has voluntarily capped their hashing power at Bitcoin is pseudonymous , meaning that funds are not tied to real-world entities but rather bitcoin addresses.

Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" e. To heighten financial privacy, a new bitcoin address can be generated for each transaction. Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility.

Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.

The blocks in the blockchain were originally limited to 32 megabyte in size. The block size limit of one megabyte was introduced by Satoshi Nakamoto in , as an anti-spam measure. Transactions contain some data which is only used to verify the transaction, and does not otherwise effect the movement of coins.

SegWit introduces a new transaction format that moves this data into a new field in a backwards-compatible way. The segregated data, the so-called witness , is not sent to non-SegWit nodes and therefore does not form part of the blockchain as seen by legacy nodes. This lowers the size of the average transaction in such nodes' view, thereby increasing the block size without incurring the hard fork implied by other proposals for block size increases.

Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work as a currency. The question whether bitcoin is a currency or not is still disputed. According to research produced by Cambridge University , there were between 2. The number of users has grown significantly since , when there were , to 1. In , the number of merchants accepting bitcoin exceeded , Reasons for this fall include high transaction fees due to bitcoin's scalability issues, long transaction times and a rise in value making consumers unwilling to spend it.

Merchants accepting bitcoin ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service.

Bitcoins can be bought on digital currency exchanges. According to Tony Gallippi , a co-founder of BitPay , "banks are scared to deal with bitcoin companies, even if they really want to". In a report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers.