GDAX Review

5 stars based on

31 reviews

Coinbase was founded by Brian Armstrong and Fred Ehrsam inwith operations beginning in once they listed Bitcoin for open trading.

This review is not about Coinbase, but before we jump to GDAX, it is important to understand where it came from. Coinbase is a licensed and approved company in the US, and is one of the oldest players in cryptocurrency exchange market. Coinbase's rating is among the highest in the world, this is down to the trust it has built over time.

Let's find out in this detailed review of this newly formed cryptocurrency exchange. After starting its operations inGDAX received a mixed response from users. The founders of Coinbase aimed to launch GDAX as a dedicated platform for seasonal traders and expert users. The interface of GDAX is not as simple as many other cryptocurrency exchanges out there however this has not put users off as it continues to build a stellar reputation.

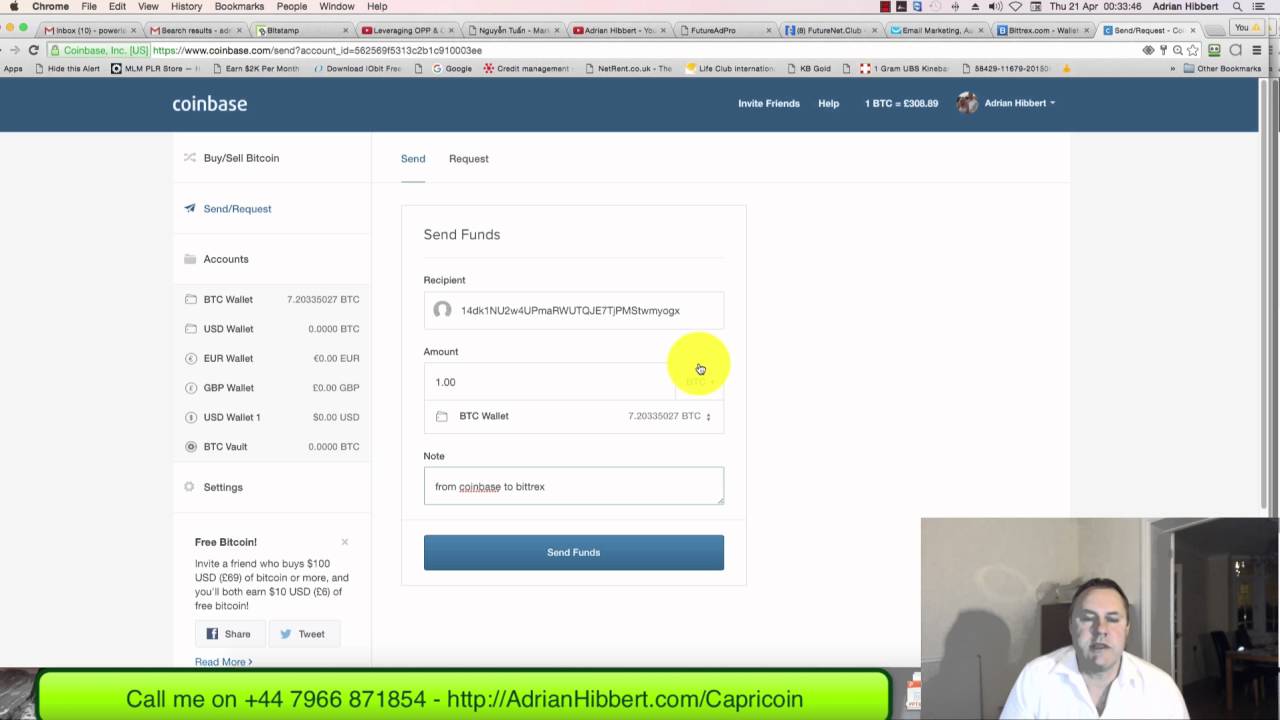

Another positive GDAX has is that it provides a seamless and smooth transfer of accounts from Coinbase. Account transfer might be smooth, but you will still need to transfer your cryptocurrency from one wallet to another to trade on GDAX.

If you have been using coinbase for a long time, getting used to GDAX would be an easy task for you. However, if you are a newbie, GDAX might pose a few extra issues with its interface being fairly complex. GDAX has limited support worldwide. It has an option for USA, UK and European customers to trade using their government issued currency, but this luxury isn't available to the customers from Canada, Australia and Singapore.

Sailing into the success-boat of Coinbase has made it easier for GDAX to receive a warm welcome from the users who wanted a platform with more flexibility and lower transaction fees. GDAX also gives its users a chance to bitcoin ethereum and litecoin speed test from usd on coinbase to btc on bittrex who wins their crypto-portfolio.

There might be many upsides of GDAX, but let's not ignore the downsides either. There are potential disadvantages that GDAX has, and some of them are. Being a sister-company of Coinbase, one of the most popular and oldest cryptocurrency exchanges of the world, GDAX has no compliance issues as such. However, it does not provide facilities and luxuries to all of its customers alike.

Or alternatively they must send cryptocurrencies from external wallets to begin trading. Market position of GDAX as of now is limited and slow, since it is a fairly new exchange in the world of cryptocurrencies. The total views on GDAX in the past six months are around 54 million, which is just a sixth of what Coinbase managed to get million.

The highest traffic it pulls from is USA While Kraken managed to constantly remain below 50 million in view-count, GDAX touched almost 64 million back in December when the price of Bitcoin soared sky-high. However, for new users it is very similar to signing up on any other cryptocurrency exchange. You need to provide your personal details and email ID, after which a verification link will be sent to your email.

Once you verify your account, you are free to add bank details to deposit funds. You can choose to skip this step if you want to deposit in crypto from an external wallet. For existing coinbase users, you just need to bitcoin ethereum and litecoin speed test from usd on coinbase to btc on bittrex who wins by using credentials of your coinbase account, and verify your identity by filling in the codes sent to you on your 2FA two factor authentication.

Once you are done, you are free to use the GDAX account almost bitcoin ethereum and litecoin speed test from usd on coinbase to btc on bittrex who wins.

However, there is a limit to withdrawals. GDAX gained almost instant popularity because it is a sister-company of Coinbase. The interface of GDAX cannot be called user-friendly for beginners, but for expert traders it is great.

Those who wanted a hardcore trading platform will love GDAX for its detailed layout and information rich interface.

GDAX allows cryptocurrency and Fiat currency pairs for trading. The best part about GDAX is its low fees. It has a maker-taker system and the makers have to pay zero fees for all their 'buy-orders', while takers pay a varying fee ranging from 0. The fee further depends upon the volume as well. If the volume is more, the fees would be less. Fee structure on GDAX also depends upon the trading pair.

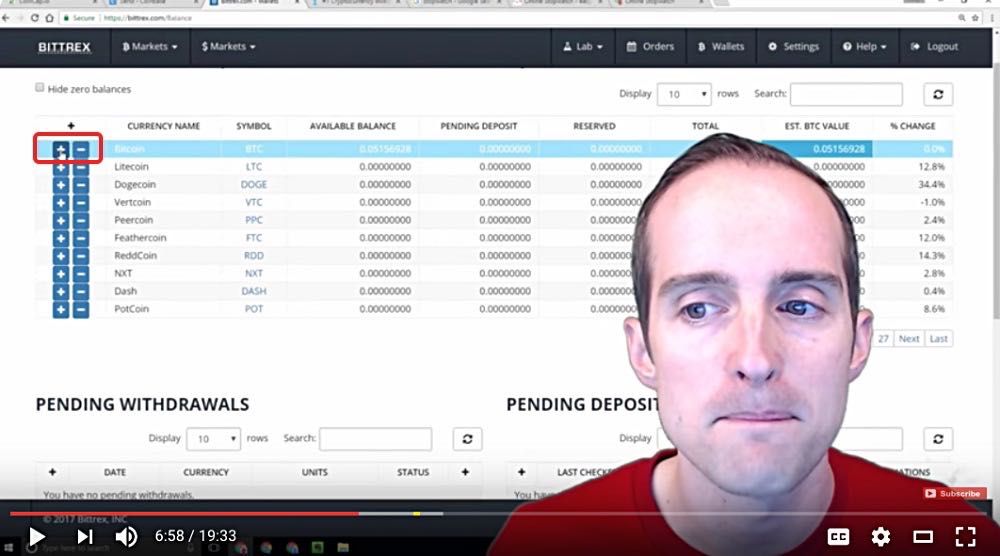

With less liquidity in some of the markets, it is hard to get an accurate price and so the exchange will look to cover itself on those where the volatility is very high. You can see the difference in the two images below.

There are users who have frequently complained about their grievances not being properly addressed, but there are customers who were happy with the instant support they received.

However, if you are still unable to find your query there, you can always send them an email, to which they typically respond between 24 to 72 hours. After the supreme-success of Coinbase, similar expectations were put on GDAX, but there are several shortcomings that have affected its growth and expansion. For now the platform is working fine for expert traders, especially as it allows margin trading.

This should give you a good basis to make a decision about choosing GDAX as your cryptocurrency exchange. Buy Bitcoin Now Rank. Buy Now Go to eToro eToro. Read More Buy Now. Thank you for submitting your comment for moderation. Notify of new replies to this comment.