Bitcoin miner asic prospero x19

19 comments

Best us bitcoin wallet

To continue reading this article, please exit incognito mode or log in. Visitors are allowed 3 free articles per month without a subscription , and private browsing prevents us from counting how many stories you've read. We hope you understand, and consider subscribing for unlimited online access. Some have said that its worth lies in a high cost of production. Others see it as simply a form of credit that allows the transfer of resources, which is why it can take the form of pieces of paper or even digital records.

Then there is the idea that a currency is worth whatever somebody is willing to pay for it given the limited supply. All these approaches run into trouble of one form or another. But their value has little relation to this cost. Today we get an answer of sorts, thanks to the work of Spencer Wheatley at ETH Zurich in Switzerland and a few colleagues, who say the key measure of value for cryptocurrencies is the network of people who use them.

The value of a network is famously accredited to Bob Metcalfe, the inventor of Ethernet and founder of the computer networking company 3Com. In other words, it assumes that all nodes can connect with each other.

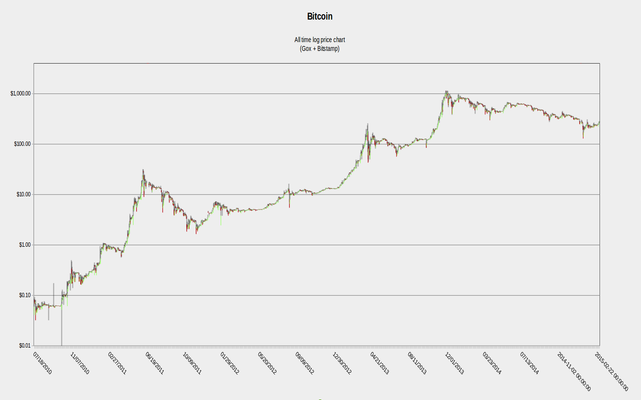

It also reveals when Bitcoin has been overvalued. Wheatley and co point to four occasions when Bitcoin has become overvalued and then crashed; in other words, when the bubble has burst. These events have been well documented. The first big crash occurred in when Mt. A crash in was preceded by the discovery of a Ponzi fraud involving Bitcoin. Another crash occurred in when high trading volumes overwhelmed Mt. Gox, causing it to collapse; the value of Bitcoin then dropped by 50 percent in two days.

The most recent collapse, at the end of , occurred after South Korean regulators threatened to shut down cryptocurrency exchanges. Sornette has long suggested that it is possible to predict the collapse of speculative bubbles using certain characteristics of the markets.

Indeed, readers of this blog will be familiar with his ideas. First, he looks for markets that are growing at a super-exponential rate—in other words, markets where the growth rate itself is growing. That can happen for short periods of time because of factors such as herding behavior.

But it is not sustainable without an infinite number of people. For this reason, a crash, or correction, is inevitable. This much is uncontroversial. But Sornette goes on to say that the timing of the crash is predictable. And this makes the market increasingly unstable, to the point that almost any small disturbance can trigger a crash. So in the Bitcoin crashes listed above, the triggering events are insignificant.

The situation is analogous to a forest fire. If the forest is dry enough to burn, almost any spark can trigger a blaze. And the size of the resulting fire is unrelated to the size of the spark that started it.

Instead, it is the network of connections between the trees that allows the fire to spread. Clearly, a prediction that Bitcoin is about to crash in the next few hours or days is much more powerful than a prediction that it will crash in the coming months or years. They put it, rather confusingly, like this: And that means there is uncertain weather ahead, at best. That sends a not-altogether-unexpected message to Bitcoin miners, speculators, investors, and potential regulators: Are Bitcoin Bubbles Predictable?

Become an Insider to get the story behind the story — and before anyone else. A new theory predicts the existence of an electronic device that works like an inverse transistor. It could make circuits, smaller, faster, and less power hungry. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events. Unlimited online access including all articles, multimedia, and more.

The Download newsletter with top tech stories delivered daily to your inbox. Technology Review PDF magazine archive, including articles, images, and covers dating back to Six issues of our award winning print magazine, unlimited online access plus The Download with the top tech stories delivered daily to your inbox. Unlimited online access including articles and video, plus The Download with the top tech stories delivered daily to your inbox.

Revert to standard pricing. Hello, We noticed you're browsing in private or incognito mode. Subscribe now for unlimited access to online articles. Why we made this change Visitors are allowed 3 free articles per month without a subscription , and private browsing prevents us from counting how many stories you've read. Facebook says it can protect you—but first it wants your most intimate photos.

Another arrest shows why no one can hide from the genetic detectives. Paying with Your Face: The Future of Work Meet the Innovators Under 35 The Best of the Physics arXiv week ending May 19, How the nature of cause and effect will determine the future of quantum technology.

Want more award-winning journalism? Subscribe and become an Insider. Print Magazine 6 bi-monthly issues Unlimited online access including all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox. Unlimited online access including all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox.

You've read of three free articles this month. Subscribe now for unlimited online access. This is your last free article this month. You've read all your free articles this month. Log in for more, or subscribe now for unlimited online access. Log in for two more free articles, or subscribe now for unlimited online access.