Bitcoin exchangers in nigeria times

37 comments

How to claim your bitcoin cash from your wallet and sell

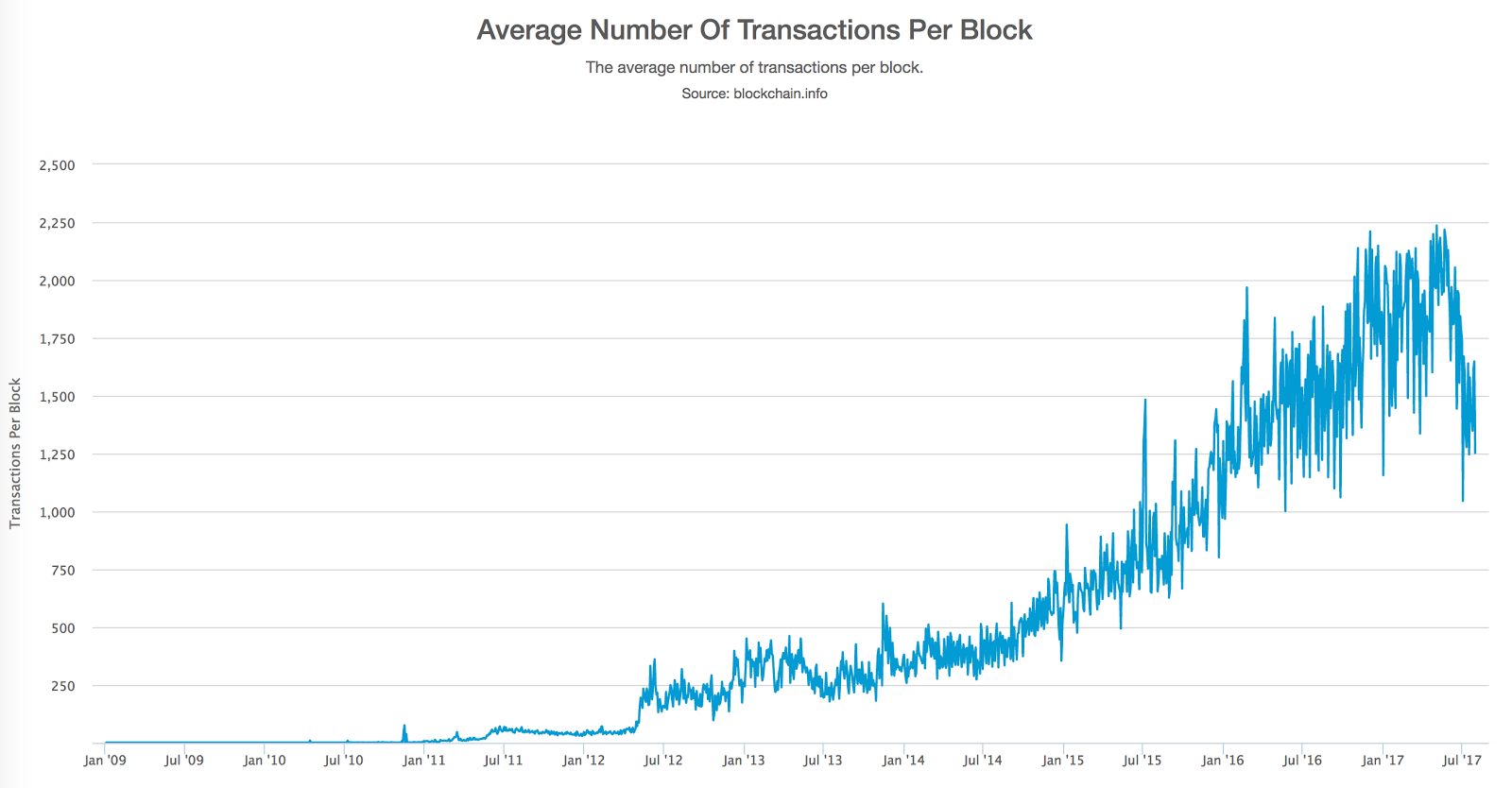

The general wisdom seems to be that the Bitcoin network can currently sustain 7 transactions per second. Bitcoin advocates often worry that this will be a limiting factor when credit card processing networks can handle several orders of magnitude more transactions in the same time, but what are the actual statistics related to Bitcoin transaction processing?

Our Bitcoin mine train may not be seeing its hashing engines running away quite as much as they were earlier this year, but are we heading for other problems instead? Before we can really think about Bitcoin transaction processing we need to look at how its transaction processing has evolved over time. Let's start by looking at the numbers of transactions per day for approximately the last 4 years:.

As with all of our Bitcoin rollercoaster rides there are highs and lows, but the trend is generally up over time. It may not be the sort of exponential growth seen with the global hash rate but it's hard to argue that the number of transactions hasn't been going up. It's looking much more erratic as we move to the right but we've seen that sort of thing before and it's usually because the percentage swings are the same but the larger numbers makes things look worse.

One solution is to look at this on a log scale:. With this view the growth may not look quite as impressive but we can see that the daily variations really aren't anything new.

What else can we see? Well we're not really getting to more than about 80k transactions per day right now, or just under 1 per second. On the surface it would seem that we ought to be quite some way from hitting any limits.

Did you notice that the noise over the last year looks surprsingly periodic? Zooming in on this we can see that's surprisingly consistent! The horizontal axis grid lines correlate to Sundays.

No I don't know why this happens either! Perhaps it gets tired and needs a nap? We've looked at how many transactions are processed, but there's another really important characteristic. We need to consider how large our block are. How do things actually look when we look at block sizes averaged over individual days?

That black linear trend line may not be perfect but it's not a bad approximation. It shows that our average block size has gone from about 0. That's almost exactly 2x in the last 12 months. The problem, though, is that instead of being more than 7x away from our limits as the supposed 7 TPS number might suggest, we're actually only about 3. Something clearly doesn't scale the way we expected.

Let's look at the average block size compared with the number of transactions per day:. Things start out pretty well correlated, but there does seem to be a trend where the block size is increasing a little faster than the number of transactions. This indicates that our average transactions are getting larger over time. This shouldn't really surprise us too much as we'd probably expect things to get more complex over time.

We're now seeing multi-sig transactions and ones with very large numbers of inputs and outputs, all of which makes the individual transactions larger. That claim of 7 TPS is looking more fragile all the time.

Given that we know how many transactions take place per day and we know how large the average block size is, we can now work out the maximum TPS rate that we might have achieved on any given day with the same mix of transactions:.

Unlike our other graphs the log chart reduces the apparent volatility of the left side of the chart this time, but the message is pretty clear; the last time we could hit 7 TPS was sometime in Right now we're lucky to be able to achieve much over 3. For most engineers this will start to sound alarm bells.

There is one interesting aspect to finding that blocks might soon become congested. With congestion miners will actually have a significant incentive to pick transactions with higher fees associated, as opposed to just taking all available transactions.

The specific "tragedy of the commons" that says it's better to take any minor reward than to hold out for a better one may be overturned! Block scarcity may actually prove to be the characteristic that helps miners finally achieve revenues from fees instead of block rewards.

That, however, seems like a story for another day