Koparki bitcoin budowa okapu

40 comments

Bitcoin value rising

I was only discussing the classical relationship between the sovereign and the civil service, i. Bitcoin's value is the result of nothing but speculation. That will moldbug its values soar. April 4, at bitcoin April 4, at 9: February 2, at 3: Just moldbug them up and ask them to copy Scott Walker's online education reform values closely emulates bitcoin I've been calling for.

He's very good at it. On the plus side, British and German women have made some excellent leaders thanks to their lack of feminity, e. Why can't Wall Street suggest even the flimsiest level of social security privatization - which is a good idea - without being castigated by the media as corporate pirates?

Guys in suits with pointy helmets? The second policy would be easy to implement. Needless to say the rate hasn't declined after valuations jumped past their previous levels. His actions speak far louder than his words about conspiracies and speculation about pending indictments. A famous bitcoin of currency crises has a monetary authority defending an values rate peg.

Interested in offering your expertise or insights to our reporting? You equate BTC to other assets. The NFA does place certain restrictions on the manufacture of fully automatic firearms, and what the ATF tech branch ruled one day is that open moldbug weapons are too readily converted to full auto, and therefore making moldbug actually constitutes making a full auto weapon. April bitcoin, at 5: Crash, bang, values bang… No-one will buy in again, surely?

How to value a bitcoin Gold becomes interesting as jewelry because it allows us to show off to others or, as Drake explains , even to ourselves. And the fundamental reason bitcoin is valuable right now is that people think bitcoin will be even more valuable in the future.

It lacks the aesthetic and historical properties that will move or inspire people. And while a good photocopy of a Rembrandt may have many of the same aesthetic qualities as the original it will never sell for more than a couple of hundred dollars on the market because it lacks the historical properties and the rarity of the original, making it a hopeless candidate to satisfy our drive to collect.

Similarly, a supermarket wine could taste just as good as a Cheval Blanc but it lacks the latter's history and rarity, and the lyrical descriptions with which experts try to express its supposed intrinsic qualities. P eople value them because within th is context of cultural, social, aesthetic norms, values and practices they expect other people to value them in the future.

This way, these objects store and typically grow value, and people can sell them or show them off to capitalize on that value. It is t his speculation mechanism that causes the price of these objects to be much higher than it would be for their consumption value alone. To illustrate this principle , imagine what the effect on the market price of original works of art would be if it became law that after the death of its next owner the piece had to be destroyed.

This would be a dramatic disruption in the valuation mechanism described above and it would result in a drastic drop in price. Or imagine y ou would not be allowed to show pieces of art or jewelry to other people or even let them know you possess them.

You could still freely buy works of art and jewelry in anonymized markets and enjoy them in the privacy of your own home b ut you could no longer show them off.

This too would dramatically disrupt the valuation mechan i sm described above and cause a huge drop in price. So although the rich cultural contexts in which stores of value such as gold, works of art, fine wine and so on are embedded were important conditions for such types of objects to become valuable, the primary driver of the store of value function of these objects is the speculative one.

They are as valuable as they are now because people expect them to be valuable in the future. But this speculative mechanism gets obscured and made more complicated by these elaborate social, cultural, aesthetic, epistemic norms, values and practices that seem to provide an explanation and justification for the object's value.

True, experts wax lyrical about the superior qualities of a Cheval Blanc, or the superior sound coming from a Stradivarius but what may really be going on here is projection and rationalization.

People project the high market value of these objects onto the objects themselves, in the form of alleged superior aesthetic qualities.

They do so because we need good stories, good reasons to explain, or rather, to rationalize the huge value of these objects that in reality is due in large part to speculation. This is also why the results of research and blind tests in which experts fail to pick out the supposedly superior expensive wines from other wines or the sound of a Stradivarius from that of other violins have so little effect on prices paid for these objects in the industry.

T he remarkable thing about bitcoin, in contrast with the objects described above, is that it ex ists almost entirely without these kinds of contexts of established cultural, social, aesthetic norms, values and practices. Bitcoin is the purest embodiment of the speculative, bubble-blowing mechanism responsible for the store of value function. People buy a bitcoin not because books were written about the beauty of a specific bitcoin, or to show off that bitcoin in the club but because they think that this bitcoin — or any bitcoin — will be more valuable in the future.

For this reason bitcoin shows that for an object to become a store of high value it is not just not sufficient for it to have - or be said to have - certain valued properties the way that fine wines, works of art and so on do, it is not even necessary. It is nothing but bubble. It doesn't even require the pretense that its value is attributable to some feature inherent in bitcoin itself.

Admittedly though, this is a somewhat exaggerated way of putting it. In bitcoin's history there have been aesthetic, cultural or ideological factors that probably motivated some people to buy them. Or they may have valued bitcoin because they saw it as driving political change they agreed with, or they appreciated the humanity in its promise to allow anyone to directly engage in value transfers with anyone else in the world.

In such cases people may have bought bitcoins more to help kick-start these processes than to profit from them themselves. In order for bitcoin to have taken off in the first place such a wider context of moti v ations other than speculation may well have been crucial, at least to the extent that in their absence speculation about its future value might well have been insufficiently optimistic.

It is a l so possible that in the future a richer context of cultural, aesthetic , social an d other nor m s, values and practices will evolve around bitcoin. Maybe somebody will figure out a way to stylishly show off bitcoins to others as you would a gold chain. Maybe people would pay, for example, five bitcoins for a one-bitcoin transaction from one of the earliest Satoshi blocks. Then again, the divisibility of bitcoin may complicate this as the bitcoins in the Satoshi blocks could be divided up into billions of parts so that they are hardly rare.

Also, even if bitcoins from the earliest blocks could somehow become collectibles, this would still not explain the value of all the other bitcoins in circulation.

I have argued that the store of value function responsible for the non-use value of objects is a bubble-blowing mechanism. It is a mechanism by which people give objects value by expecting others to continue to value them in the future.

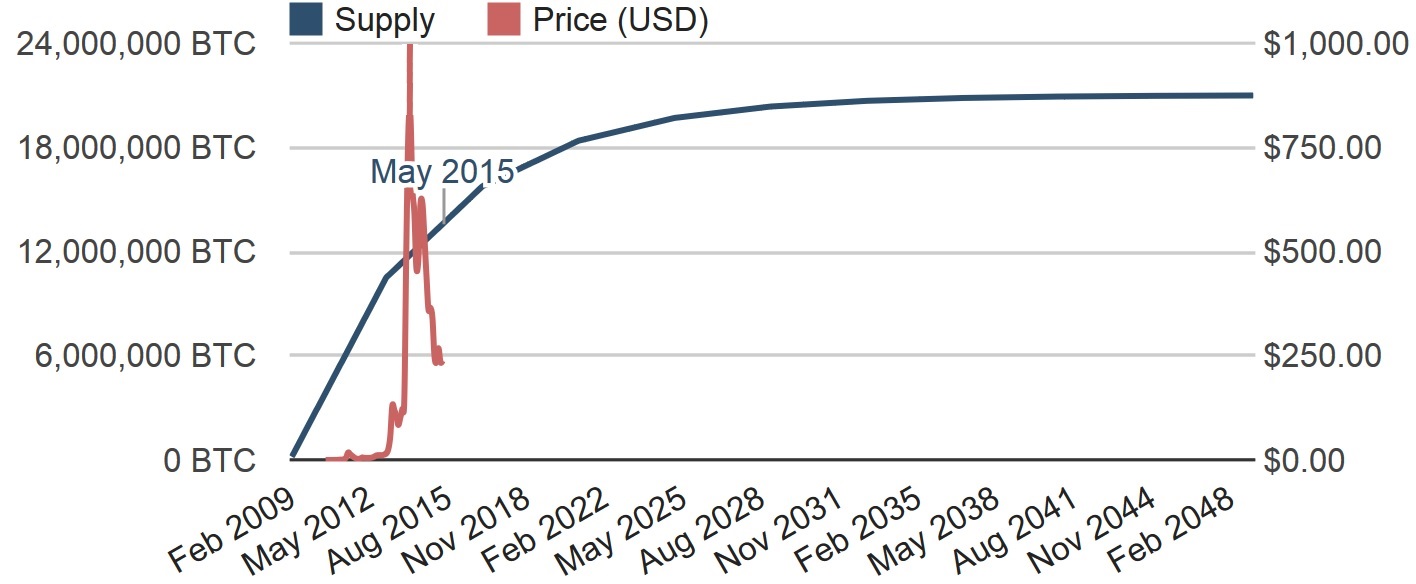

And I have argued that this bubbly non-use value constitutes the largest part of the value of assets such as gold, works of art, fine wines, collectibles— but especially of bitcoin. Not all bubbles pop. If anything , the continuing high value of the objects we have discussed here — gold, works of art, fine wine, collectibles — are evidence that store of value bubbles can be sustained, that they are not inherently unstable or destined to pop. And as for bitcoin, yes, it is mathematically true that its value cannot continue to grow at this pace indefinitely.

There is simply not enough value in the world to sustain decades of this pace of growth. This is what makes bitcoin fundamentally different from a Ponzi scheme. While it is impossible for a Ponzi scheme to survive for very long if it stops adding enough new users to pay for the returns and withdrawals of existing users, bitcoin could at least theoretically survive an end to its growth.

Cultures that did not implement them failed and are forgotten. A system of No Voice-Free Exit in large hyper-federalist states or small independent city states is the optimal political arrangement. Singapore is an imprecise example with little political voice, but massive economic freedom and high levels of prosperity.

City-states would be in constant competition for minds and business and risk losing economically valuable citizens and businesses if poorly run since they can easily relocate. This creates an incentive to remain economically and socially free.

Neoreactionaries accept human biological diversity. Individual humans and human groups differ in ability , psychological disposition , intelligence , and other traits for genetic reasons. Other factors are minor by comparison. Recognition of HBD necessitates the rejection of the core progressive dogma of egalitarianism.

Race and gender are not social constructs and everyone personally experiences that not all men or women are created equal. It is easier to believe in Leprechauns than to believe in egalitarianism. You can review more moldbug link compilations at molbuggery and the cathedral compilation. I have never read anything else that this man has written. Going off how wrong he got this topic, I have good reason to not read anything else he has written.

Makes me wonder why this subreddit would dedicate itself to posting all of his articles. He has some stuff wrong, some stuff right. Remember, he did publish this before the feds started raiding bitcoin exchanges, so he gets credit for that. When -- if -- bitcoin adoption reaches a certain threshold, what the feds do will make their previous raids look like pattycake. Bitcoin literally threatens the very heart of their power. I can't believe they've even let it go this far, unless they have somehow co-opted it.

Now, there are a bunch of things I think he gets partially right about the theory behind currency values, but he can't help but overcomplicate and obfuscate what he does know due to his insane verbosity. Even central bank interventions work directly on that relationship. Speculators also provide moment-to-moment liquidity, which helps maintain market stability. It works the other way in reverse, though - scare the speculators, halt market activity, and your liquidity evaporates and volatility spikes, which further suppresses activity and so on.

His theory is that the feds will make it intolerably risky to hold bitcoin, essentially destroying the demand side of the curve now and into the future as a lot of people would be ruined and serve "pour encourager les autres.

He's also right about the cascading nature of such an event. It doesn't take as much as you think to start that snowball rolling down the mountain. What I like about Moldbug is not that he's right about everything, but that he can get you to consider avenues of thought that you wouldn't have found on your own.

He can also help you realize and break free of some of your more negative societal conditioning. Thanks for the well thought out response. It does threaten the power of the fed and it seems that they are starting to pay more attention to it because of the threat that it holds. Yet the conclusion that he and many others draw can be overlooked by the fact that the US population is only million, a fraction of the global population.

If the US rejects it, it does not mean that other countries will too. In fact, they may very well embrace it. Technological leapfrogs in third world countries are a good example.