Bitcoin's Time Locks

4 stars based on

64 reviews

Bitcoin, having no discernible faults, comes equipped with several different time locks. These tools allow you to specify time-based conditions under which transactions are valid. Using time locks you make a transaction now that pays someone next week, add a mandatory waiting period for coin movements, set up complex smart contracts that flow across several transactions, or accidentally lock up your coins for centuries. Most of these time locks were added to Bitcoin quite recently.

They're built into the structure of transactions, and have more than a few idiosyncrasies left over from buggy code written by our favorite anonymous cypherpunk, Mr.

The corresponding Bitcoin Improvement Proposals BIPs are wonderful and detailed, but assume a lot of background knowledge. This is an attempt to compile all the information I can find on the time locks, and explain it in depth. Before we dive into the tools themselves, let's figure out how to describe their operation.

Time locks have three important attributes: Every transaction has multiple time cltv bitcoin value fields they're present even when not used. Scripts, on the other hand, can cltv bitcoin value zero or many time locks. In terms of functionality, transaction-level and script-level locks are superficially similar, but perform very different roles.

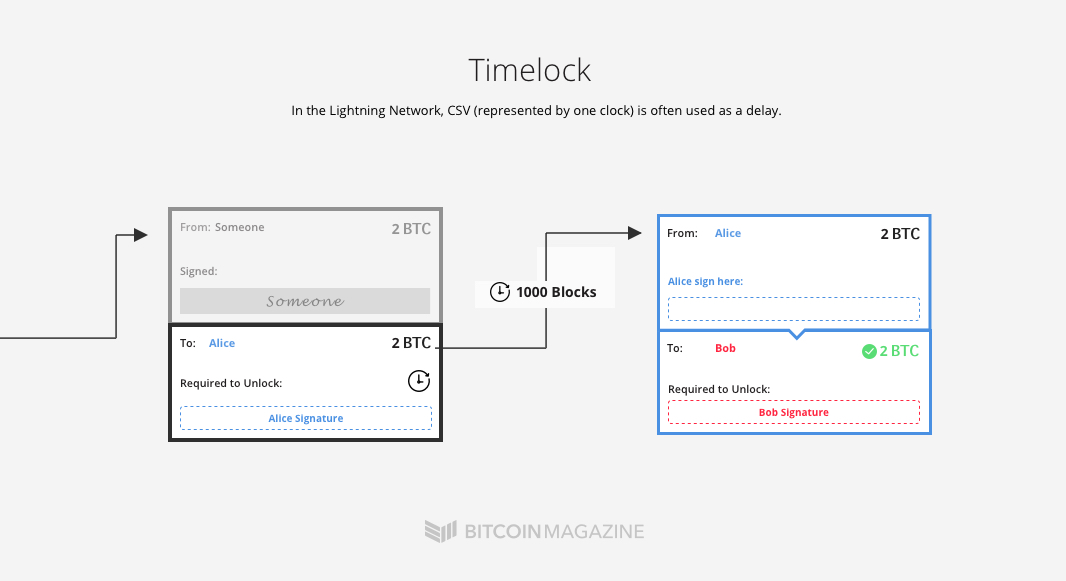

Transaction -level time locks cause a transaction to be invalid until a certain time, regardless of the validity of the signatures and scripts. Script -level time locks will cause script evaluation to fail unless the transaction is also locked. A failed script evaluation makes the transaction invalid. In a nutshell, transaction-level locks determine when a transaction may be confirmed, while script-level locks determine whether a given scriptsig is valid.

The major difference between them is what exactly they lock. A cltv bitcoin value lock constrains only a specific transaction. Think of transaction-level locks as future-dating a check: I can write you a check that becomes valid later, but the date applies only to cltv bitcoin value check, and I could spend the money other ways you don't know about.

Script-level locks sets conditions on all transactions spending an output. In other words, Transaction-level locks affect what you can do with a transaction after it's constructed, but Script-level locks determine what transactions can be made in the first place.

Transaction locks aren't as useful as you might think. They don't control coins, only spends. This provides a lot of versatility to P2SH transactions. Script-level time locks require that a corresponding transaction-level time lock is also included. Script-level locks rely on transaction-level locks for enforcement.

Rather than checking the time from within the script, script-level locks check the transaction's lock. This is elegant and economical, if a bit un-intuitive. The cltv bitcoin value checks that the transaction is locked at least as long as the script path. It treats the transaction lock as a guarantee that time has passed.

Well, really, they're both relative. You get to cltv bitcoin value arbitrary-origin-point-relative or previous-output-relative. But that's the kind of cltv bitcoin value pedantry I love.

When we time lock coins, we set a target for their release. Absolute locks define this target in terms of a set time. They pick an exact moment when the lock expires. Relative time locks define it as an amount of time elapsed since the previous output confirmed. It's the difference between "meet me at Transactions that are locked to an absolute time are invalid until cltv bitcoin value time has passed.

This means that I can make a transaction years in advance, sign it, share it, and even post it publicly with a guarantee that it won't be confirmed before its lock expires. I might use an absolute cltv bitcoin value to send money to my children or create a savings account that you can deposit to, but can't withdraw from cltv bitcoin value next year. Relative locks, on the other hand, mark a transaction invalid until a certain amount of time has passed since the cltv bitcoin value previous outputs were confirmed.

This is a subtle and powerful feature. The real beauty of relative lock-times is setting locks relative to un-broadcast, un-confirmed transactions. Once a transaction is confirmed, we can always set an absolute lock-time in its future. But to do that, you have to wait for cltv bitcoin value to confirm, and learn its confirmation time.

Or set up a long lock in advance, which becomes an expiration time for your entire smart contract. Relative locks can be set on un-confirmed transactions, meaning that you can create and sign an entire multi-step smart contract in advance, and be guaranteed that its transactions will confirm in the order you expect, no matter when you execute it. In Bitcoin, time is a consensual hallucination and lunchtime never comes.

Transactions can't exactly look at a clock on the wall, so we need to decide what "time" is. Bitcoin has two ways of measuring "time": These were implemented as modes of operation for each time lock, instead of full separate lock mechanisms. You can specify a number of blocks for the lock, or a number of seconds.

Both of these have their own complications. In practice, both of these metrics are accurate enough for real-world uses. But it's important to understand their idiosyncrasies. We often say that blocks follow a poisson distribution: But this isn't quite right. When hashpower is increasing, blocks come faster than expected. Hashpower goes offline or is pointed at other chains, blocks come slower.

Difficulty adjusts every blocks about every 2 weeks to target 10 minutes, but blocks can slip a significant amount from where you'd expect them to be due to network conditions, or just random chance.

Timestamps are just as finicky. You see, in Bitcoin, cltv bitcoin value doesn't always go forward. Due to consensus rules for block timestamps, time can sometimes reverse itself for a block or two. Or just stop for a minute. There are reasons for this, I promise. It pretty much always stays within a couple hours of "real" time. To make timestamp-based locks reliable in spite of this, they measure using 'median time past' MTP method described in BIP Rather than using the current block's timestamp, timestamp-based locks use the median timestamp of the previous 11 blocks.

This smooths out time's advance, and ensures that time cltv bitcoin value goes backwards. Now that we understand what we're talking about, let's talk about the tools themselves.

There are four time lock options right now: Two of them are script-level, two are transaction-level. A transaction is a simple datastructure that contains fields for version, inputs, outputs, and a few other things. It specifies a block number or time stamp. The transaction is not valid until that time has passed. Times are expressed as an unsigned 32 bit integer. If it is , or above, it's treated as a unix timestamp.

So nLocktime can lock transactions for a years using block numbers, or until ish using timestamps. And at this point we'd have to hard fork to change that. The cltv bitcoin value was that you could create a transaction with cltv bitcoin value lock-time, and then replace it by sending a new version with at least one higher sequence number. Miners were supposed to drop transactions with lower sequence numbers from the mempool.

If all inputs had the maximum sequence number, it meant there could be no more updates, and the transaction could clear regardless of the time lock. This was never fully implemented, and later abandoned. In a curios slip up, Satoshi seems to have assumed good behavior, which is not a reasonable assumption in Bitcoin. It's impossible to guarantee that miners will see updated transactions, or drop older version if they do see newer ones.

Miners will mine the most profitable version of a transaction, not the latest. Satoshi gave us lemons, and we made nSequence time locks. Sequence numbers have been around since the beginning. But because transaction replacement was never implemented and wouldn't have worked in the long run anywaythey became cruft. For years, the only thing they could do was disable nLocktime.

Now, sequence numbers are used to enforce relative cltv bitcoin value locks on the the transaction level as described in BIP This means that several different cltv bitcoin value lock conditions can be specified on the same transaction. In order for a transaction to be valid, all conditions must be satisfied. If even a cltv bitcoin value sequence lock is cltv bitcoin value met, the entire transaction will be rejected.

Bitcoin developers are amazing at upcycling, but sometimes you end up with a few knots in the wood. The sequence field is 32 bits, but we can't use all of them, as it would interfere with nLocktime and RBF signaling.

To balance these demands, nSequence was built to use only 18 of the 32 bits.