Gdax trading bot python

21 comments

Zcash miner mac

Moreover, as the end of the September approached, only a small fraction of customers had received their machines. According to e-mails sent out by Coumans, there was a problem with the air cooling of the chips, which he said should be resolved shortly.

According to a source close to MAT that wishes to remain anonymous, the company had been in trouble since June, months before it stopped pre-orders. The source suggested MAT had insufficient funds to cover other costs required to build the ASIC miners, such as the cost of software and additional hardware, and that MAT engaged in questionable activities regarding its cloud mining operations. This led to many of them asking for refunds, while some big customers even canceled their contracts with us.

Coumans told CoinDesk that he was unable to provide any further information at the time of publishing, due to legal reasons. Bankruptcy image [9] via Shutterstock. Bitcoin mining difficulty has decreased for the first time in two years. The difficulty level crossed the 40,,, mark late last month, peaking after several consecutive quarters of rapid growth. The 1,,, milestone was passed last December, while the last difficulty drop was recorded back in late The estimated next difficulty level is 39,,,, or The sheer size of the bitcoin network ensures resilience and stability, but the hash rate has been stagnant for weeks and started declining in the first days of December.

The network is still oversized given the average daily volume of bitcoin transactions, so stability and security are not a concern. The drop in difficulty and hash rate was expected due to depressed bitcoin prices. The advent of more efficient ASICs, coupled with low bitcoin prices, has obviously rendered a lot of mining hardware obsolete, prompting operators to pull the plug on older, less efficient facilities.

Power costs obviously have a natural lower limit and, unlike cost of hardware or power efficiency of hardware, cannot keep halving — no matter how efficiently sourced. Given this limit, we have expected difficulty would slow down in the short term or even go backwards as we have seen.

The network is reaching equilibrium and one of two things need to happen in order to reverse the negative output trend — the bitcoin price needs to go up or the cost of mining needs to go down. Bitcoin mining is a capital-intensive industry with very fast turnover. Few miners can afford to hold freshly mined coins for long, hence they are usually sold at market price, even if this means the operators incurs a small loss.

Profit simply has to be reinvested quickly in order to maintain competitiveness. Should the price recover, we can expect more investment in additional capacity and, if the gain is big enough, currently uncompetitive hardware could be put back to productive use.

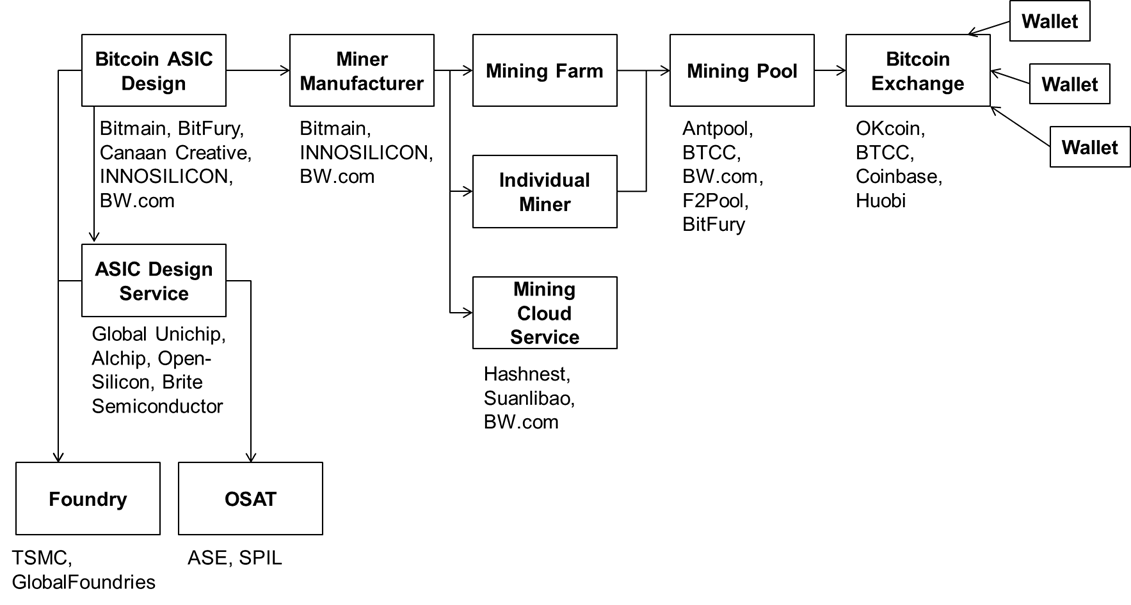

However, it is nearly impossible to predict bitcoin price trends and this factor remains an unknown. That is to say, with less investment and fewer people willing to pre-order new hardware, development will inevitably slow down. This is the first time bitcoin ASICs have had to transition to completely new nodes rather than use proven and mature manufacturing nodes like 28nm. This trend obviously favours bigger manufacturers, who have the resources to design, tapeout and order FinFET parts.

The first products based on FinFET [5] nodes are expected in the first half of the year, but, in an industry plagued by delays, it is difficult to ascertain exact timeframes for new ASIC rollouts. Charts via Blockchain ; feature image via Shutterstock [6] [7]. In a statement, the company said that it would be relying on solutions developed by its engineering team, noting:. The first Neptune chips [2] were manufactured a few months ago and the transition to the new process yielded a significant performance improvement over previous generation 28nm chips.

The 20nm Neptune features cores and consumes 0. The gains on the efficiency front are even bigger, as the company said the new Solar chips will achieve 0. Different chipmakers have different definitions of what constitutes FinFET manufacturing processes, but the aim of all these new processes is the same it has always been — to deliver better efficiency and superior performance.

Intel was the first chipmaker to start employing non-planar 3D transistors in commercially available chips, but these chips are referred to as tri-gate designs rather than FinFET designs. While Intel has been making inroads in the foundry business in recent years, the company does not lease its latest manufacturing processes to third parties. The company pulled in its 16FF process by roughly a quarter and now expects to commence volume production in the first quarter of TSMC was originally planning to start volume production in the second quarter.

The two companies said they should be ready to manufacture their first 14nm FinFET products by the end of , but the ramp-up comes later, sometime in Mature processes do not struggle with yield issues, and these issues tend to take a much bigger toll on complex, large chips such as high-end GPUs.

Yield issues mean that manufacturers simply get more faulty dies per wafer, pushing the unit price of healthy dies up. Bitcoin ASICs are a low-volume affair with a very short lifecycle, so any potential issues will most likely be outweighed by superior performance. Chips built using the latest manufacturing processes also tend to cost somewhat more than those built on mature nodes, but once again the price premium is outweighed by superior performance, even in consumer chips, let alone bitcoin ASICs.

At a time when many bitcoin hardware manufacturers are struggling and facing numerous challenges, Alchip [2] is doing rather well. Alchip helped design bitcoin mining ASICs for both firms, using 28nm and 20nm manufacturing processes. Bitcoin mining hardware companies tend to be very secretive, but the same is true of all chip companies, as they go to great lengths to keep unannounced products away from prying eyes. Stock exchange screen [5] image via Shutterstock.

Alchip ASICs [6] [7]. BitFury founder and CEO Valery Vavilov indicated that the new funding will allow the company to complete production of its 28nm ASIC chip without selling reserve bitcoins it has mined from its three industrial-scale data centres. Vavilov stressed in statements that the funding round, as well as the speed with which the capital was acquired, should do much to position BitFury as an industry leader in the bitcoin mining space, saying:.

BitFury further indicated it would use the funds to increase the capacity of its data centers to megawatts, a move it suggested would allow it to maintain its competitive edge in a transaction processing market that is developing at a rapid pace. As suggested by the company at the time, the megawatt goal would do much to ensure it remains a leader in the bitcoin mining space.

BitFury announced in September that it is seeking to achieve energy efficiency of 0. At the time, BitFury noted that it was focusing on the energy efficiency of its chips, as the metric is key for determining the cost of bitcoin transaction processing, impacting capital costs and operating expenses. The bitcoin mining industry has witnessed massive change over the past two years. Technology is the first problem. Yet progress is slowing down due to a number technical limitations plaguing all chipmakers.

The second problem involves economics. It is more down to earth, but it is closely related to chip design and manufacturing. Bigger chips manufactured on relatively immature processes tend to be costlier to produce and develop. The first technical challenge can be described as the thermal barrier.

At the same time efficiency becomes an even bigger problem. However, they cannot keep evolving and developing at the current rate. This approach involves more spending and development than a transition to a new manufacturing process and it usually does not yield the same performance or efficiency increase. ASIC designers tend to keep a lot of information away from prying eyes. ASIC makers reveal some basic specs, such as the number of processing cores and the size of the chip package, but they do not paint the full picture.

Demand, caused by ever higher difficulty, is outstripping development. In roughly the same period the difficulty shot up from about 65 million to 27,,, on 31st August. The old approach no longer works, as illustrated by hash rate trends in late August and early September. This is the focal point; this is where technology and economics intersect. It can be maintained through additional investment in industrial-scale mining operations, but only in theory.

The days of high yields and ROI measured in weeks rather than months are over. Technology simply cannot evolve at a rate that would enable such growth in the long run without additional investments. Thermals and efficiency are becoming a big problem. If the price does not go up they could end up making even less. If it goes down, pulling the plug is another option, as miners will run their hardware at a loss for long.

This figure does not include operating expenses, cost of capital and investments in next generation hardware. Energy costs are another constant. They are more likely to go up than down, forcing miners to migrate to regions with abundant, cheap electricity [2]. Iceland and Scandinavia have already attracted a number of mining operations. This trend will inevitably lead to even more centralisation. The cost of keeping the network running is going up, but the returns are not.

This does not include just individual miners, but small mining companies as well. Therefore we expect to see more consolidation and diversification moving forward [3].

So will the network continue to grow more powerful? There is no straightforward answer as nobody can estimate the price of bitcoin over the next few quarters.

Should the price remain stagnant, we could even start to see a drop or at least a stagnation in the hash rate. The difficulty has gone up three times last month, going up from 19,,, to 27,,, in under 25 days.

Each increase was followed by a sharp but brief decline in the hash rate, which was compensated for in the days following each increase. Big difficulty increases past the 20,,, mark clearly affected a large part of the network, rendering many miners obsolete overnight. They were replaced by more efficient units that kept the hash rate up, but in turn they also increased the difficulty, creating a vicious circle that will claim even more obsolete hardware in the near future.

Image [6] via Shutterstock. New funding and expansive initiatives are pushing the boundaries of the mining sector and opening doors for both recent entrants and established heavyweights.

Today the bitcoin network hash rate stands at nearly petahashes per second, according to Blockchain [1] , with the difficulty resting just below 17 billion. Cybersecurity entrepreneur and FireEye [2] founder Ashar Aziz is investing an undisclosed sum in the California-based company. Aziz remarked in a press statement that becoming involved with bitcoin is part of a broader shift to a safer, cryptographically enhanced digital economy, saying:.

Since its formation two months ago, PeerNova has emerged on the global bitcoin stage as a leading voice. Bitcoin mining hardware manufacturer BitFury has announced the creation of BitFury Capital, a new seed investment initiative that will fund nascent companies in the bitcoin space. The company is actively seeking partners and fund participants, with those interested being invited to apply, according to a 9th July press release [5]. In a statement, BitFury [6] chief executive Valery Vavilov said that the company wants to use its weight to provide support to other parts of the bitcoin market.