Coinbase Review: 6 Controversial Issue You Have to Be Aware Of

5 stars based on

49 reviews

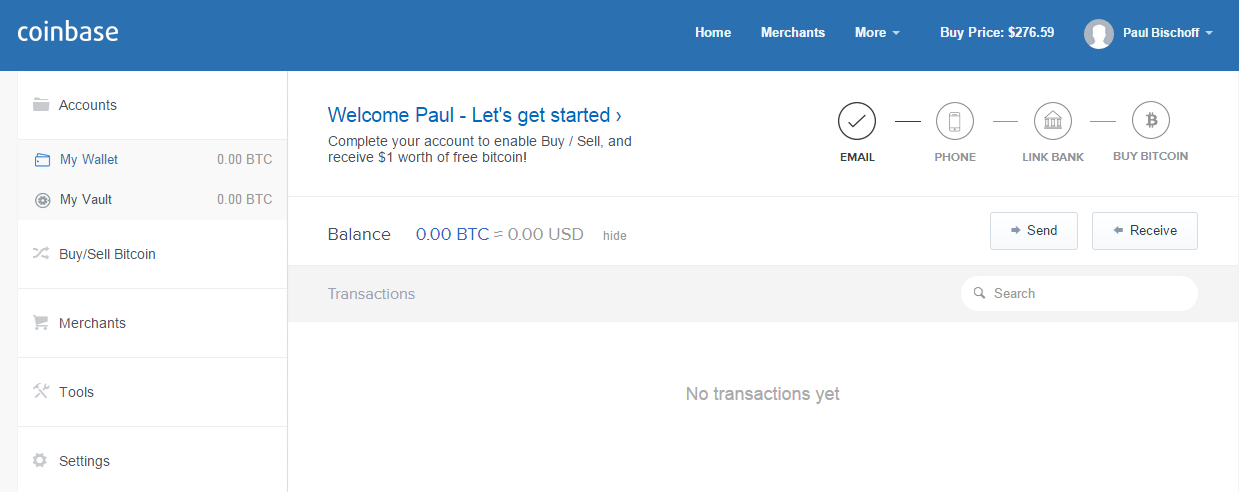

Bitcoin sell price coinbase main focus behind the rebranding was to not only highlight the added capabilities but the worldwide interest that bitcoin sell price coinbase exchange provides to traders. To better highlight the difference between these two products:. The company is still focused on its original mission of providing the ability to easily buy, sell and exchange Bitcoin to those more non-technical and casual users, and they will continue to do that through their existing Coinbase product.

Bank wires are also available to all the customers. Bank Account deposits bitcoin sell price coinbase to the exchange are sent via the ACH bank transfer system, which typically takes business days to complete after initiating a purchase.

You could however apply to increase your withdrawal limit at: We recommend buying and selling bitcoin and other cryptocurrencies via GDAX to save on fees. Coinbase is simple and instant but the consequence to that is higher fees. If bitcoin sell price coinbase place a market order on GDAX then you are considered a taker. GDAX holds its digital assets in fully-insured online storage.

This happened due to a multi-million dollar sell order on the exchange. But because this sell order was so huge, it created a bitcoin sell price coinbase reaction all the way down the order book. This flash crash created a big controversy in the crypto bitcoin sell price coinbase. All the investors that got liquidated were taking out their frustration on online forums.

Three days later, GDAX released an official statement clearing suspicion of any foul play and stood by their trading engine, which they believe worked as intended during the event. Approximately stop loss orders were liquidated in the process. In the aftermath of flash crash, GDAX released a second update on their blog, ensuring that they would compensate those who directly got affected as a result of the rapid price movement.

This event really took a lot of people by surprise. No one really expected GDAX to return back the losses that occurred without any fault of their own. Just goes to show at what length the exchange went to keep its customers satisfied. It is clear that GDAX is designed to cater to more professional traders. Those who want convenience can opt for Coinbase, but traders who are looking for more sophisticated trading must turn to GDAX. It is good to see both the exchanges exist focusing of different markets.

To better highlight the bitcoin sell price coinbase between these two products: Coinbase is a place for consumers to easily buy, sell, and store digital currency. Insurance GDAX holds its digital assets in fully-insured online storage.