Mining for bitcoin explained

22 comments

Mineracao em nuvem bitcoin

Recently over dinner, I was asked to explain bitcoin mining, and I struggled as it is entangled with a number of other concepts. Wait for it to be mined in a block average 10 mins. Miners take the list of unconfirmed transactions specifically, those that they know about , and they bundle them into a block, which is just a list of transactions plus some other data. If they guess right, then the block is published to the rest of the network.

The computers on the network validate that the block meets the criteria, and then ignore it or store it into their blockchains. The competition then starts again with the unconfirmed transactions that have accumulated since. The network adjusts the difficulty of the guessing game to target a block being created every 10 mins or so, irrespective of the amount of computing power in the network.

Wait for more blocks to be mined on top average 10 mins per block. The current advice suggests that after 6 blocks, the chances of the transaction being unwound due to a competing longer chain replacing your blocks is very small. If you are receiving a payment, then the higher the value your payment, the longer you may want to wait to reduce the chance of your payment being unwound. There are two parts to this. First you need a way to get transactions into the ledger, secondly you need a way to make it expensive for miscreants to add dishonest blocks.

Transactions are added to the ledger in blocks so as to create some sort of time order to the transactions. However, the guessing game makes it computationally expensive therefore financially expensive to add blocks. This cost acts as a deterrent to miscreants who would otherwise want to add their dishonest blocks. When you mine a block, get to collect any voluntary transaction fees from the transactions you have included.

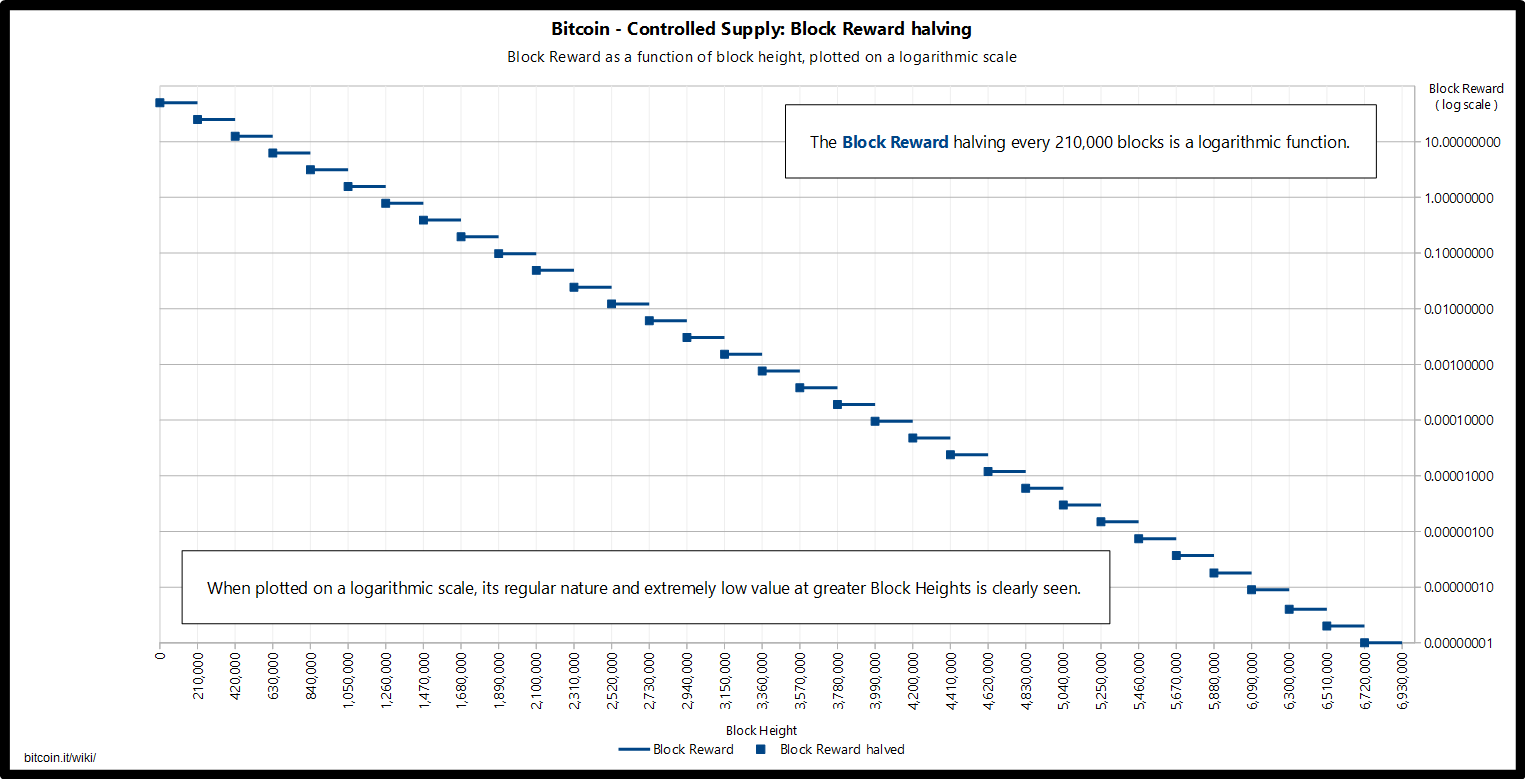

The reward decreases with time, and in theory, transaction fees will replace the block reward. If there are more unconfirmed transactions than can fit in a block, rational miners will mine the ones with the highest transaction fees first. A hash is a fingerprint of data. Hashes look random compared with the data put in. You can play with hashing here: If you change just one part of the data, the hash looks entirely different. I added a question mark:.

Adding or changing just one characters results in a totally different-looking hash. What does the hash of this look like? I kept going, and to find something that gave a hash starting with a double zero, it took attempts:. Bitcoin mining is essentially the same game, where you tweak the input data the block header so that you get an output hash that matches what is required by the network at that point in time.

Satoshi Nakamoto, the proposer of bitcoin, recognised that if you want lots of people to spend hardware and energy creating this network, you need to incentivise them: The white paper is here , and well worth a read. How do you pay anonymous participants, without creating some sort of power structure? Any source of funding provided by some entity e. Satoshi realised that an intrinsic source of funding, where a payment is paid by the system rather than by any external party, would be the answer.

This is why miners are paid by the system, in tokens which have a value that is related to the size and security of the system. Theoretically, the more valuable the tokens become, the more money can be spent mining, leading to an increase in security and an increase in the value of the network.

You just need to download some software and run it. Your computer will then start taking transactions that it receives through the bitcoin network, and it will bundle them into blocks, and start mining the block. Your chance of mining a block is somewhat proportional to the amount of computing power you throw at it, because mining is a guessing game, and faster computers guess more quickly. In practice, successful miners form groups, or pools, and combine their processing power.

If they win a block, the reward gets shared between participants. This is similar to forming a lottery syndicate, so you win less, but more often, and your income becomes lumpy. So despite the rhetoric of bitcoin being decentralised, it is controlled by a handful of people in China. See this Financial Times article for further reading: Mining is mainly done by Chinese pools. In , at first people could mine successfully on their laptops and home computers, using the CPU Central Processing Unit to do the calculations.

This was the next revolution in hashing power, starting in I recommend this article which describes the history of mining better than I can: Other nodes will reject this, which is why it is important to confirm a transaction across a number of nodes. With transactions, the effect a dishonest can have is very limited.

If the rest of the network is honest, they will reject any invalid transactions coming from the baddie, and they will hear about valid transactions from other honest nodes, even if the miscreant is refusing to pass them on. With blocks, if the miscreant has sufficient block creation power and this is what it all hinges on , he can delay your transaction by refusing to include it in his blocks. This lets him unwind a transaction. To conclude, bitcoin mining is the theoretically decentralised process where anyone can add a block of transactions to the bitcoin blockchain, without needing permission from any authority, and get paid in bitcoins for it.

It is made deliberately difficult, using proof of work as a defence against Sybil attacks. These articles are helping me a lot in understanding bitcoins and blockchain. Many thanks for all the useful, helpful information you have in this article, and across the site.

Hi Sean, yes you can mine for any amount less than the limit and it seems to have been done before. You are commenting using your WordPress.

You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email. How to double spend. Thanx for your work. Absolutely brilliant series of articles — many thanks! Can someone be outside of a pool and mine for rewards smaller than Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public.