Can you mine dogecoin with asic

46 comments

Side chains blockchain bitcoins

If you've seen the incredible upward momentum of Bitcoin, Ethereum, and other cryptocurrencies, you've maybe also considered getting in on the action. Now, you're gonna learn how. But first, a disclaimer: Bitcoin, Ethereum, and so many of the other cryptocurrencies out there can be a way to pay for stuff online, sure.

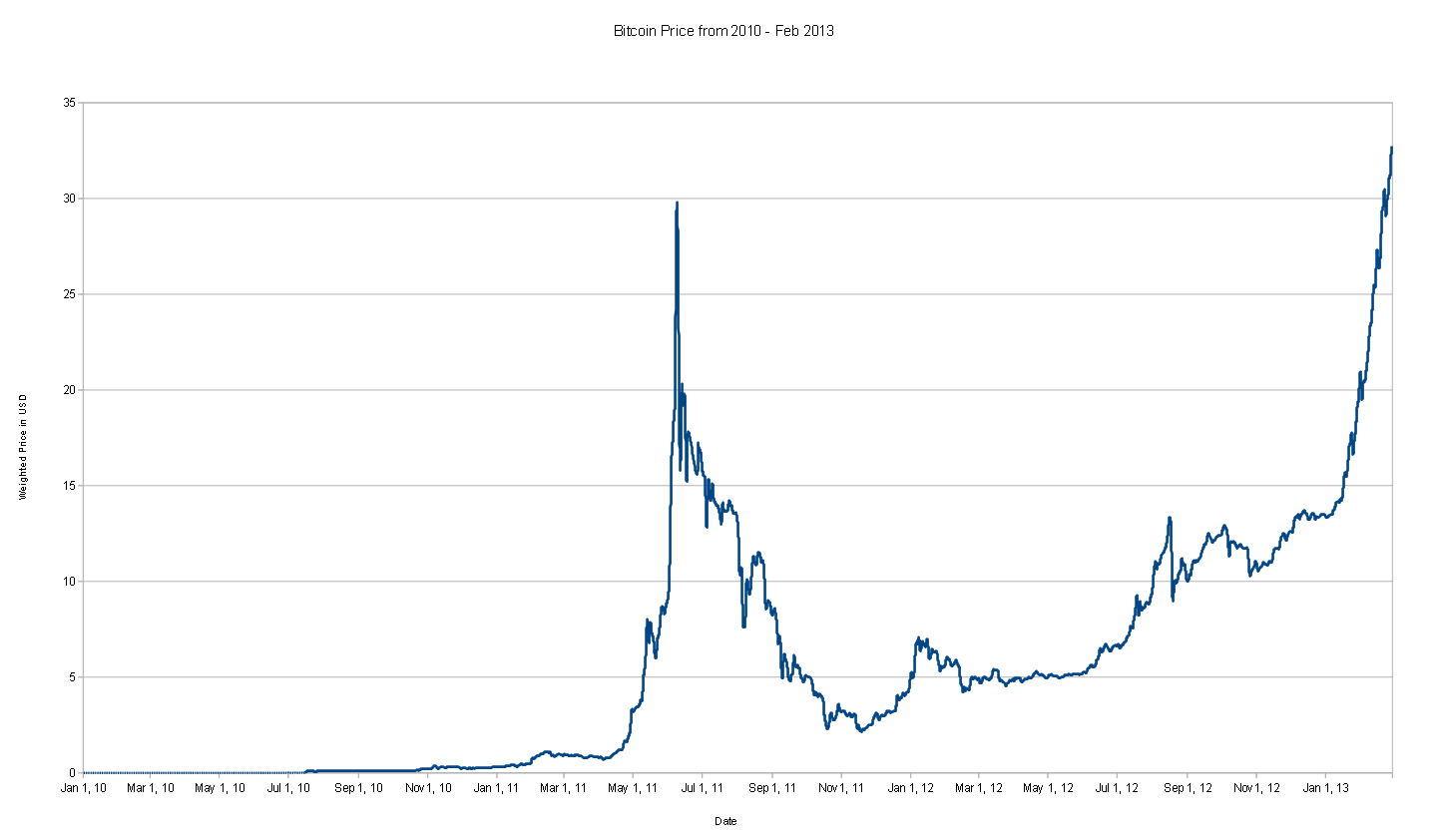

And they can also be if they aren't already more popular as investments. And investments, you might know, can go up and down. You can gain money on them, or lose it. And those values can fluctuate wildly, as you might've also seen lately.

To put it simply: We're not here to tell you whether or not you should buy it, just to show you how you can pull it off. That said, the rise of cryptocurrencies are an exciting moment for technology, and even if you don't want to actually buy any, it's worth knowing how it all works. Just like depositing money in the bank or buying a stock, you keep your cryptocoins in a digital account known as a wallet , which lets you store, receive, and send them. But it's a bit more complicated than that, and there's some serious notes of precaution to be aware of with a wallet.

Cryptocurrency won't just magically appear in your wallet out of thin air. You've gotta buy it, first. There are several ways to do that, but the easiest is to exchange a fiat currency—dollars, euros, pounds, etc—for some cryptocurrency. And the easiest place to do that is at an exchange. Think of a cryptocurrency exchange as a stock market for crypto. You register for it, deposit your fiat currency of choice, and then, you can buy yourself some crypto. But the cryptocurrency market is still fairly new—and it's not bound by the same laws and regulations as the stock market.

So before you do anything else, remember this: The cryptocurrency markets have matured in recent years, but there's still a lot that can go wrong. There are scammers out there, aiming to separate you from your money. Software errors could theoretically wipe out your store of bitcoin. And there's always the possibility of user error i. Hackers can also break in and steal it. One of the largest bitcoin exchanges, Mt. Gox, has had some of its bitcoin stolen, and it went bankrupt in Many users who had their bitcoin in Mt.

Gox are still waiting to get it back. It eventually recovered and reached new heights, but it took a while to get there.

And yes—things have changed since Mt. There are well-funded exchanges out there, backed by well-known VC funds, overseen by regulatory bodies like the New York State Department of Financial Services. None of this guarantees your money as totally safe, though. Same with the new, decentralized exchanges that are coming—exchanges which promise to keep your money safe, by means of technology instead of authority.

We'll come to see how well they work. If you're looking for your first exchange , you could do a lot worse than Coinbase , a U. Coinbase lets you deposit fiat money from a bank account, and trade Bitcoin, Ether, and Litecoin. And while there are hundreds of cryptocurrencies, these three are a very good, core trio.

Each shows a lot of promise, each in its own different way. Coinbase is pretty simple. You're never going to see stuff like cryptographic keys or QR codes, which may be intimidating to beginners. But Coinbase isn't without its drawbacks. For one thing, you don't have access to your private cryptographic keys—in other words, you don't actually control the cryptocurrency you have on Coinbase so much as you give it to Coinbase for safekeeping.

Coinbase also charges some fairly big fees on transactions. Finally, there's a pretty long list of complaints on various crypto-related forums about Coinbase freezing customers' funds for dubious reasons. Coinbase also lacks advanced options such as stop-loss orders or margin trading.

If that's what you're looking for, take a look at also U. Another alternative is the Luxembourg-based Bitstamp , which has been around for more than five years and has successfully navigated through many dark periods in Bitcoin's history.

Bitfinex is another large exchange, although it was subpoenaed by the U. First, you register with a username and a password, as you would with any other online services. Then, you'll probably be required to send some proof that you are who you say you are—an ID scan, for example. You don't want to trade at an exchange that accepts just anyone, as that'd likely indicate that the exchange isn't audited to a high standard. Once you've done that, you'll need to send some funds.

On Coinbase and Kraken, the easiest way to do that is to follow the instructions on how to transfer the money from your bank account. In most cases, it'll just be a standard wire transfer, and you can probably get help at your bank if you're unsure what to do.

In this example, I'm about to buy a euros worth of Ethereum. This will cost me an additional 2. Then, you put in a buy order. You choose how much money you want to spend, and which cryptocurrency you want to buy.

Congrats, you just became the owner of some digital money. Selling is similar, and both buy and sell orders will cost you a little, so don't do it just for fun. The exchange might have fees of its own, too, and exchange rates vary considerably from exchange to exchange. Before you open an account and buy your first cryptocurrency, you need to think long and hard why you need it in the first place. If you're here to trade, then just leave it on the exchange or leave just enough so you can trade at volumes you're interested in.

All cryptocurrencies are extremely volatile, and you should be prepared to lose a large percentage of value in a flash. However, the volatility is a risk you need to take if you're interested in trading. Day traders, who typically buy and sell many times during one day, have various way of mitigating risk, including never leaving an open position and using stop-loss orders. It's very much not recommended to try to guess the market's sentiment in very short time frames, as it's extremely hard to do unless you're an expert.

Again, you can just leave your money in the exchange, but that increases the risk of getting swindled by the exchange itself, or a hacker breaking through its security. This risk gets smaller by the day, but it's real. There's a couple of things you can do to minimize that risk, most of which are obvious for example: Also, some exchanges such as Coinbase offer the service of a "vault," which lets you store your bitcoin in such a way that it takes a longer period of time and multiple checks for anyone, including you, to access it.

Alternatively, you can send your crypto to a wallet that you control. There are many software wallets, and some, like the mobile wallet Coinomi , support a large number of cryptocurrencies. For Bitcoin, some popular choices include Electrum and Xapo , which has the added benefit of issuing you a pre-paid card which can be used to spend BTC in stores and ATMs. A small fee will be deducted and you're now in control of your funds.

Again, this comes with certain risks. You could forget your password. You could get hacked. You could lose your smartphone which is why you should always generate and keep a backup phrase somewhere if you have a mobile wallet.

You can also offload your funds to cold storage. This could either be a paper wallet—literally a piece of paper with an address, keys, and a QR code—or a hardware wallet, such as Trezor or Ledger , both of which work with multiple cryptocurrencies.

Hardware wallets come with their own set of instructions, and creating a paper wallet goes beyond the scope of this text, but you'll find excellent tutorials online.

Keeping your funds offline makes them safe from hackers. But that doesn't mean they're impervious to real world threats. For example, a house fire could burn your paper wallet and its associated data, or a flood might destroy your hardware wallet. The main, crucial lesson is: Perhaps you're not interested in saving or trading cryptocurrencies; you want to be an active part of the ecosystem. Things get a bit complicated here, as each cryptocurrency is different.

With Bitcoin, you can buy stuff at numerous online and even some offline stores. Overstock, Steam , and Microsoft all accept Bitcoin in some capacity. Cryptocurrency is also increasingly appearing as an option on real estate listings. Trulia had 80 listings with prices in crypto in January while Redfin numbered some For newcomers, this sort of approach is impractical, as most retailers that accept BTC also accept regular old cash, so converting your money to BTC just to buy something doesn't make much sense.

But there are use cases for spending BTC in stores. Say you bought bitcoin a few years ago—you could be a millionaire right now, and you might want to spent some of that money.

Ethereum, currently the second largest cryptocurrency in terms of market value, is different. Since Ethereum is more of a platform for decentralized applications and less of a payment system it works as both, though , you'll need ETH to participate in token sales , and to build your own apps on the platform.