Using Blockchain to Block Accounting Frauds

4 stars based on

48 reviews

A few colleagues and myself discussed mega trends and disruptive technology and how this affects the accounting profession today. One topic that was brought up was the concept of triple entry accounting. The double entry principle is something that has been ingrained with us since we decided to pursue the profession. For every debit, there's a corresponding credit and vice versus.

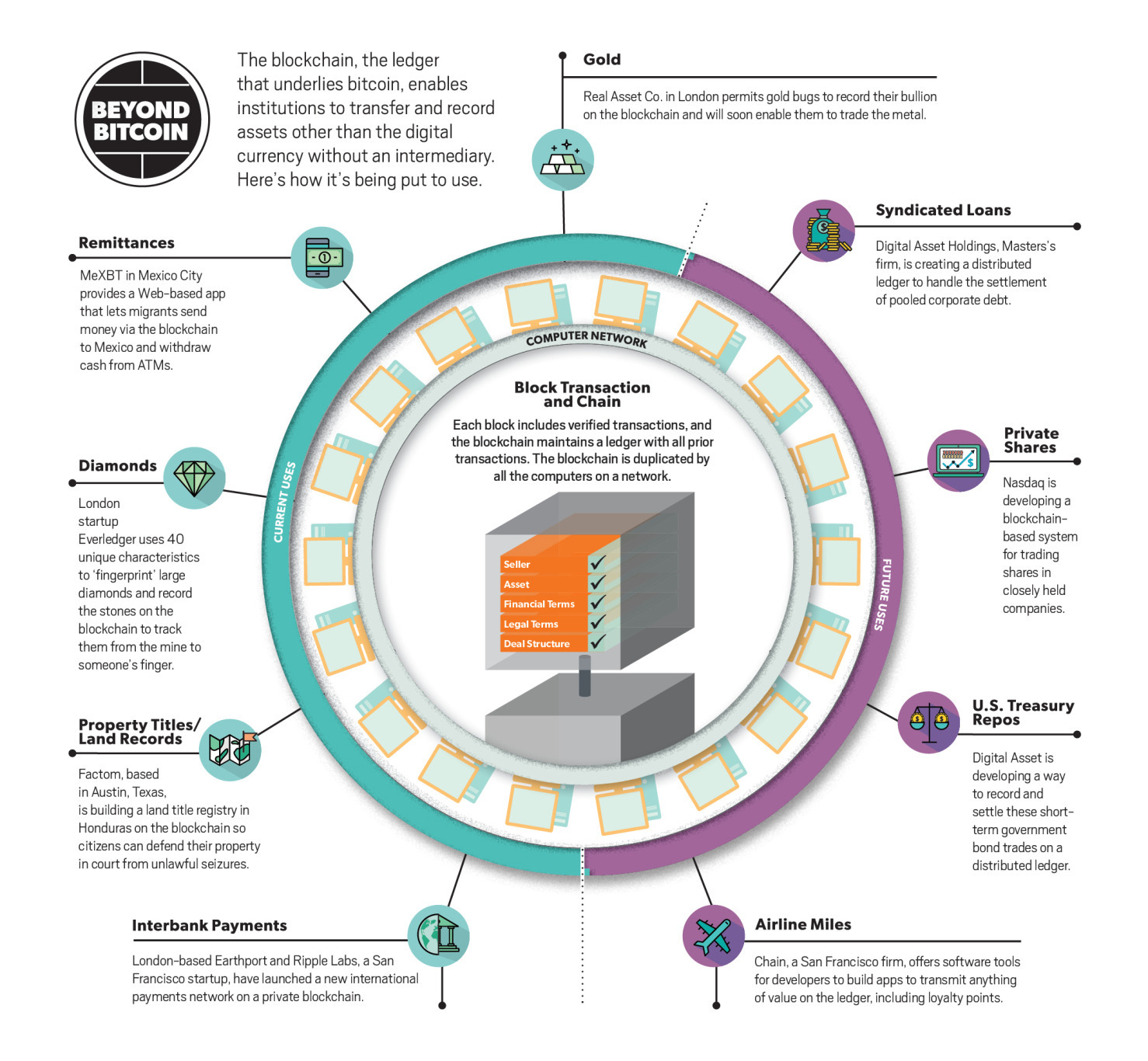

It's the principle to ensure we triple entry accounting blockchain stocks all revenue and expenses and, its effect thereof on our financial position at a given point in time. To fully grasp the triple entry principle, one has to understand some fundamentals of the blockchain technology. Refer to my friend's brilliant article on such but to summarize:. So coming back to triple entry accounting and what is this? Essentially, an entity may still maintain its books and records by applying the standard double entry accounting principle.

Records can be altered during the reporting period, correcting entries can be booked and true up entries can be passed until the period is closed. These accounts usually have the effect of posting the other side of that correcting entry and on many occasions made no accounting sense except for being the balancing entry.

What about the audit step of scanning accounts and balances for unusual activity. If we don't define a parameter, this cannot be conducted by means of computer assisted audit techniques, it's very judgmental and needs human intervention. However, with the introduction of triple entry accounting, such accounts will become obsolete, substantive testing on external audits will be reduced and a more control based approach will be adopted as there is an outside triple entry accounting blockchain stocks party verification process via the blockchain.

It has a 30 day payment term. A self-executing contract would be enabled on the blockchain, whereby when delivery of the good is accepted at the warehouse of the company ABC, a delivery note is automatically created and this prompts the following self executing entry on the block chain:.

Then upon day 29 when the invoice is processed for payment, using triple entry accounting blockchain stocks online payment system with the bank, a payment remittance and receipt is automatically initiated via the blockchain which prompts this entry:. So, these entries may look familiar in isolation for each entity triple entry accounting blockchain stocks, the big difference is the following:.

The power of triple triple entry accounting blockchain stocks accounting is demonstrated above. Blockchain will do the same for the profession but will be far stronger as there is an external, independent and decentralized means of record keeping.

As the accounting profession evolves with technology, we should accept and embrace this and move with the times! Refer to my friend's brilliant article on such but to summarize: A self-executing contract would be enabled on the blockchain, whereby when delivery of the good is accepted at the warehouse of the company ABC, a delivery note is automatically created and this prompts the following self executing entry on the block chain: These are self-executing entries on a 3rd party secured platform ie Triple entry accounting system Transactions cannot be altered for any reason whatsoever.