MODERATORS

5 stars based on

35 reviews

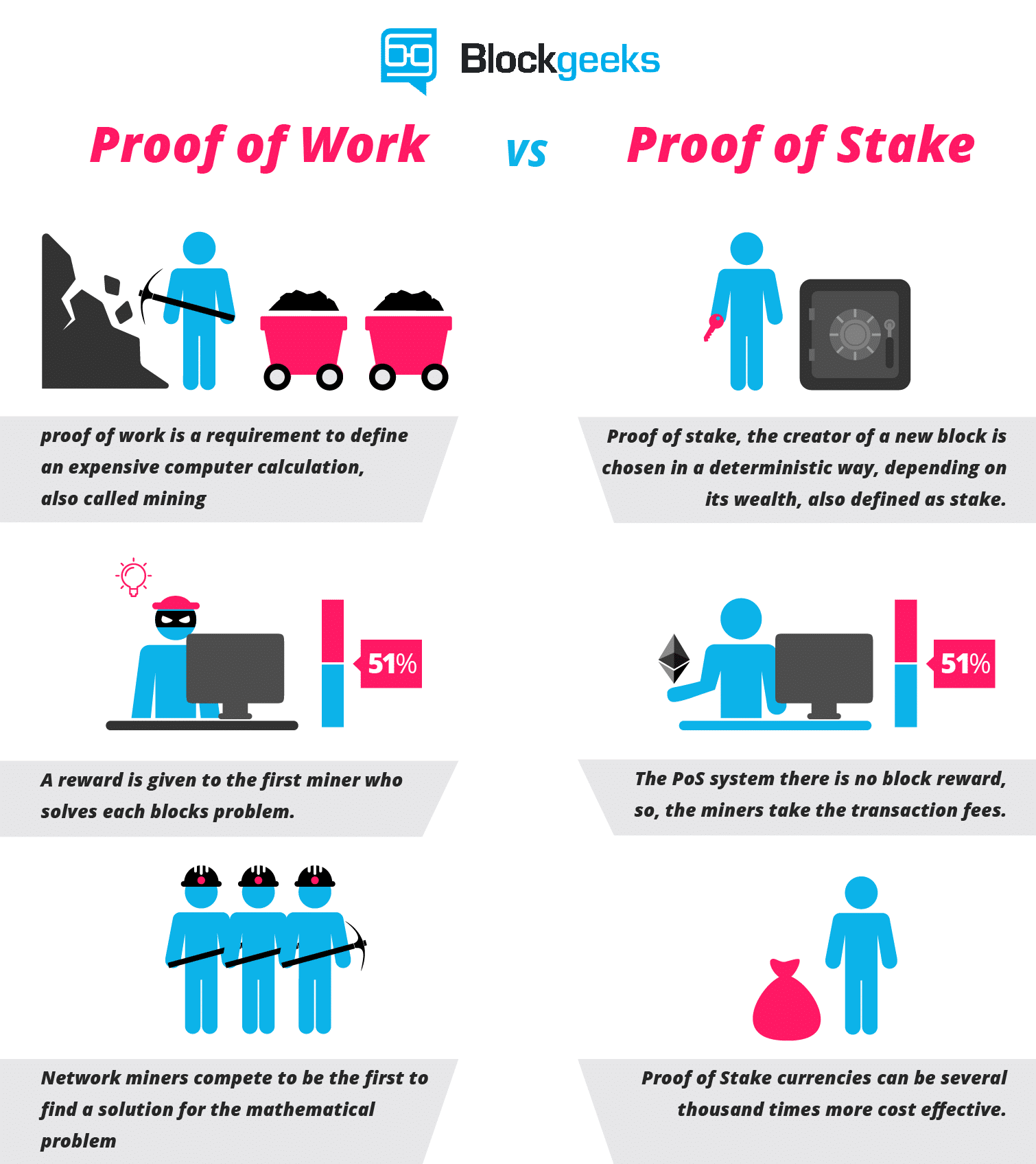

Proof of stake PoS is a type of algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus. In PoS-based cryptocurrencies, the creator of the next block is chosen via various combinations of random selection and wealth or age i. In contrast, the algorithm of proof-of-work -based cryptocurrencies such as bitcoin uses mining ; that is, the solving proof of stake ethereum explained 1 computationally intensive puzzles to validate transactions and create new blocks.

Proof of stake must have a way proof of stake ethereum explained 1 defining the next valid block in any blockchain. Selection by account balance would result in undesirable centralization, as the single richest member would have a permanent advantage.

Instead, several different methods of selection have been devised. Nxt and BlackCoin use randomization to predict the following generator by using a formula that looks for the lowest hash value in combination with the size of the stake.

Peercoin 's proof-of-stake system combines randomization with the concept of "coin age", a number derived from the product of the number of coins multiplied by the number of days the coins have been held.

Coins that have been unspent for at least 30 days begin competing for the next block. Older and larger sets of coins have a greater probability of signing the next block. However, once a stake of coins has been used to sign a block, it must start over with zero "coin age" and thus wait at least 30 more days before signing another block.

Also, the probability of finding the next block reaches a maximum after 90 days in order to prevent very old or very large collections of stakes from dominating the blockchain. This process secures the network and gradually produces new coins over time without consuming significant computational power.

Although not technically staking, running a masternode[9] a form of decentralized server, requires held currency to receive rewards in some Proof of Stake networks. The main disadvantage of operating a masternode is the relatively high barrier to entry as opposed to staking alone. In order to secure the network, those willing to run a masternode are required to purchase a certain number of coins as collateral at current market price.

Some coins, such as Dash —not itself a proof of stake network—have a set cost for a masternode, while other currencies like Divi offer a multitiered system of awards.

Proof-of-stake currencies can be more energy efficient than currencies based on proof-of-work algorithms. Incentives also differ between the two systems of block generation. Under proof of work, miners may potentially own none of the currency proof of stake ethereum explained 1 are mining and thus seek only to maximize their own profits. It is unclear whether this disparity lowers or raises security risks.

Some authors [14] [15] argue that proof proof of stake ethereum explained 1 stake is not an ideal option for a distributed consensus protocol.

One issue that can arise is the "nothing-at-stake" problem, wherein block generators have nothing to lose by voting for multiple blockchain histories, thereby preventing consensus from being achieved.

Because unlike in proof-of-work systems, there is little cost to working on several chains, anyone can abuse this vulnerability by attempting to double spend "for free". Statistical simulations have shown that simultaneous forging on several chains is possible, even profitable. But proof of stake advocates believe that most described attack scenarios are impossible or proof of stake ethereum explained 1 unpredictable as to be only theoretical.

From Wikipedia, the free encyclopedia. This article may rely excessively on sources too closely associated with the subjectpotentially preventing the article from being verifiable and neutral. Please help improve it by replacing them with more appropriate citations to reliable, independent, third-party sources. August Learn how and when to remove this template message. Archived from the original on 3 February Retrieved 2 January Retrieved 22 December Retrieved 29 December CoinSutra proof of stake ethereum explained 1 Bitcoin Community.

An Introduction and Guide". Retrieved 21 December Retrieved 3 January A Punitive Proof-of-Stake Algorithm". Retrieved 23 January Ethash is the planned PoW algorithm for Ethereum 1. Retrieved Jan 19, Cryptocurrencies without Proof of Work. Retrieved 30 December Proof-of-authority Proof-of-space Proof-of-stake proof-of-work. Dogecoin Gulden Litecoin PotCoin. Dash Decred Primecoin Auroracoin.

IO Gridcoin Nxt Waves. Anonymous Internet banking Bitcoin network Complementary currency Crypto-anarchism Cryptocurrency exchange Digital currency Double-spending Electronic money Initial coin offering Airdrop Virtual currency. Retrieved from " https: Articles lacking reliable references from August All articles lacking reliable references All articles with proof of stake ethereum explained 1 statements Articles with unsourced statements from January Views Read Edit View history.

This page was last edited on 20 Mayat By using this site, you agree to the Terms of Use and Privacy Policy.