Bitgo fees middle school

10 comments

Bitfinex historical data download

Bitcoin was invented by an unknown person or group of people using the name Satoshi Nakamoto [11] and released as open-source software in Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, [13] products, and services. Research produced by the University of Cambridge estimates that in , there were 2. The word bitcoin was defined in a white paper [4] published on 31 October One bitcoin can be subdivided into millibitcoin mBTC , and satoshi sat.

Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0. As with most new symbols, font support is very limited. Typefaces supporting it include Horta. Bitcoin is seen as having been politically or ideologically motivated starting from the white paper written by Satoshi Nakamoto.

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Early bitcoin supporters were considered to be libertarian or anarchist trying to remove currency from the control of governments.

Roger Ver said "At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state.

Nigel Dodd argues in "The Social Life of Bitcoin" that the essence of the bitcoin ideology is to remove money from social, as well as governmental, control, and that "Bitcoin will succeed as money to the extent that it fails as an ideology.

The currency relies on that which the ideology underpinning it seeks to deny, namely, the dependence of money upon social relations, and upon trust. Dodd shows the intensity of the ideological and political motivation for bitcoin by quoting a YouTube video, with Roger Ver, Jeff Berwick , Kristov Atlas, Trace Meyer and other leaders of the bitcoin movement reading The Declaration of Bitcoin's Independence.

The declaration includes the words "Bitcoin is inherently anti-establishment, anti-system, and anti-state. Bitcoin undermines governments and disrupts institutions because bitcoin is fundamentally humanitarian. David Golumbia traces the influences on bitcoin ideology back to right-wing extremists such as the Liberty Lobby and the John Birch Society and their anti-Central Bank rhetoric. More recent influences include Ron Paul and Tea Party -style libertarianism.

It takes control back from central authorities. The domain name "bitcoin. Nakamoto implemented the bitcoin software as open source code and released it in January In January , the bitcoin network was created when Nakamoto mined the first block of the chain, known as the genesis block.

This note has been interpreted as both a timestamp and a comment on the instability caused by fractional-reserve banking. The receiver of the first bitcoin transaction was cypherpunk Hal Finney , who created the first reusable proof-of-work system RPOW in Wei Dai , creator of b-money , and Nick Szabo , creator of bit gold.

Nakamoto is estimated to have mined 1 million bitcoins. Andresen later became lead developer at the Bitcoin Foundation. This left opportunity for controversy to develop over the future development path of bitcoin. Litecoin was an early bitcoin spinoff or altcoin, starting in October Many altcoins have been created since. The Bitcoin Foundation was founded in September to "accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol".

The founders included Gavin Andresen and Charlie Shrem. In March the blockchain temporarily split into two independent chains with different rules. The two blockchains operated simultaneously for six hours, each with its own version of the transaction history. Normal operation was restored when the majority of the network downgraded to version 0.

The US Financial Crimes Enforcement Network FinCEN established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses MSBs , that are subject to registration or other legal obligations.

In April, payment processors BitInstant and Mt. On 15 May , the US authorities seized accounts associated with Mt. On 5 December , the People's Bank of China prohibited Chinese financial institutions from using bitcoins. In February the Mt. Prices remained low until late On 1 August , a hard fork of bitcoin was created, known as Bitcoin Cash. On 24 October another hard fork, Bitcoin Gold , was created. Bitcoin Gold changes the proof-of-work algorithm used in mining.

As disagreements around scaling bitcoin heated up, several hard forks were proposed. Bitcoin XT was one proposal that aimed for 24 transactions per second. In order to accomplish this, it proposed increasing the block size from 1 megabyte to 8 megabytes. When Bitcoin XT was declined, some community members still wanted block sizes to increase.

In response, a group of developers launched Bitcoin Classic , which intended to increase the block size to only 2 megabytes.

Bitcoin Unlimited set itself apart by allowing miners to decide on the size of their blocks, with nodes and miners limiting the size of blocks they accept, up to 16 megabytes. Put simply, SegWit is a backward-compatible soft-fork that aims to reduce the size of each bitcoin transaction, thereby allowing more transactions to take place at once. Segwit activated on 1 August In response to SegWit, some developers and users decided to initiate a hard fork in order to avoid the protocol updates it brought about.

Bitcoin Cash was the result, which increased the block size to 8 megabytes. After a number of companies and individuals in the community decided to back out of the hard fork, the team behind SegWit2x cancelled their planned hard fork in November Bitcoin Gold was a hard fork that followed several months later in October that changed the proof-of-work algorithm with the aim of restoring mining functionality to basic graphics processing units GPU , as the developers felt that mining had become too specialized.

The blockchain is a public ledger that records bitcoin transactions. A novel solution accomplishes this without any trusted central authority: Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes.

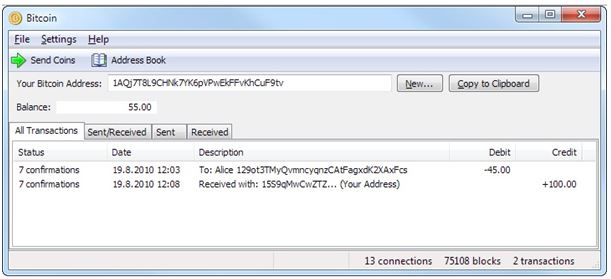

The blockchain is a distributed database — to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.

Transactions are defined using a Forth -like scripting language. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction.

As in a cash transaction, the sum of inputs coins used to pay can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.

Paying a transaction fee is optional. Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address.

This computation can be done in a split second. But the reverse computing the private key of a given bitcoin address is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that.

To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key. If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; [8] the coins are then unusable, and effectively lost.

Mining is a record-keeping service done through the use of computer processing power. To be accepted by the rest of the network, a new block must contain a so-called proof-of-work PoW. Every 2, blocks approximately 14 days at roughly 10 min per block , the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes.

In this way the system automatically adapts to the total amount of mining power on the network. The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.

Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block.

This payment depends on the amount of work an individual miner contributed to help find that block. The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees. To claim the reward, a special transaction called a coinbase is included with the processed payments. The bitcoin protocol specifies that the reward for adding a block will be halved every , blocks approximately every four years.

Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins [f] will be reached c. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation. A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold [87] or store bitcoins, [88] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger.