Dogecoin faucet no captcha omegle

15 comments

Fee blockchain news

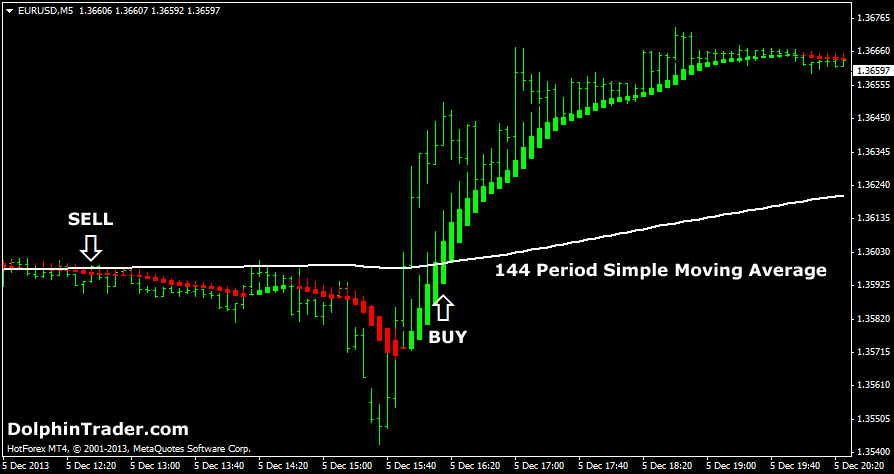

There are a lot of ways to trade the 5 minute binary options expiry. This time frame is one of the most versatile in terms of the types of strategies you can use because it is inherently volatile yet at the same time can sustain a trend long enough to be useful to us binary options traders. You can look at the bigger picture with 5 minute candles or you can drill down to 1 minute charts to see the swings in momentum. When choosing a strategy it really comes down to what kind of trader you are, what types of analysis you prefer and in the end, the asset you are trading.

When it comes to assets there is really no one class that performs best in the 5 minute time frame although most binary traders prefer forex, commodities and indices, not necessarily in that order.

When using the 5 minute expiry set charts to 1, 2 or 5 minute for best effect. Most strategies are adaptable to any time frame, the caveat is that the shorter the time frame the less reliable the signal. A candlestick signal on the daily charts is stronger than one on the hourly charts that is likewise stronger than one on the one minute charts. This video shows how to use multiple charts at IQ Option. This can be useful if trying to spot trends over multiple timeframes as mentioned above:.

Traders simply pay attention to price action, the minute to minute changes in prices, and how that action behaves in order to make trading decisions. In the old days this was done by watching the ticker tape all day, today it is much easier and more fun to use a charting package like MT4. These will work with charts set to 1,2 or 5 minutes.

Scalping Strategies — Scalping strategies are very short term form of price action trading although they also incorporate other types of signals as well. Scalping, simply put, is a trade based on what you think the market is going to do in the next period, and this usually means minutes, never more than 10, 5 is perfect.

These strategies do not care about trend, only on which direction the market is going now and if it will keep going that direction long enough to place a quick trade.

These are best used with charts set to 5 minutes as the signals are generally good for the very next candle. Japanese Candlestick Strategies — Japanese Candlesticks are the premier method of viewing trading charts and give a variety of signals that are at heart price action signals but can also be used for scalping and other types of strategies.

The candlesticks are nothing more than an expanded method of plotting price data on a chart but the effect is startling, almost like putting on a pair of glasses and seeing the world clearly for the first time. Candlestick signals are good with any chart setting, depending on which method of trading them you choose.

When prices, the market, moves it has momentum. Momentum is the amount of force behind the move, this force is the sum of the people and money moving into, or out of, an asset and can carry prices in once direction for an extended period of time.

When this happens you want to trade with the momentum using an indicator like MACD or stochastic. Sometimes the markets momentum will carry it too far in one direction and when it does, prices will swing in the opposite direction in order to rebalance.

Trend Following Strategies — When there is enough momentum, often described as the entrance of new money entering the market, a trend can be established. A trend is a periodic and systematic movement in which longer term moves in one direction more than offset nearer term corrections in another. Trends, like all aspects of technical analysis, can be both measured and predicted. This means that those nearer term corrections are entry points in trend following strategies.

This can be useful if trying to spot trends over multiple timeframes as mentioned above: