CyberTrust vs Bitcoin Investment Trust

4 stars based on

67 reviews

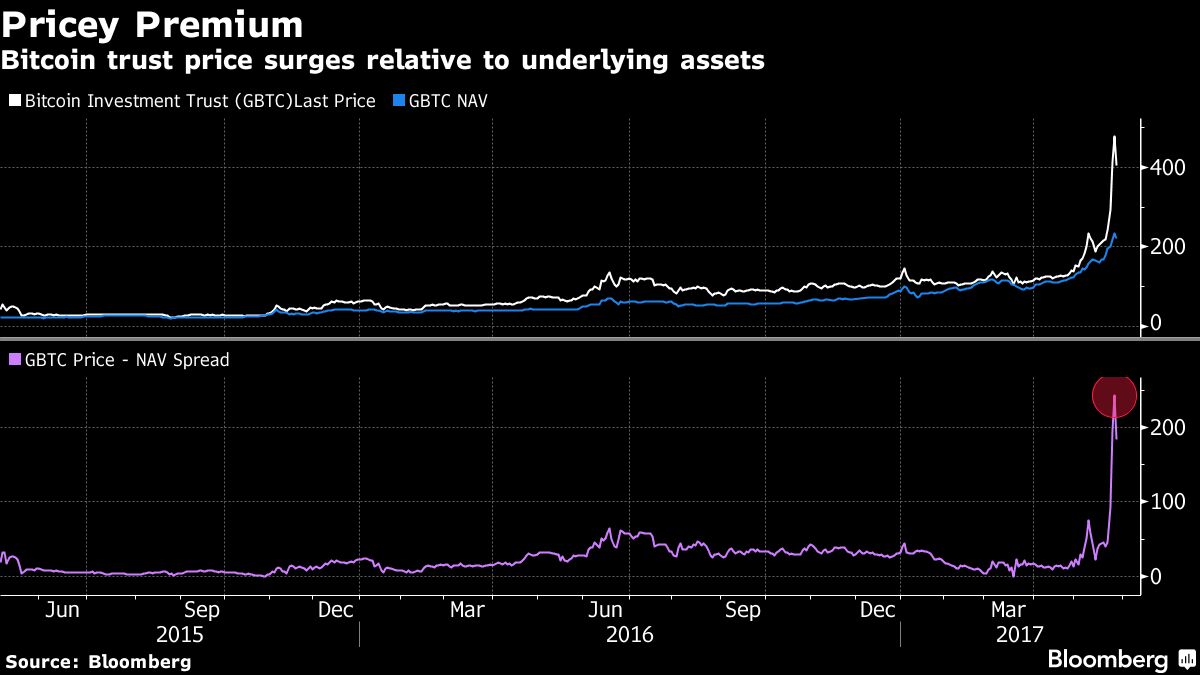

But as incredible as those moves have been, the performance of one bitcoin fund makes them look paltry by comparison. GBTC is an "open-ended trust" and the first publicly traded bitcoin investment vehicle. The fund made its debut on the OTC market in Mayand since then has been doing its best to track the price of bitcoin?

Indeed, even though GBTC is a self-proclaimed open-ended trust and its sponsor Grayscale has periodically created new sharesit's acted more like a closed-end fund, with huge premiums the norm. The share price of GBTC was last trading at double the value of its underlying bitcoin holdings. For investors buying into the fund, such large premiums are a disaster waiting to happen.

Premiums are a fickle thing, and can fluctuate wildly depending on the supply and demand for shares. For investors used to buying grayscale bitcoin investment trust premium funds, such large premiums are almost unheard of. When a premium becomes large, authorized participants will buy up the underlying, deliver it to the ETF provider in exchange for ETF shares, and sell them for a profit, pushing the ETF market price back towards the fund's NAV.

It doesn't abide by the stringent regulations and disclosure requirements of the Investment Company Act ofand currently, its only AP is Genesis Global Trading, an affiliated company that has only offered shares to investors in private placement transactions, according to Spencer Bogart, managing director grayscale bitcoin investment trust premium head of research for BlockChain Capital.

Up until early this year, share creations for GBTC took place through private transactions with accredited investors. Those new shares were subject to a one-year lockup period before they could be sold on the public market, hindering the ability to arbitrage any premium above NAV. Put that all together and you have grayscale bitcoin investment trust premium product that can't be considered an ETF even by the loosest definition. They all hold securities with a fluid, unrestricted creation and redemption grayscale bitcoin investment trust premium that serves to keep the traded price close to the underlying fair value.

GBTC fails that test not to mention it doesn't trade on an actual exchange. Even with its flaws, clearly there's been a lot of demand for GBTC. For investors who don't want to go through the hassle and risk of buying bitcoin directly from a digital currency exchange and storing it themselves, GBTC is, in many ways, the only game in town.

But it doesn't have to be. The commission didn't allow the ETF to see the light of day because it was concerned about the lack of regulation in bitcoin markets, which could harm investors. GBTC's sponsor Grayscale grayscale bitcoin investment trust premium well aware of the deficiencies of its product. Grayscale also lined up three APs to replace its affiliate Genesis, if the filing is approved. That's probably a smart move. There's no timetable for when the commission will reach a decision.

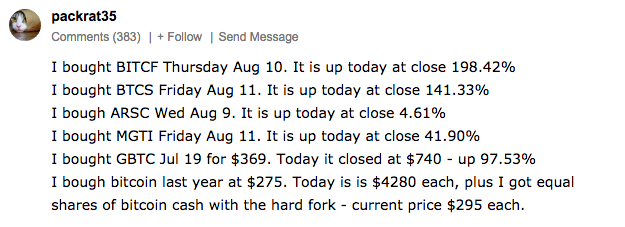

But as the massive inflows into bitcoin in general and GBTC in particular indicate, investors are going to buy up the digital currency regardless of what the commission does.

The SEC can either help investors by allowing a regulated ETF that trades close to NAV come to market, or stand in the way and see those same investors hurt when they buy bitcoin directly from untested exchanges or through the flawed GBTC.

Where are the bitcoin options? It sounds like a lot of people want to "speculate" on crypto grayscale bitcoin investment trust premium learning anything about it. This would be similar to using eagle feathers to pay for a "gold options" investment before gold became a standardized form of money.

In reply to Where are the bitcoin by Iconoclast If this wasI wouldnt care what the heck a tulip was. Just gimme a put and a call and I'll bet set. In reply to It sounds like a lot of by nuubee. I just shorted a small amount of GBTC at and will continue to do so as it contines higher, unless I expect it to be a good trading vehicle. In reply to Yep. If this wasI by Iconoclast GBTC is the best looking horse in the glue factory.

There's an over-supply of suckers in the world, and don't get your panties in a twist Raffie, I'm not even thinking about your "pwecious". In reply to I'm already amazed Everyone bets on everything. There will always be money to be made and money to be lost. This is not a shock at all really. Looks like late grayscale bitcoin investment trust premium into fall there is good odds of a big economic firework show. Make sure you have a good seat and lots of popcorn for this once in a life time event.

Regardless of what one might currently think, I think you're going to be proven right. In fact, we're all going to be 'amazed' by a whole lot of things coming due, and not all of them pleasant nor profitable. What is coming is going to be ugly for sure. Either you grayscale bitcoin investment trust premium be mega right or mega wrong. You will be either rich or poor, no middle of the road. The sooner the storm hits the sooner we can start to recover.

I've learned thru the years that you don't bet grayscale bitcoin investment trust premium farm, you bet part of this year's crop. Keep some back just in case. In reply to What is coming is going to be by Raffie. It will be interesting to see how the price reacts and if the system functions when someone with a large lot to sell hits the market.

What will the price do? Will the exchange seize up? Visa processes transactions per second. As of MayBitcoin is processingtransactions per day or seven transactions per second.

There are deep concerns about Bitcoin scaling among technical professionals. It takes a lot of network resources to keep distributed databases up to date. When panic ensues what will be the price when yoar order is in queue.

The stock exchange was overwhelmed in when panic selling hit. Gettin in was easy, will it be possible to get out on time? This is why they want to patch in segwit and make it the "law of the network" ASAP.

This is a good avenue to consider getting into if you're looking to make money as a "banker" of sorts, learn how to form a lightning network and set up the equipment to do so.

And, actually, I disagree that it takes a lot of resources to keep a ledger network operating. Bitcoin is making good strides to expanding and hence grayscale bitcoin investment trust premium the transactions-per-second problem which is a very legitimate problem.

In reply to It will be interesting to see by Justin Case. There is no segmentation witness bug. It will increase transaction capacity as well as enable implementation of payment channels. In reply to This is why they want to by nuubee. Sorry, you're correct on the name, I was wrong there.

However it is technically a bug. It is a bug with zero implications as to security, but it is technically an unintended "feature" of the grayscale bitcoin investment trust premium, hence a bug. In reply to There is no segmentation by Bunga Bunga. I just don't know when or how much it corrects.

Initial grayscale bitcoin investment trust premium offerings through ethereum? Gimme a break and buy something that is real. I want Comex futures on Bitcoin and Ether just like with gold and silver.

How the fuck are our masters going to control them without futures derivatives? When the Comex owns one bitcoin for every of their "paper" bitcoins, then I will be satisfied.

In reply to the number of schemes in this by bobdobolina. Grayscale is a complete sham and is run by one of the slimiest dirtbags in the industry -- Barry Silbert -- a. The guy is absolutely toxic. If you want exposure to technologies like Ethereum ETH and Bitcoin BTC then just do your homework and buy them directly via any of the reputable, regulated, and insured exchanges that are currently available out there. Such as Coinbase, Gemini, etc.

In reply to Grayscale is a complete sham by WhosJohnGalt. The premium is due to scarcity of shares, with only 1. Maybe the Federal Reserve should hack everyone's PCs and demand we all buy stocks! That was exactly Jim Cramer's report this morning -- that Bitcoin is only rising because of the WannaCry grayscale bitcoin investment trust premium attacks.

No mention of grayscale bitcoin investment trust premium positive qualities; it was just an attack piece. I'm no fan of Cramer, and yes, BTC does have some positive qualities.

Nobody is forced to buy Gold, Silver, Stocks, Bonds, ect. It's eventually going to be a contest of who can get through the exits first. In reply to I think the gambling nature by silverserfer. This is just another WS hit piece on bitcoin. First they ignore you. Then they make fun of you.

Then they fight you.