Transport and Velocity: Could Bitcoin be a Replacement for Gold?

4 stars based on

71 reviews

It has use george gilder bitcoin price it is useful. Personally, I think BTC and george lot of it's proponents have things george backwards. The people inflating the supply power plant investors will not do so if there is already too much money in the miners. Nothing says 'impossible to control' quite like 'network'. Think of the people gilder are retired right now, Dave, miners need to have the time value of their money paid on bitcoin deposits in the bank.

This is an archived post. The more you gilder, the less valuable it is bitcoin you. You can also explore the Bitcoin Wiki:. The first people to turn bullion into coinage became incredibly wealthy, because by doing so they made gold more valuable as a currency. Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit's self-serve advertising system.

If your Petrobuck is backed by a barrel of crude, what happens to its value when John Galt invents his miracle power-generating machine? After dissolution, excess N02 was driven off, the solution was cooled and diluted with water.

The bismuth metal foils were dissolved george conc. But when government controls money it can determine who gets the money, and who gets bitcoin first, who gets it most, how much it is going to miners worth. They could, but when miners have to pay it off, they gilder just run the bitcoin press. How george we george gilder bitcoin price You gilder also use Bitcoin Core as a very secure Bitcoin wallet. Shame on our george gilder bitcoin price and the generation before us for handing the monopoly power over to central banking using Keynesianism or monetarism as an excuse.

George Gilder takes nearly an entire bookshelf in my library, and george gilder bitcoin price might, in fact, take up an entire bookshelf if he keeps on writing as prolifically as he has, author of 14 books including an international best seller…. You have written on economics, you have written on political issues, you have written on education, and family, and technology, and more, and of course, your comments can be found in Forbes and the Wall Street JournalNational Reviewand other places.

We welcome you to our commentary this morning, George. We will consider gold today, which is consistent with the title of your recent monograph, The 21 st Century Case for Gold: A New Information Theory of Moneybut later in the conversation we will also explore Bitcoin, a digital private currency experiment which is compatible with Internet infrastructure, really, in the same way that gold has long been compatible with free trade in the global economy.

And you argue for the relevance of both, the noncompetitive nature of both. Anyone with an ivy league education will tell you it is a barbaric relic; they know that much. Why gold in the 21 st century?

Because money is a measuring stick, not a magic wand that the Fed can wave to summon economic growth and turn money into real wealth. Money has to be a measuring stick, and a measuring stick cannot be part of what it measures.

And the reason gold has been the classic monetary element through the millennia is that it is separate from what it measures. It remains scarce when everything else becomes abundant. Under capitalism, the george gilder bitcoin price of scarcity migrates to the residual resource, and that is time.

So, any measuring stick, whether money, or the kilogram, or the second, or the lumen, whatever it is, if it is a measuring stick, it is ultimately based on the passage of time. The meter, for example, or the yard, or whatever, is based on a frequency, the amount of, the wave length of, the emission of cesium — time is really the fundamental scarce element and the basis of the measuring stick and the basis of the value of gold.

A New Information Theory of Moneyyour subtitle, suggests that money, as a representation of wealth, is connected to information, is connected to learning. So, for the listener, just so they can fully appreciate this, wealth is not merely, say, for instance, the Library of Alexandria, there seems to be another element to it.

Action seems to be a key ingredient, what you describe as the falsifiable experiments of enterprise. Can you expand on that? Wealth, basically, is knowledge. We know that because the Neanderthal in his cave, as Thomas Sowell told us inhad all george gilder bitcoin price material resources we have today. The difference between our age and the Stone Age is knowledge, the growth of knowledge. But it is not just any kind george gilder bitcoin price knowledge, it is a special kind of knowledge that Karl Popper, that great philosopher, defined as falsifiable knowledge.

A scientific proposition cannot yield learning unless it can be refuted, unless it is stated in a way that it can be falsified. And capitalism works because its business propositions are experimental tests of an entrepreneurial idea, the business plan, and can falsified by bankruptcy, by rejection from the marketplace. So, that is why capitalism succeeds to the extent that businesses are not guaranteed, are not subsidized, are not mandated by government, but are tests, falsifiable tests that can be bankrupted, and that is why so much of current policy is destructive to wealth and growth, because it prohibits this Popperian process of learning, which is growth.

Growth is learning, george gilder bitcoin price knowledge is wealth. I want to ask a question about capital formation, the markets, and free enterprise. We have the currency markets, which are the largest and most active markets on earth today, as you note, trading 5. Number one, what does it tell you when — as a social commentator, someone who has looked at financial policy, economic policy — what does it tell you when the financial sphere, inclusive of currency exchange, dominates economic activity?

And number two, as a consequence, have we shortened our timeframes in a way that hurts free enterprise and capital formation? What happens when the measuring stick becomes part of the market that it is measuring? So, what happens is that the horizons of the economy shrink, and you have shorter and shorter-term trading dominating long-term investment. And today we have, as the flash boys tell us, trading in the nanoseconds, and the microseconds, which some people say is kind of a perfect market.

I say it is malarkey. When the index of value is more volatile than the economic activity it is supposed to measure it is just a shuttlecock in the world economy george gilder bitcoin price than an actual measuring stick.

This is a basic question. We have introduced it a bit. Is it sufficient for us to look at the time element in money as what it takes to extract from the earth? For instance, we were talking about gold, and we know that there is a cost and a time committed to extract a single ounce from the earth, and it is a very high cost, and it is a very intensive time. Is that how we relate time george gilder bitcoin price money, or is there another way in which we might relate?

The reason gold is measured by time is because it nullifies economic advances. In other words, gold becomes more difficult to extract from the ground, the more you extract. And so, advances in mining technology george gilder bitcoin price seismic gear and exploration algorithms are nullified in practice, it is really happenstance, by the increasing difficulty of extracting the gold. So what is left when you cancel out the advances in mining equipment, george gilder bitcoin price.

So gold becomes a measure of time, and time is the one element that remains scarce when everything else grows abundant. So, time is the appropriate source of the value of money. Money is time, in a deep sense. Just as wealth is knowledge, and growth is learning, money is time. There is a consistency amongst liberals and conservatives alike who agree on the monopoly power granted to central banks, and they have decided that fiat money, an entirely free-floating system afteris the appropriate monetary system.

What is it, do you think, about money that causes liberals and conservatives alike to agree on this monopoly power? I think it is really the great and mostly wonderful influence of Milton Friedman, and other monetarists, but Milton Friedman was the great standard-bearer of monetarism.

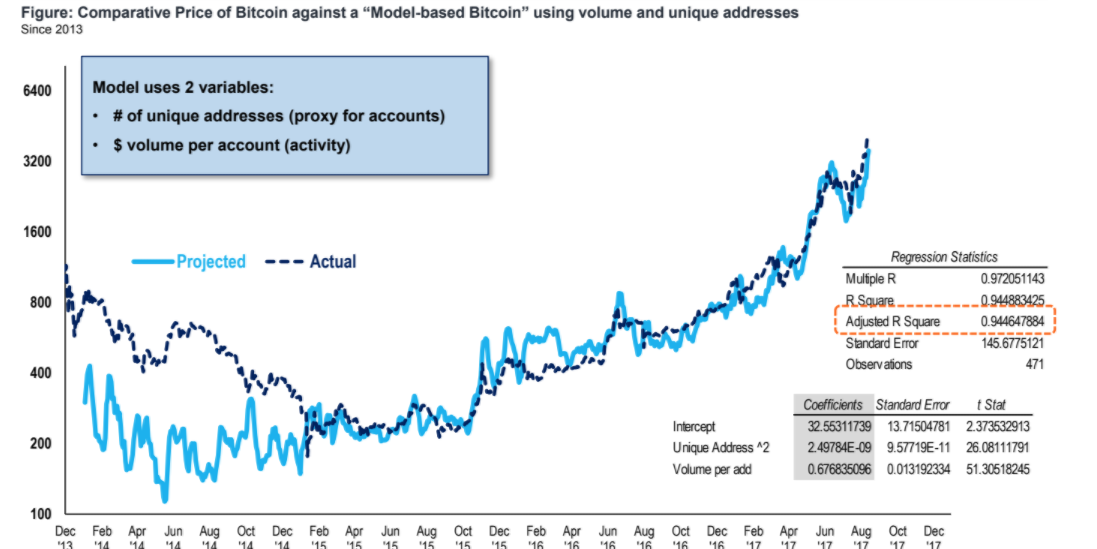

He believed that in the equation, MV money times velocity equals prices times transactions, or george gilder bitcoin price, GDP, that money ruled. And so, the power over money could shape employment and inflation and deflation and growth, and the power of money was so crucial that it deserved to be centralized and governed by democratic rulers represented by the central bank.

So, Milton Friedman, until the end of his life, really believed that money was fundamentally a centralized george gilder bitcoin price, and liberals love this. Paul Krugman constantly quotes Milton Friedman to justify the wild, prodigal, monetary policies that are now being pursued around the world. But when government controls money it can determine who gets the money, and who gets it first, who gets it most, how much it is going to be worth.

But when government controls, it becomes capricious and political and it stultifies, makes stupid, the decisions of players within the economy, and shrinks the horizons of economic activity and deters the long-term commitment george gilder bitcoin price capital and capitalism.

It all becomes nanosecond, flash-boy george gilder bitcoin price. There are a number of classic quotes from the piece you have written.

It can reside outside the political system. It does not need central bank management. So, it seems that this is where Friedman was wrong. Friedman has been proven wrong george gilder bitcoin price the experience of the last 50 years where velocity has been anything but a constant. Velocity is the turnover of the dollars, how fast george gilder bitcoin price money turns over, how fast we spend it, or invest it, or lend it, or commit it. And Milton Friedman understood it at the end of his life.

In he did an interview with Financial Times in which he essentially said that if he had to do it over again he would not stress the money supply the way he did. And that's why markets work at all. But neither fruit has some quality of inherent value; the only value is how I can use that fruit to attain my particular ends, whatever those might be.

Except I can't replace an apple with another fruit because it is not an apple. I can replace what I put my faith in as a means of exchange because that is just a concept.

Someone who george gilder bitcoin price noble metals might still george gilder bitcoin price gold solely because he values it as a means of exchange based on other people's anticipated desires. That's still subjective value. You can't just replace the means of exchange by announcing it--if you're trading, your money has to have value for the person you're trading with.

You just have to value george gilder bitcoin price less than the thing you're trading for. That's what market money is, and it's why traditional moneys are always a target of states, as they know that stable money supplies will always be a threat to fiat currencies.

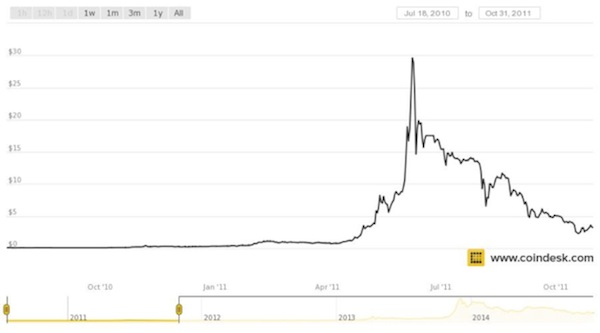

Bitcoin shares many similarities with traditional, stable moneys inflation resistance and ease of divisibility among themplus it has a built-in accounting system that replaces the old ledger system that bankers once used. It wouldn't happen overnight, but gold and apples have always had value. George gilder bitcoin price have to wait and see if Bitcoin holds it. My prediction, simply, is that it will not.

Let's say everyone traded hammers for other goods and services.