The Economics of Blockchain

5 stars based on

41 reviews

March 10, — economics. This is a post that I am struggling to write. I really have no idea what is going to happen in So there you have it. A lot of unknowns. That is how I am going into As has economist blockchain the next big thing my practice, I celebrate the end of a year and the start of a new one here at AVC with back to back posts focusing on what happened and then thinking about what might happen.

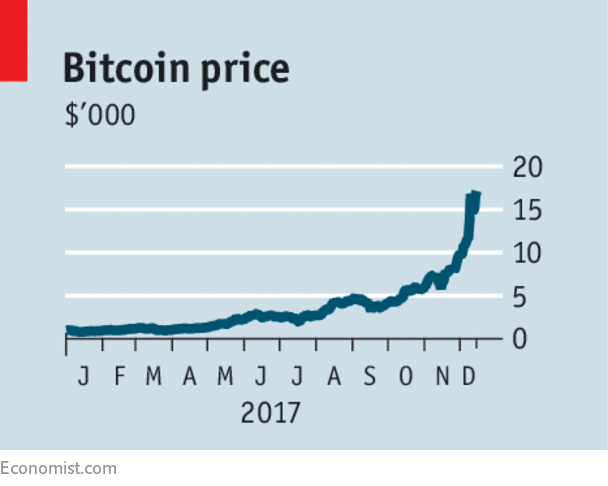

I went back and looked at my predictions for and I completely whiffed on the breakout year for crypto. Maybe I got tired of predicting a breakout year for crypto as I had mentioned it in my and predictions, but whatever the cause, I completely missed the biggest story of the year in tech.

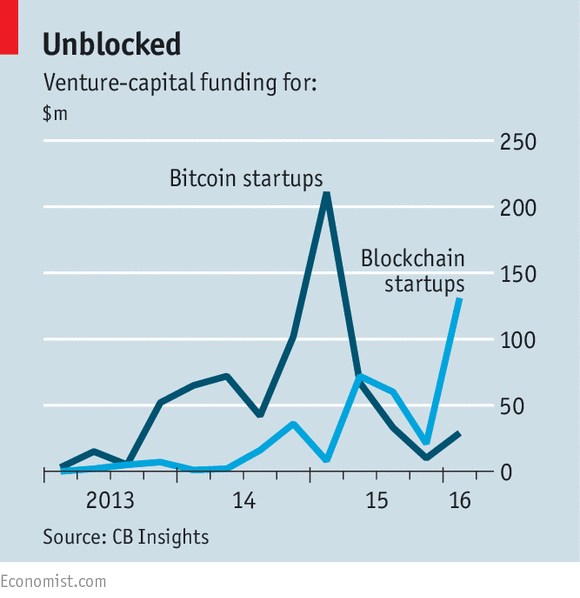

If you look at the Carlota Perez technology surge cycle chart, which is a framework I like to use when thinking about new technologies, you will see that a frenzy develops when a new technology enters the material phase of the installation period.

The frenzy funds the installation of the technology. Clearly, not all of that money will be used well, maybe very little of it will be economist blockchain the next big thing well. But, like the late 90s frenzy in Internet 1. And we need that infrastructure badly. But it will and the money that is getting invested via the frenzy we are in is going to make that happen. This is the biggest story in economist blockchain the next big thing in because transitions from Internet 1.

In the venture business, you wait for these moments to come because they are where the big opportunities are. And the next big one is coming. The big story of in the US was the beginning of the end of white male dominance. This is not a tech story, per se, but the tech sector was impacted by it. We saw numerous top VCs and tech CEOs leave their firms and companies over behavior that was finally outed and deemed unacceptable. He is the epitome of white male dominance.

An unapologetic actually braggart groper in chief. I think it took something as horrible as the election of such an awful human being to shock the US into deciding that we could not allow this behavior any more. Courageous women such as Susan Fowler, Ellen Pao, and many others came forward and talked publicly about their struggles with behavior that we now deem unacceptable. It took Nixon to go to China and it took Trump to end white male dominance.

The big change in the US is that women now feel empowered, maybe even obligated, to come forward and tell their stories. And they are telling them. And bad behavior is being outed and long overdue changes are happening. Women and minorities are also signing up in droves to do public service, to run for office, to start companies, to start VC firms, to lead our society. Like the frenzy in crypto, this frenzy in outing bad behavior, is seeding fundamental changes in our society. I am certain that we will see more equity in positions of power for all women and minorities in the coming years.

Although I did not get much right in my predictionsI got this one right. You could see it coming from miles away. Tech is the new Wall Street, full of ultra rich out of touch people who have too much power and not enough empathy. Erin Griffith nailed it in her Wired piece from a few weeks ago. Add to that context the fact economist blockchain the next big thing the big tech economist blockchain the next big thing, Facebook, Google, and Twitter, were used to hack the election, and you get the backlash.

I think we are seeing the start of something that has a lot of legs. And we are increasingly being controlled by machines. This is likely to be the narrative of the next thirty years. And they are related to each other in the sense that each is a reaction to power structures that are increasingly unsustainable. Economist blockchain the next big thing are in the midst of massive societal change and how we manage this change will determine how easily and safely we make this transition into an information driven existence.

May 13, — economicspolicy. Mankind has been economist blockchain the next big thing new ways to organize and govern since we showed up on planet earth. Our history is a gradual evolution of these organization and governance systems. I have been thinking for some time that we are on the cusp of something new. The Internet is, at its core, a scaled decentralized system. Its design has been a resounding success. It has scaled elegantly and gradually to well over 2bn users over fifty years.

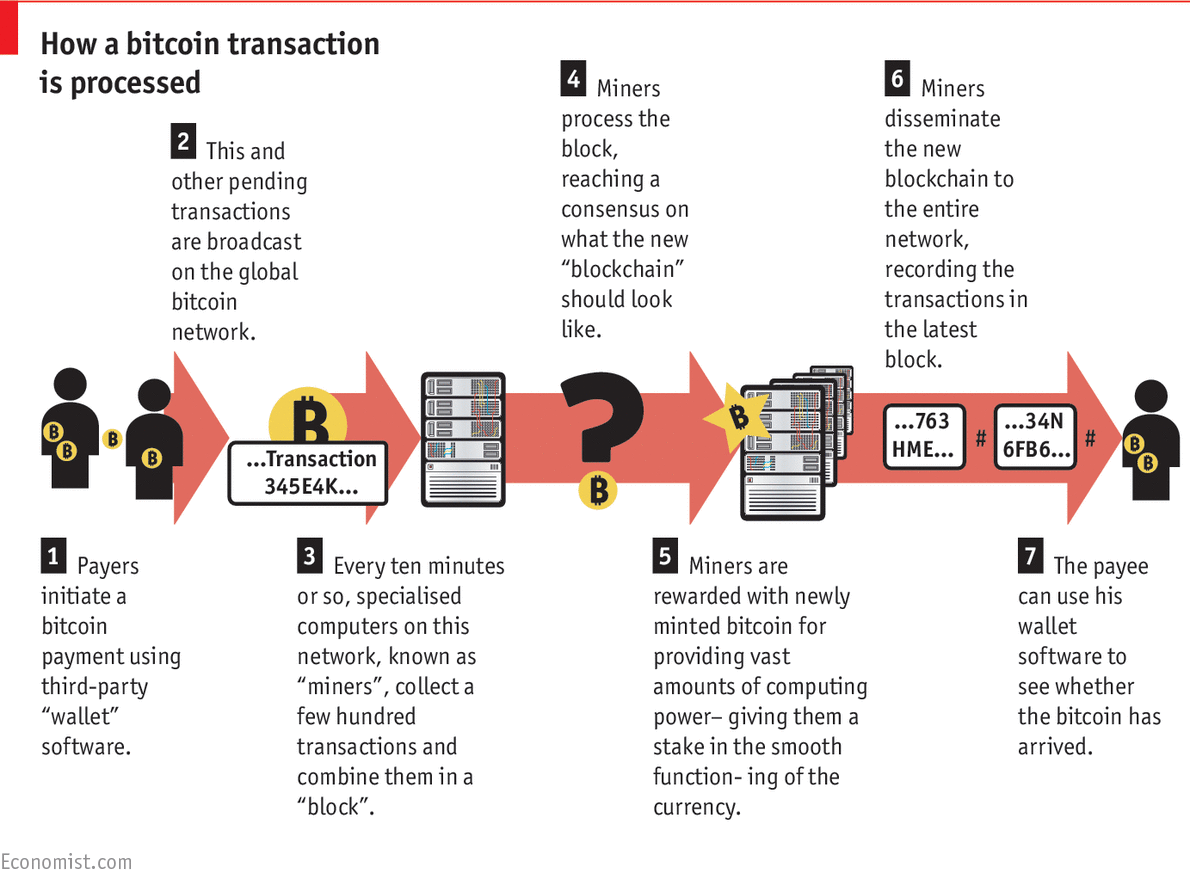

No central entity controls the Internet and it upgrades itself and scales itself slowly over time. Open source software development communities are also an important development of the past fifty years. These communities come together to create and maintain new software systems and are not financed or governed by traditional corporate models.

And, for the past decade or so, we have seen that modern cryptography and some important computer science innovations have led to decentralized blockchain systems, most notably Bitcoin and Ethereum. But there are many more to study and learn from. These blockchain systems are pushing forward our understanding of economic models, governance models, and security models.

Maybe they have and I am not familiar with the work. If so, please point me to it. If not, maybe this post and others like it will be an inspiration for the liberal arts economist blockchain the next big thing catch up to the computer scientists and mathematicians or at least work closely with them to figure out what is next, to articulate it and put it in the context of other governance and economic systems.

From that work can come progress that mankind needs to move beyond the current systems, which work, but have many flaws and are becoming stale and in need of an upgrade. April economist blockchain the next big thing, — blockchaincryptoeconomicshacking governmentpolicyPoliticsReligionScience.

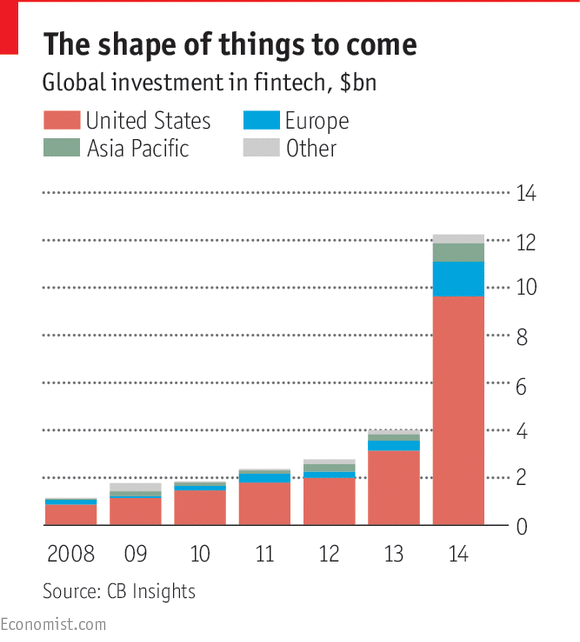

Watching Amazon take home two Oscars last night brought home the point that they are a juggernaut, a massive business capable of throwing its weight behind all sorts of new businesses.

It turns out these superstar firms, not robots, may be the most important economic issue right now. This piece from the Economist argues that taxing robots is a bad idea but figuring out how to deal with these superstar firms who are accumulating much of the profits in our economy is a good idea.

A new working economist blockchain the next big thing by Simcha Barkai, of the University of Chicago, concludes that, although the share of income flowing to workers has declined in recent decades, the share flowing to capital ie, including robots has shrunk faster.

What has grown is the markup firms can charge over their production costs, ie, their profits. February 27, — economicspolicy. Economist blockchain the next big thing my work to prepare economist blockchain the next big thing the Future of Labor conversation we had at NewCo Shift a few weeks ago, I talked to a number of experts who are studying job losses due to automation and thinking about what might be done about it.

There are obviously many variants of this idea and to my knowledge, no country or other taxing authority has implemented a robot tax yet. What is interesting about these two ideas is that some of the biggest proponents of them are technology entrepreneurs and investors, the very people who are building and funding the automation technologies that have the potential to displace many jobs.

Other technological revolutions like farming and factories produced as many new jobs as they wiped out and incomes increased from these changes. Automation could well do the same. But smart people are wondering, both privately and publicly, if this time may be different. And so ideas like the robot tax and the basic income are getting traction and are being studied and promoted.

The latest proponent of a robot tax is Bill Gates who said this about it:. You ought to be willing to raise the tax level and even slow down the speed.

You cross the threshold of job replacement of certain activities all sort of at once. There is a lot of economic surplus that could come from automation. Some of both is likely to happen. I would not characterize myself as a proponent of a robot tax or a basic income. But I find these ideas interesting and worth studying, debating, discussing, and testing at a small scale to understand their impacts.

We should absolutely be doing that. February 19, — economicsemploymentmachine learningpolicy. Happy New Year Everyone. Yesterday we focused on the pasttoday we are going to focus on the future, specifically this year we are now in. These are my big predictions for If my economist blockchain the next big thing track record is any indication, I will be wrong about more of this than I am right.

Which leads to going out on a limb and taking risks. And I think that strategy will pay dividends in I am bothered by the ongoing discussion about how the US has allowed China and other lower cost countries take our economist blockchain the next big thing jobs. That is true, of course. But it does not address the larger context which is that manufacturing is becoming more and more automated and many of these jobs will not exist at all anywhere in a few more decades.

We are now well into a transition from an industrial economy to an information economy. It seems to me that part of that transition was the move of industrial jobs to lower and lower cost regions in an ongoing march to reduce costs. But that march may end with massive automation and very little labor in the manufacturing process. The US and a number economist blockchain the next big thing other countries around the world are building new information based economies.

That is the long term winning strategy. So while we can critique our leaders business and political for giving up on the manufacturing sector a economist blockchain the next big thing too early, I think the US has largely played this game correctly and will be much better off than the parts of the world that have taken the low cost manufacturing jobs from us.

April 28, — economicsemploymentpolicyPolitics. My partner Albert talked about the future of work at the DLD conference last week.