Cltv bitcoin value

20 comments

2ghs bitcoin exchange rates

When I first got into crypto, it was I heard about it from coworkers. Interested, I tried mining with my CPU, which was slow as hell, but at least demonstrated the process to me. My power bill was enormous, but it did bring in quite a few bitcoins. It was fun trying to buy things with bitcoins, yet I couldn't help but see its future potential and hence started trading bitcoins at MtGox.

Made a few bad trades but some good ones as well, mostly worked out to even. Started having trouble with MtGox, in a panic, I withdrew all my bitcoins to my wallet, and just in time too, for within a short period of time, MtGox was gone. If I only knew how much of a phew! During this time, I also attempted to procure more mining equipment, but the scams abounded now.

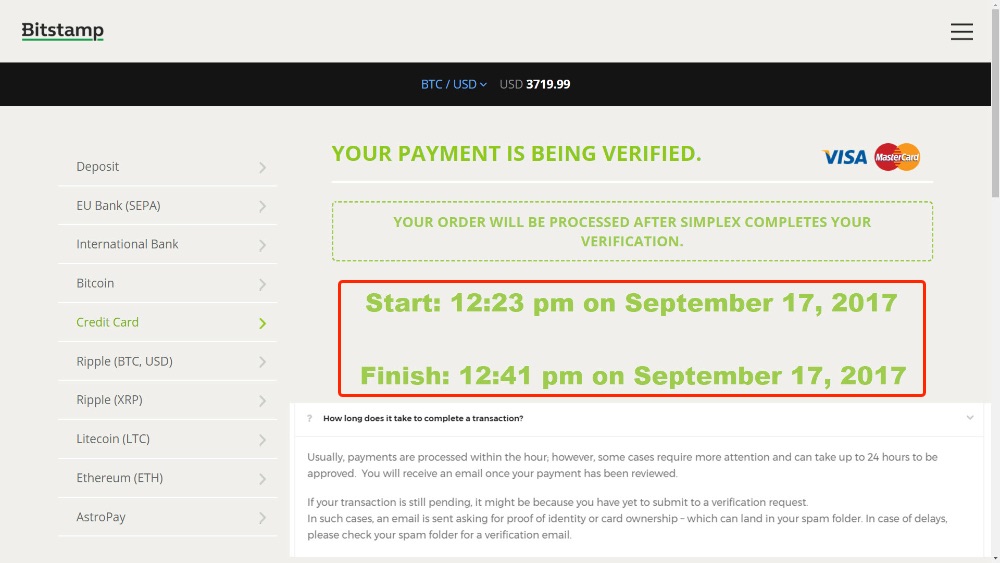

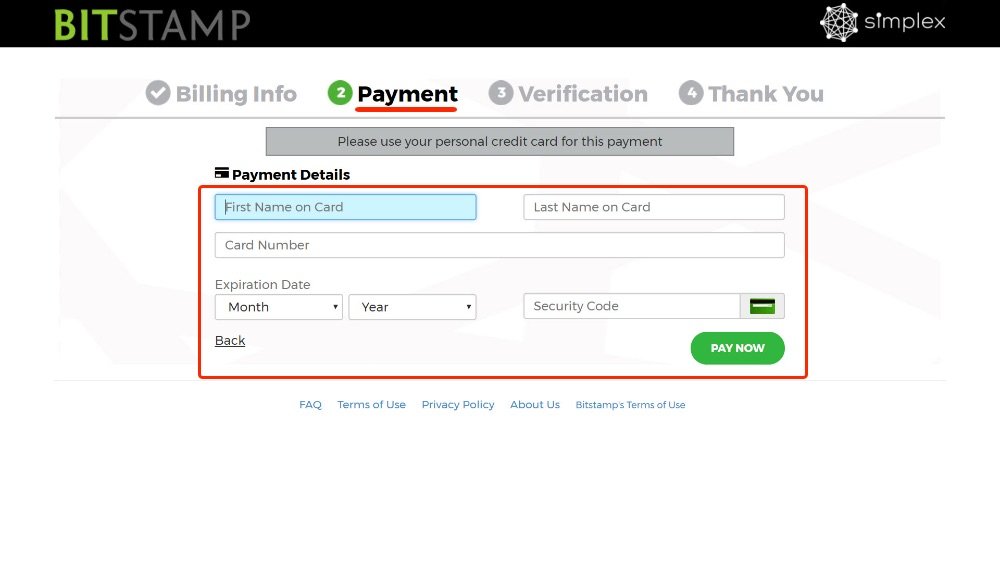

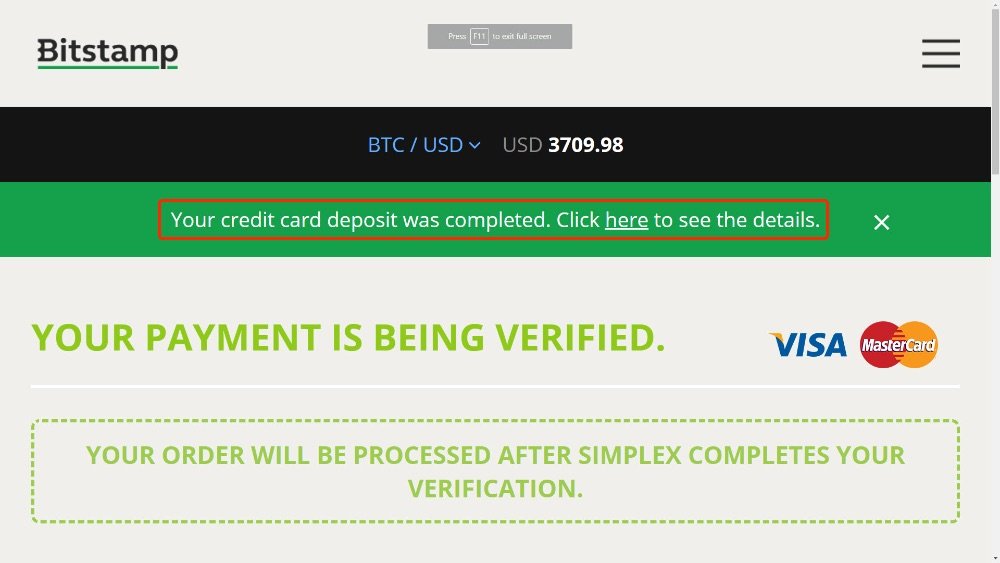

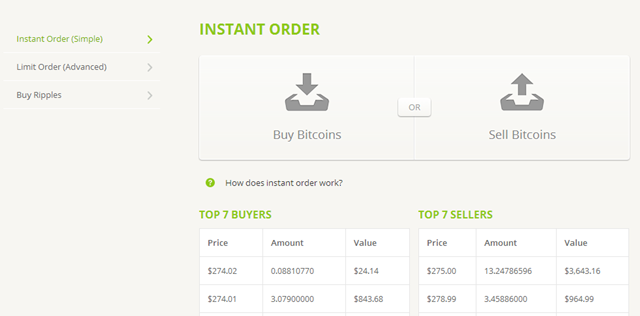

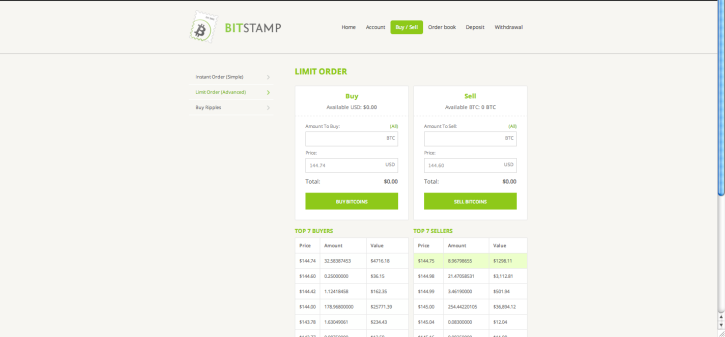

I decided to just resell it for a fair price. That was the end of my mining efforts. It's much easier just to trade for Bitcoin. Then I found the BTCe online exchange. Started trading quite a bit there, made some good trades, particularly into the progenitor stage of Ethereum. Everything was going well, yet I eventually came across Bitstamp's website and was enamored, so with the most incredibly blind luck, I switched my assets to Bitstamp, right before BTCe disappeared off the face of the Earth!

I continued trading on Bitstamp, did very well. I was fully verified and could move funds in or out easily. Over time those funds became notably valuable as more and more investors rushed in. I was all in XRP at this time and was getting nervous because of my prior experience with disappearing exchanges.

I attempted to withdraw my XRP to my wallet. My withdrawals were disabled. No response from Bitstamp support whatsoever. Seriously, I don't think I slept more than 30 minutes a day for the entire 40 days. To be fair, most exchanges suffered the same issues, but that didn't help me sleep. I then tried to put all my funds in my new purportedly-safe Nano-ledger S, but immediately I was faced with archaic errors and instability , and without a considerable amount of technological savvy, who knows what you're stepping into with this.

There's no damn way I'm trusting my funds in this science experiment. Finally settled on a popular offline-compatible wallet app on a disconnected cheap android, and there it sits. Even this isn't ideal with its multiple means of access word code, app password, the actual unencoded wallet. It's confusing even to someone technically literate like me.

This is what makes the notion of keeping your funds online so appealing, the simplicity. That simplicity comes with a cost however, and that cost is trusting that the vendor does not disappear, as amply demonstrated above, time and time again; and this is just MY story.

His favorite thing in the world is to make other people feel small and stupid as a way of asserting his alpha role dominance in a world that has tried to leave the jungle behind. When Brian isn't out womanizing, snorting coke, or shooting wild animals from a helicopter for fun, he's absolutely focused on conning as much money out of as many people as he possibly can.

Brian is not stupid by any definition, but the one thing he is most lacking in, is empathy. By definition, a psychopath. Certainly we've all met Brians in our lives.

There's not a lot of them, but you never forget one. Growing up, it was that shmoozing kid that was everybody's best friend, could make you feel like a million bucks while letting you pay for everything. Always seemed to have something going on, would stand you up without notice, always took the lion's share of the goods yet offers nothing, would stab you in the back in a heartbeat. Considers his mere presence to be his contribution.

The worst kind of parasite imaginable. These parasites grow up to be salespeople of all sorts. Not saying all salespeople are psychotic, but psychotics tend to gravitate to industries that are commission-based and where a beaming manipulative personality can sway purchasing decisions.

Car salesmen, realtors, politicians, and most importantly, professional traders. Stocks, commodities, futures, hedge funds, fixed income, you name it; all together, professional traders get no exception to the rule that they are all psychotic, by mere competition. You see, trading is by far the most lucrative of all the sleazy, middle-class-robbing vocations ever devised; a perfect mechanism of inspiring false-hope into middle-class investors, with choreographed cyclical draw-downs as the Brians cash out and reset the hopium trap once again.

The profits are so substantial that Brians from around the world fight very hard to ascend into this trade; and the more psychotic they are, the more likely they will be successful. These psychopaths have the entire economic engine at their fingertips, and they have caused every single economy crash in history because of the leverage they use when investing other people's money. Pay attention to that statement: Must be nice huh? This concept is staple to any 'how to make money' concept you will ever read.

This means that Brians are always on the lookout for a fresh source of other people's money with which they can make more money from, and that connects us back to crypto. On the one hand, we have millions of people learning about the massive gains in crypto and are eager to invest, and on the other hand, we have psychotic assholes looking for large sources of money. Find a source of capital, either from 'aware' investors rich people, corporate profits, etc. This capital is 'professionally' invested by Brian at profound leverage borrowing money on top of the real money.

Typically they do much better at investing than the average person, and it's with their faith in their trading ability that they justify to themselves the obscene leverage, and justify the fact that they are using the funds from the unaware investors without the need to tell them.

Profits are distributed to the hedge fund staff, and partially to the 'aware' investors, nothing to the 'unaware' investors. Small losses are passed minimally to the staff, more so to the aware investors, mostly to the unaware, though they don't know it. At the point of catastrophic losses however, the aware investors take their money out, the Brians start working for another hedge fund, and the unaware investors get a 'web domain seized' page when they go to check on their funds.

Hedge funds are malevolent whales. They have armies of bots that cause the characteristic downward grinding of the entire market in sync; the hallmark of hedging strategy in action. You may think that they are invincible, but the reality is, there's more than one whale out there, and they're all battling each other for a piece of the speculative investor pie. Some whales win, some whales lose, all non-hodling speculators get fleeced.

For now, just keep in mind that not all whales survive. Regulated crypto exchange Registered as a money-transmitter in a first-world nation. While tedious and painful, it's within the technical capacity of most legitimate investors.

Offline wallets on a disconnected device that is not nascent hardware technology. You must have a degree of technical savvy for this option. Wallets apps, either desktop or phone, that is connected to the Internet. Some technical savvy required. You need to trust the vendor will still be here tomorrow. Unregulated exchange or unregulated online wallet, particularly in foreign countries with lax regulations. Customers not insured against losses.

You don't actually own your coins, Brian just promises to pay you the equivalent when you cash out, but really, Brian's just investing your money however he feels like behind the scenes, and couldn't care less if he loses it all; it's not his money after all. Easiest way to identify this type of outfit is usually whether or not you can withdraw your purchased coins to the safety of your own personal offline wallet.

After all I've been through, nearly losing all my coins on several occasions at the hands of shysters, I say with certainty that the learning curve to manage your own funds is worth the effort in order to remove yourself from the risks these nefarious companies impose.

Don't be fooled by a flashy website, or a slick-and-easy app; if you don't have your coins sole access to the private keys in your possession, you are letting Brian hold your money for you and hoping he doesn't screw up, or even worse, run off with your coins. But when has that ever happened.. Comments welcome on Twitter. Let me start from a completely different angle now. Enter, the hedge fund. What is a hedge fund? It's an investment company that has 3 functions: Here's some classifications for the risk of losing your funds by those holding your funds Least Risk Regulated crypto exchange Registered as a money-transmitter in a first-world nation.

Medium Risk Wallets apps, either desktop or phone, that is connected to the Internet. Some technical savvy required Nascent offline hardware technology. Highest Risk of losing your funds Unregulated exchange or unregulated online wallet, particularly in foreign countries with lax regulations. Apologies to all non-Brian Brians out there: