MODERATORS

5 stars based on

73 reviews

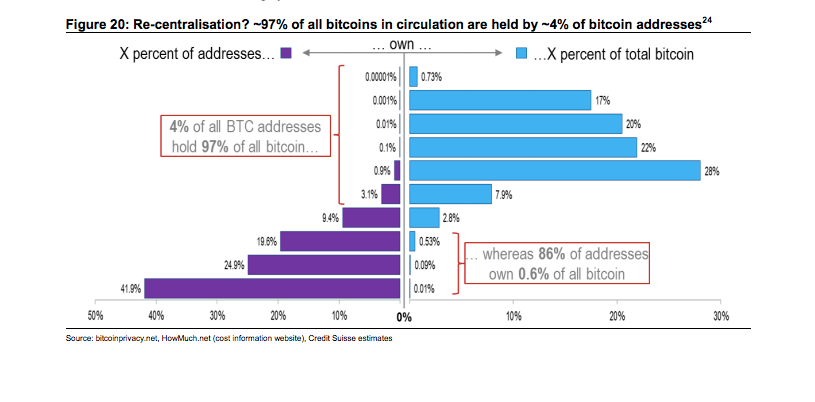

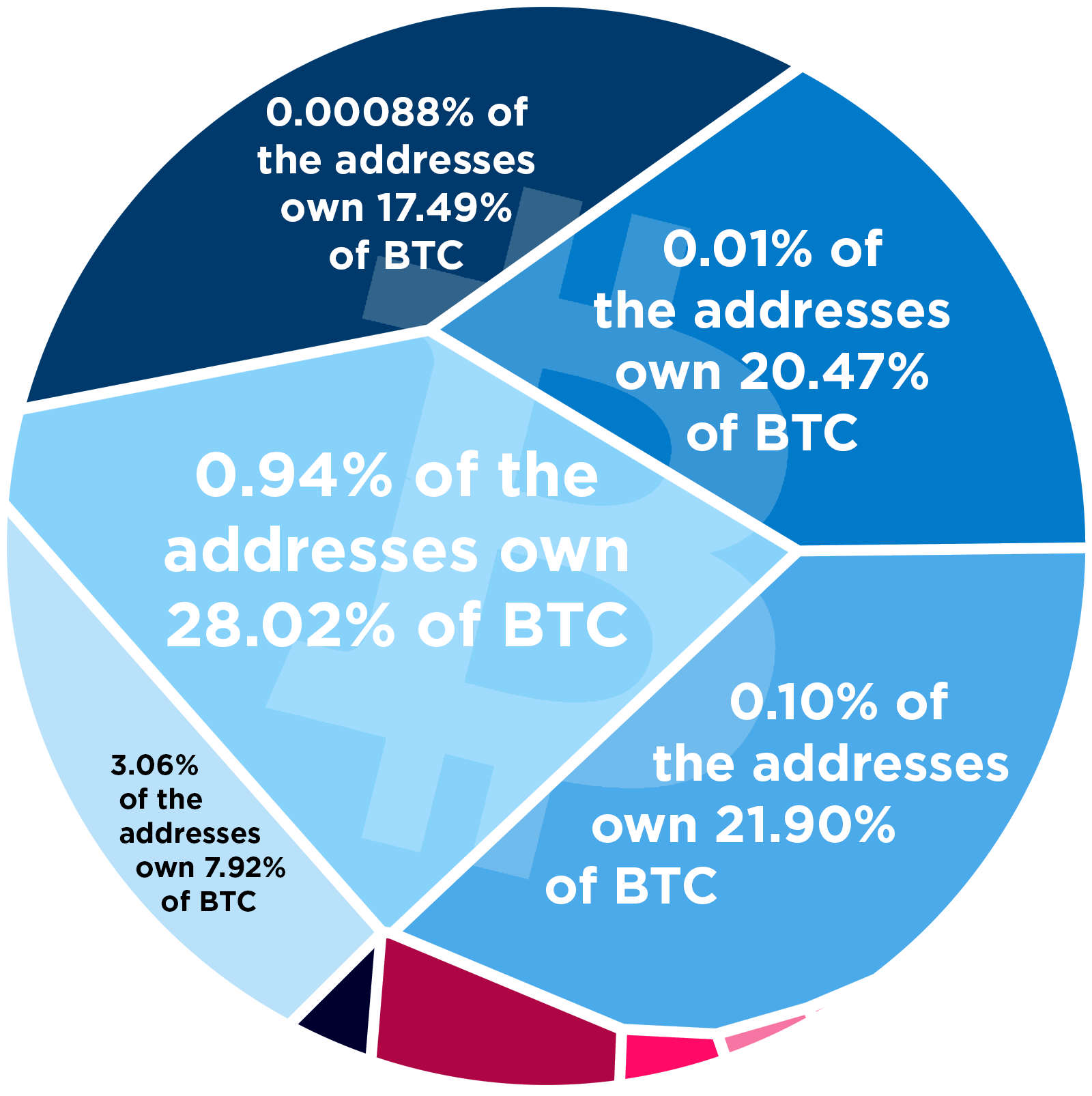

This is not intended to be "FUD" post but rather a "perspective" one. In the traditional FIAT world, money is concentrated in a handful of people due to abuse of power. In the crypto world, and especially in Bitcoin, this happens because of the early adaptation from visionaries and the original believers that adopted the technology. We still don't know if Satoshi Nakamoto was a financial visionary, a revolutionary, a researcher having fun or a government agency deploying a beta digital currency to replace the old obsolete system.

We can speculate and hypothesize about all the scenarios but in the end, we will be left with bitcoin ownership concentration other than a tinfoil hat. Either way, the story behind Bitcoin should not distract us from the main point. A few people hold the vast majority of wealth. It doesn't matter if they spread it through a few wallets. Some coins have not moved for ages even if the price has climbed or plummeted in crazy magnitudes.

If one single whale decided to play the market, they could easily spread havoc. This brings us to the point of decentralisation which was one of bitcoin ownership concentration main points of Bitcoin and the thereafter blockchain development.

The technology bitcoin ownership concentration be decentralised but that does not mean the system is. As of recently,6 mining farms controlled most of the ecosystem. Most new people entering are playing with launch money. It is not clear how and when institutional investors entered the scene. A small bear market on Bitcoin shakes the entirety of all other projects. I wouldn't call Blockchain a bubble but Bitcoin ownership concentration would definitely call Bitcoin bitcoin ownership concentration.

I do not believe a Bitcoin crash will decimate the entire ecosystem as it did bitcoin ownership concentration the past. I believe this time will be different. Bitcoin ownership concentration market cap of Bitcoin will eventually flow into the alt coins. It will be a slow process that will last a year or more. This will happen partially because Bitcoin is an old technology and as much as it wants to act as a store of value, money is dependent on velocity, not hoarding.

The second important reason is the blockchain itself. If Blockchain bitcoin ownership concentration are to take over the world all that money will not just be sitting there waiting for the lambo moment. They will flow in order to grow. Yeh it's hard to see Bitcoin really surviving long term unless significant upgrades are made to it so that it can keep bitcoin ownership concentration with the pack, however it will still be top dog as long as it's the gateway between fiat and crypto.

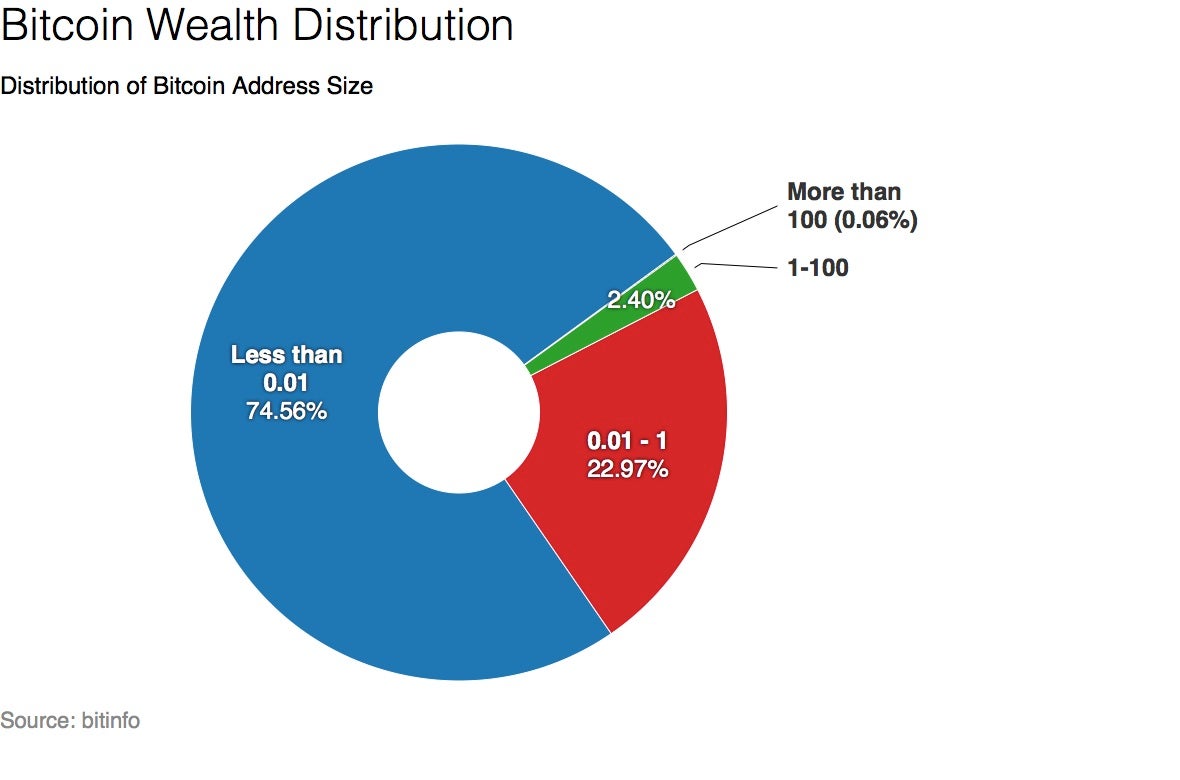

So low balance address are unspendable because of high fees. Transaction fees are in terms bitcoin ownership concentration bitcoin, not dollars, so yes. The dollar price of bitcoin makes no difference. It could be a million dollars, or it could be a penny, it wouldn't make sense to consolodate them until those fees come way down. A de-centralized technology that was centralized. BTC has issues which will, eventually, be bitcoin ownership concentration out.

However, the world does not rely on BTC anymore. There are many other worthwhile tokens that are going to have as big an impact. BTC is really a store of wealth. It isnt useful for transactions. Will this change in the future? That is why I keep taking slivers of BTC off and investing elsewhere.

Ride the BTC upward and then roll it bitcoin ownership concentration other things. Thanks for this reminder. This is super important to consider. But then, we just don't know. These addresses could also be lost money, no? If the owners misplaced their private keys to them? Probably unlikely but possible.

However, BTC itself seems to have all the makings of a massive speculative bubble - let's hope that when it eventually pops it doesn't take the rest of the market with it. At the risk of being shot for blasphemy: Ever since entering the crypto space I have been appalled and shocked how much it simulates copies? Can't we do better than that? I'm banking on holochain and ethical ICOs.

Bitcoin ownership concentration, thats the current situation. I found no data for its change over time and little bitcoin ownership concentration none coparison to wealth distribution in the world.

Can you point out where exactly is the data how do rich get richer? And why is it bad? They are probably all miners, right? This is bitcoin ownership concentration current global wealth distribution. Authors get paid when people like you upvote their post. Do you even LN? How does the money distribution compare to the world?

How does it change? That about sums it up. Well, the money seems to disagree. Great article, thanks for the perspective. I agree, blockchain technology is still in it's infancy and has a ton of room to still grow. Than the rich getting richer.