Consensus algorithm bitcoin minerals

31 comments

This twitter bot tracks neonazi bitcoin transactions

Just to be brutally truthful, there are tons of mainly technical issues that I still do not quite grasp, and which might even invalidate some of the claims I put forward. Yes, cryptocurrencies are all the rage, but other than the simple fact that this is a kind of commodity-currency, the above developments clearly suggest that the base in this case USD will be heavily diluted, inflated away, and useless.

But is Bitcoin really a superior form of money? As for medium of exchange, we need to make a qualification as we rarely directly exchange cash money but rather we issue claims on base money, which is basically also how commercial banks create money, and can be something as mundane as when we use a credit card.

If we rarely transact directly and simultaneously with base money, two time-consistency problems arise:. Any money needs to provide an acceptable solution to these risks for parties involved in the transaction. In my humble opinion, while Bitcoin might do away with any possible lack of trust in the means of payment 1 , its payments are also irreversible at least without expensive judicial confrontation.

Fiat-money payments, on the other hand, can efficiently be reversed. Some may see this as a flaw, but think of how it helps to build trust on behalf of the buyer. Such transactions would probably not occur with irreversible Bitcoin payments. Put another way, fiat currencies build trust and facilitates trade that would not take place under bitcoin-type of money. Of course, the feature of reversibility also opens up for a certain degree of discretion often of the intermediator, typically a bank.

If and when that happens there has already been multiple incidents , all your previous transactions become exposed. Likewise, the increased complexity of the cryptopuzzles make storage impractical why most users tend to store their coins in exchanges. And we know from the Mt Gox experience there have been others that such exchanges can be compromised, and lose the coins.

Without store of value it will be hard for us to make economic calculations and to balance future incomes and outlays, hampering the formation of more complex economic and thus physical constructs. If the value of our assets incl. Put another way, such monies are unavailable for stabilization policy purposes, should they ever replace current fiat-money as unit of account.

In essence, this means that when we enter a recession, unemployment rates will need to rise further to bring about the necessary relative-price adjustments. Under a fiat-money regime, this adjustment would be facilitated by changes to interest rates or QE or of the currency. In fact, fiat-money were designed to bring price stability and, hence, to minimize cyclical swings. A glaring example and a blatant rip-off from David Andolfatto of St Louis Fed of life under a Bitcoin-money regime is to see how the use of Bitcoin would spell out in terms of the US deflator for personal consumption expenditures PCE.

Bear with me for a moment: If the US would have started to use Bitcoin in January , the ensuing year would have implied more than a doubling of prices and a purchasing power cut in half. In USD-terms, prices would have been almost completely stable. Fact is, it would even have been better for the US to switch to Euros instead of Bitcoin, as it would have implied at least a relatively stable price level.

Admittedly, since USD has been the actual unit of account for all US domestic contracts, the comparison is not completely fair, but that would probably only imply a minute improvement in the performance of Bitcoin as a store of value and unit of account. By now, you have probably guessed that I am a bit hesitant to a more wide-ranging use of Bitcoin in the economy. Unfortunately, there are other issues with Bitcoin and many other cryptocurrencies that I fail to wrap my head around.

For instance, one of the stated objectives with Bitcoin was to bring down transaction costs for doing small transfers. The way I see Bitcoin, this seems completely topsy-turvy. Transaction costs will probably rise as maintaining the ledgers and mining new Bitcoins requires ever more computer capacity and energy 2. This cost will only rise as the cryptopuzzles that needs to be solved will become ever more complicated.

In addition, it puts a severe limit on the number of transactions per time unit. This is not yet in the Macrobond database, but as I know all of you will send support-tickets asking for this to be added, it is just a matter of time. Bitcoin transaction costs are on the rise. One of the reasons for these developments is of course the rising value of Bitcoins. As of now, at least, bitcoins need to be transferred into a working fiat-currency, making this transaction cost very real.

Even in Bitcoin-terms the transaction cost has nonetheless risen and is currently between one to two per cent, which puts it on par with any old credit card. Transaction costs are, admittedly, not fixed on Bitcoin markets but depend on, among other things, how you prioritize your transaction.

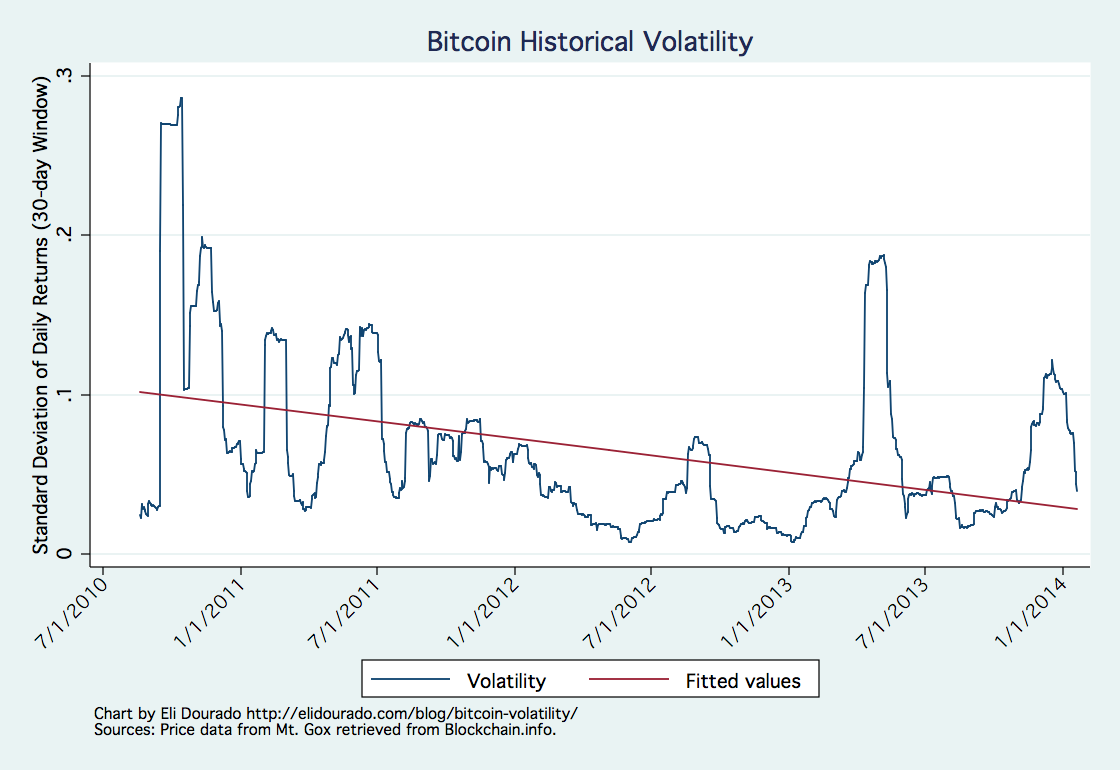

Given the extreme volatility of the currency, it is nonetheless plausible that most participants prefer rapid settlements. Many of the alternative cryptocurrencies out there were created to address some of the weaknesses discussed above, but any clear alternative has yet to materialize. On that note, and remaining vigilant on the ongoing hype of ICO: And that will probably pose a more acute threat to the current fiat-money system than what Bitcoin and its siblings can ever muster.

For now, and as I have tried to argue above, current fiat-monies perform the three basic functions of money much more efficiently then cryptocurrencies. In addition, they provide a means to stabilize economies and the transaction costs are not dauntingly high for most transfers. However, the fiat-system requires a certain amount of trust and the flexibility of the arrangement also invites discretion which might provoke some. Let us put it bluntly, every fiat-system has failed and all current and future fiat-systems will probably also fail.

No state has ever lived indefinitely and I believe this conjecture to hold true for modern nation states as well. A fiat-system is an agreement.

We agree to live in and use the money of a nation and let the government collect taxes and seigniorage to all our benefit. In return, the government will not go all haywire and squander all our money effectively refusing us the possibility to exchange our amassed assets for a decent standard of living in a not too distant future.

In economies where trust in the government is low, I can more easily understand the presence of such fears. That Cypriots popularized Bitcoin during the enforcing of capital controls and that Chinese people similarly saw Bitcoin as a way to sneak past currency and capital controls 3 is even somewhat understandable. For most other countries; developed economies and democracies, the current interest in cryptocurrencies is simply … baffling. A world marred by mediocre weak income growth, low or negative interest rates, rising debts and brazen political clientelism is fertile ground for conspiracy theories: Central banks are only an extension of the state.

If they could, they would inflate away all debts, confiscate massive assets, and destroy our future welfare in the blink of an eye. If holding such thoughts, Bitcoin should perhaps not be argued for in terms of efficiency, but more in terms of political ethics, or the lack of it.

From that perspective, Bitcoin is the digital equivalent of gold. Given the massive drawbacks of current cryptocurrencies it is perhaps even more surprising that almost all major central banks CBs and attached institutions BIS, IMF have articulated such an overwhelmingly positive view of central bank crypto currencies and other forms of e-money. Then again, considering even the slimmest chance of a loss of seigniorage, that position is perhaps understandable after all.

And to fully utilize the digitalization of money, the CB will want to and needs to become the depository institution ledger keeper of both households and companies incl. Actually, this will probably happen anyway, as depositors will eventually all run to the public debt financed central bank with deposits when they fear their current private debt financed bank is insolvent. Thus, in extension, the central bank could very well become the sole lender in the economy.

And here I thought cryptocurrencies were some kind of gigantic libertarian project. I apologize for an unnecessarily melodramatic final passage. Red Kryptonite was later described as causing odd behavior or bizarre transformations, albeit temporary and non-fatal. TV adaptations typically show Red Kryptonite making Kryptonians dangerously uninhibited and narcissistic. If you like what you read, why not subscribe to have these analyses delivered to your inbox every Friday?