Cartera bitcoin android wallet

47 comments

Counterparty vs ethereum crypto

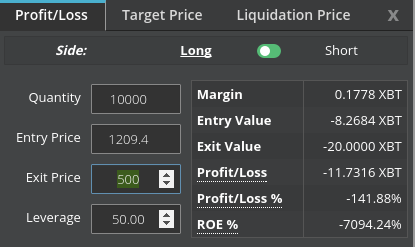

Let's consider an example - a falling market. This has a potential to make profit to a trader. This is called a short position. You are able to decrease it to lower your risks, or increase it to allow for greater market fluctuations but a higher risk to you.

If the market moves while viewing the details, the position will not be opened, and new details will be offered that reflect current best offer. On a busy market this can be a little frustrating, so you can flag this feature off and open a position with best current conditions provided by the exchange. The currency needed to repay the debt is bought and given back. You get the rest of the money provided the position was profitable as well as the amount reserved as insurance initially.

If your position is not profitable, some of the reserved insurance will be used to repay the broker. You may place market orders or limit orders using your own funds only.

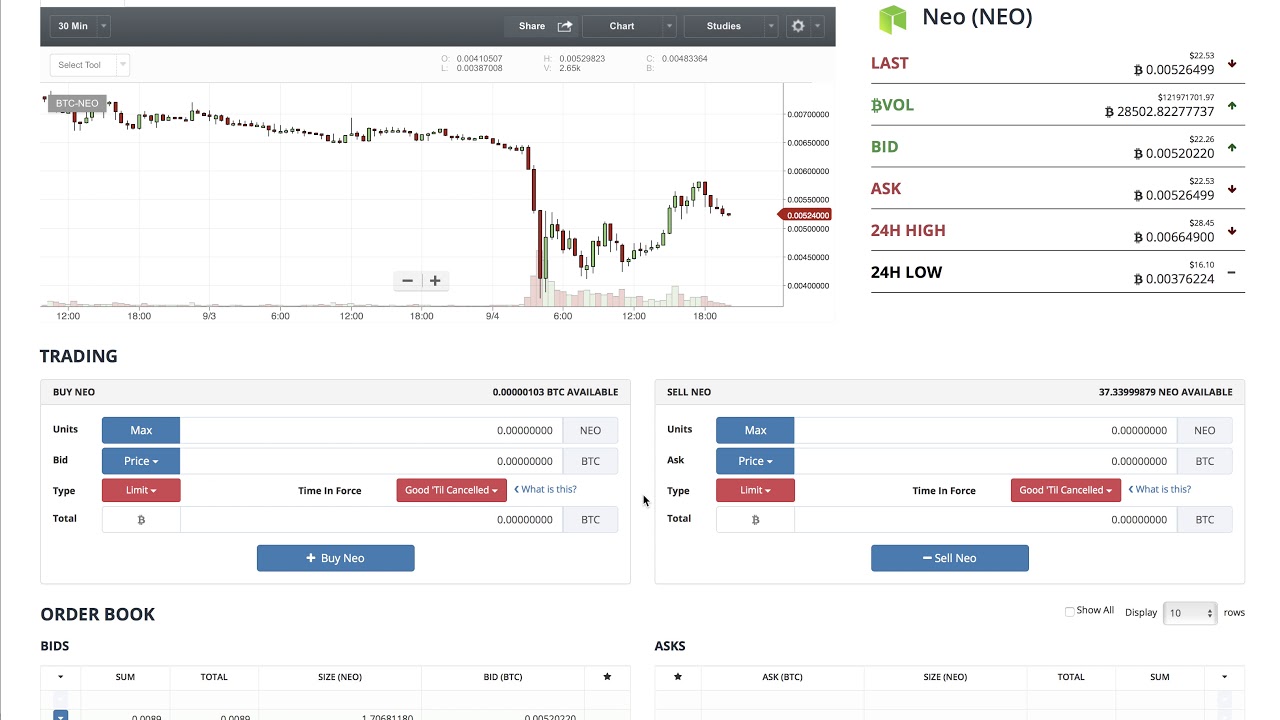

Margin trading can be done using leverage only. If I see a market opportunity I'd like to take it while I wait for my deposit to clear. Hey no i meant, is it possible for me to set a target price? Let's say i go short at and want to set my target at to automatically close position. Is there any way to do so? Target price option is not there as the risk prevention mechanism automatically closes the position in case there is a risk of going to loss minimizing it for the users.

We have a weird problem, when making Margin Trading. When trying to short Bitcoin using our USD wallet with 1: BTC and our profit is calculated on that amount, so in order to actually short 0. But the fees are calculated based on the amount we have set and not on the true amount. The weird thing is that, if we are going long with the same amount and leverage everything is at is. I searched everywhere for an explanation for this and could not found anything?

Akhil G, you can check transcation ID: When using leverage 1: That behaviour is acting correctly when I open a long position, but when I open a short position even though I enter an amount of 0. Is there a logic why the short and the long position are different, it is very confusing.

You can check Order ID: That still does not explain the different in amount used when making short and long positions with the same leverage and the same currency as collateral.

Please tell your tech team to compare these two orders. They have exactly the same parameters and completely different outcomes in terms of profit calculation, which is the confusing part and I don't think it's related to the borrowed amount. Please check the currencies in both order they are different. I have rechecked with the tech team , the margin trading works on certain specifications and it is not a bug.

No, they are not different, your system for some reason show them as different. But here are the original orders:. Nothing else was changed. I have not idea why your system show different currencies afterwards in the history, like I said this is very confusing.

If you basically only do a long or a short, they should be the same with the same amount. Detailed position data will be displayed. Sorry, didn't get your query clearly. Hey how do i set the price to to close my margin position? Please check the stop-loss price for closing position. Is it possible for you to give me the order number under the example you have given? I see that this order has the following case: Edited by Akhil G August 16, Akhil, When using leverage 1: As explained the the tech team I am replying to you.

For us this looks like a bug, you don't want to fix. But here are the original orders: Zhen Wang I have already mentioned it is not a bug and teach team has confirmed it. Please sign in to leave a comment.