Hacker news dogecoin pool

15 comments

Nexys 3 spartan6 fpga board bitcoin exchange rate

Jesse Powell, CEO of crypto asset exchange Kraken, explains why he publicly rejected then-Attorney General Eric Schneiderman's request for information from crypto exchanges, why he felt it was a publicity stunt and why Kraken, which stopped serving New York customers after New York's Bitlicense was introduced, doesn't see the market as a top priority. Plus, he gets into why he named the exchange after a Norse sea monster, the dangers of the exchange's margin trading product, and what steps he recommends everyone in crypto take to keep their tokens safe.

Past Unchained episode with Brock Pierce who also had a pre-Bitcoin career involving video game currency Jesse and Brock were competitors: Kraken donation to Coin Center: Kraken down for 40 hours: Past Unchained episode on taxation of crypto: Kraken blog post on phone numbers being hijacked: My article on the same topic: This recording of a panel I moderated at Ethereal with Ethereum researcher Vlad Zamfir and GovernX founder Nick Dodson covered the topic that it seems everyone in crypto is discussing these days: We talk about how the community should decide whether or not to unlock the funds frozen by bugs, on-chain governance, what role the Ethereum Foundation plays and what it means that nearly all the people who write Ethereum's code are men.

If you liked this discussion, also be sure to check out my recent episode with Aya Miyaguchi, executive director of the Ethereum Foundation: Thank you to Ethereal for hosting a great event! Click here to refresh the feed. The newly appointed head of the Ethereum Foundation, Aya Miyaguchi, talks about her background as a teacher, at Kraken, helping the Mt. Gox trustee unwind that mess, and the closed process by which she was plucked for her current role.

She also describes her goals with the Ethereum Foundation, how the EF believes the Ethereum community should make decisions, how it defines community and more.

She also talks about how she hopes to push more financial inclusion with Ethereum, and what she thinks needs to be done to get more women involved in crypto. We go over whether or not it plays an essential role in Ripple's products, why banks are unlikely to adopt it, and why it's centralized.

We also discuss whether or not it's an unregistered security although the class-action lawsuit alleging XRP is an unregistered security being sold in a "never-ending ICO" came out after we recorded -- link below. We also discuss recent attempts by XRP to get it listed on top crypto exchanges, and how, as Selkis puts it, there's a fine line between some of its business activity and bribes.

We also ponder the question: Full text of class-action lawsuit against Ripple: Bloomberg article on lawsuit: Matt's article on why big banks have no interest in using XRP: How Ripple tried to buy its way onto crypto exchanges: Ryan's post on XRP: Izabella Kaminska's article on XRP: CoinDesk article on XRP: XRP chat post by David Schwartz: Bitmex post on XRP: Here is the second special episode from the Time Summit, a Bridge Alternatives event, on how institutional investors can do operational due diligence.

They discuss why a year of experience in crypto is so valuable, how they determine who the serious players are in the space and why the speed of disruption from the internet revolution gives them motivation to get into the crypto markets. Thank you to the Time Summit, a Bridge Alternatives event! We discussed what infrastructure tools need to be built to get institutional players comfortable with the space, how custodying a digital asset differs from custodying a traditional asset, why they can see institutional players dealing in stablecoins and trading on decentralized exchanges at some point in the future, and what needs to be built out in terms of trading infrastructure for institutional players.

The episode with Mike Belshe where we discuss custodying digital assets and qualified custodians: Kyle Samani and Tushar Jain, cofounders of Multicoin Capital, dive deeply into their sometimes controversial and unpopular opinions on how the crypto revolution will play out.

They describe why they don't think the technology that a team develops early on will play nearly as big a role as some think, why there will be a spectrum of blockchains offering different features with different tradeoffs, and why they're bearish on stablecoins.

They discuss why they disagree on whether or not the Lightning Network is revolutionary and therefore why they disagree on whether Bitcoin is failing. Samani and Jain also explain how they decide whether or not to invest in a token, their strategies for trading and why they don't have to be invested in a project to help out.

A blog post that came out after we recorded in which Kyle expands on his contention that technical features will matter less in the long-term success of a network than people think: Kyle's post on the outlook for coins for store of value, utility tokens and stablecoins: More Multicoin thinking around stablecoins: Paul Walsh had long ago predicted that internet scams would migrate from email to private messaging platforms, but it wasn't until crypto mania took off that his thesis was proved right -- in a big way.

In the summer of , the founder and CEO of MetaCert discovered many crypto Slack channels were being overrun by scammers capitalizing on FOMO to get people to inadvertently give them their ether and other tokens. Now, the company has several products to help prevent crypto enthusiasts from being scammed and it also decentralizing its work so the whole world can help classify bad links and proven others from being scammed.

In this talk, he describes how the scams work, how Metacert tries to keep people from falling victim, and how best you can protect your own crypto. Link to episode where Mike Belshe and I discuss physical crimes against crypto people: In this live recording of a panel discussion at the CoinAlts Fund Symposium, Marco Santori, president and chief legal officer of Blockchain, managing director at Grayscale Investments, and Barbara Minuzzi, cofounder and managing partner of Ausum Ventures take stock of the year and discuss a range of trends they're seeing in the industry.

Santori describes what the ICO wave was like from his seat as one of the most in-demand lawyers for ICOs, and why he doesn't actually think that securities such as a SAFT can later transform into something that is a non-security.

He also talks about how big corporations are thinking about use blockchain technology -- and why we haven't yet seen much activity on that front in the market. We talk about the current clouds over the industry -- custody and regulation -- and Sonnenshein explains why investors choose Grayscale's investment products, such as the Bitcoin Investment Trust, rather that investing in the coin directly, and.

Thank you to the CoinAlts Fund Symposium for hosting the panel: Perianne Boring, the founder and president of the Chamber of Digital Commerce, and its global policy director and general counsel Amy Kim, discuss why U. They also discuss what they call the "failure" of the regulatory regime that requires certain types of crypto companies to get licenses from 53 different states and territories and why no firms have so far even gotten close. They also advocate for the technology to be taxed more like currency than property, claiming that the current classification stifles usage of cryptocurrencies as currencies.

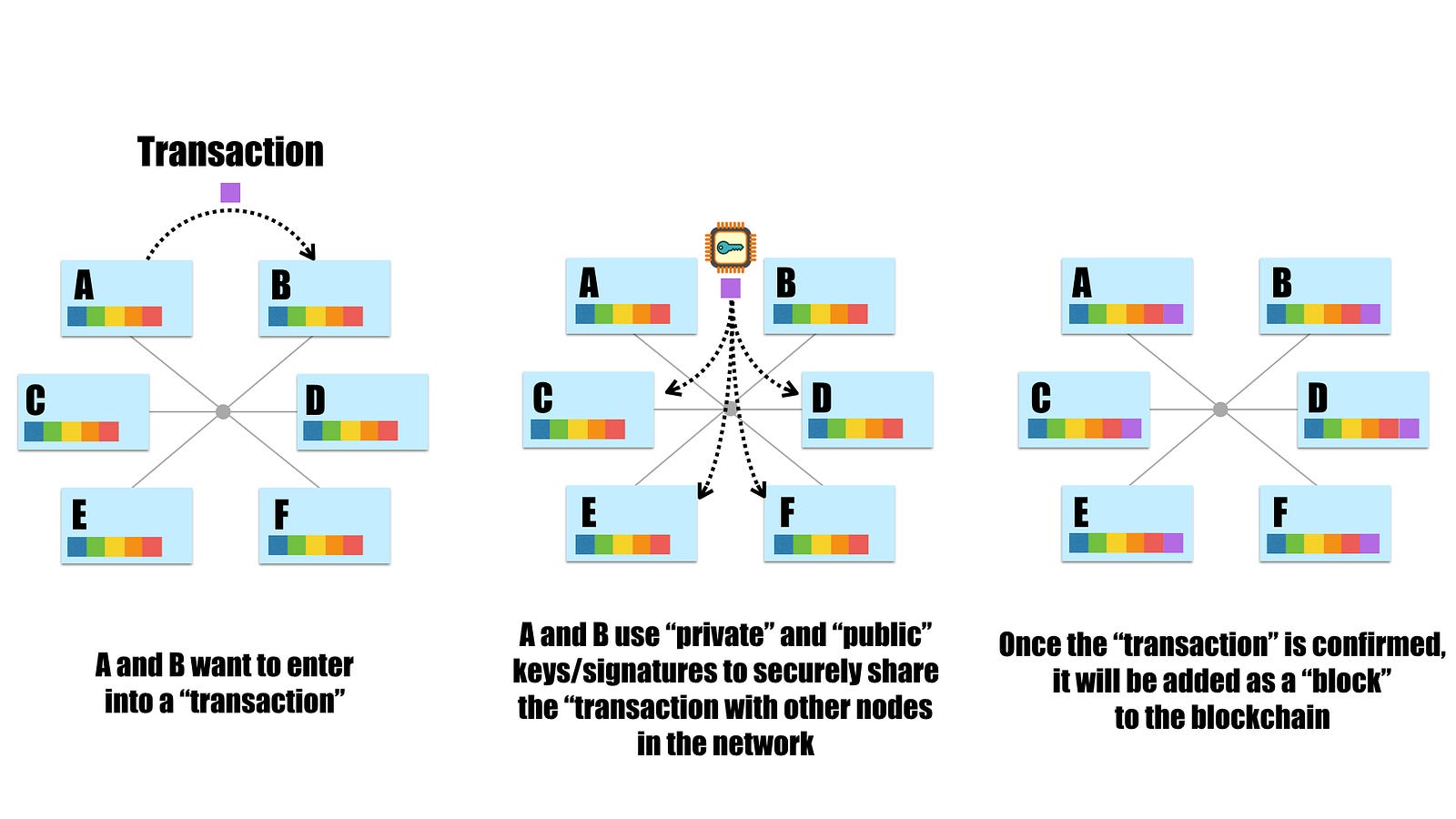

We also dive into juicy questions like whether ether, which was sold in what we would now call an initial coin offering, is a security and what self-regulation of the crypto space could look like. Chamber of Digital Commerce: Through Inforum at the Commonwealth Club, I recently moderated a sold-out discussion on the basics of blockchain technology and cryptocurrency. My guest was Kathryn Haun, a former federal prosecutor who is now teaching a class on cryptocurrency at the Stanford Graduate School of Business and serves on the boards of Coinbase and Hacker One.

We go through all the elementary questions most newbies have: I think it's a perfect primer for people new to crypto -- whether you're listening for tips on how to explain these concepts to your friends and family, or you're a newbie yourself and want a dead-simple explainer. This is the first in a series of talks with Inforum on blockchain and crypto, so stay tuned for future events. Inforum at the Commonwealth Club: Valery Vavilov and George Kikvadze of Bitcoin mining and blockchain software company Bitfury discuss why the firm has partnered with the publicly traded Hut 8, how it plans to branch out into mining other crypto assets, and how it chooses where to open mining operations.

Vavilov also tells the story of a childhood experience that has influenced Bitfury's decision to work so much with governments and regulators, and he and Kikvadze describe the company's new blockchain analytics tool, Crystal, plus its hand in launching other blockchain-and-government-focused organizations such as the Blockchain Alliance and the Blockchain Trust Accelerator. Bitfury's origin story as told by Bill Tai: Pilot with Coca-Cola and State Department: To recognize someone for a future ad spot, go to https: In an intermittent series on cryptoeconomics, Olaf Carlson-Wee and Ryan Zurrer of crypto hedge fund Polychain Capital describe what cryptoeconomics is, what goals it typically helps networks accomplish and what behaviors token systems might someday incentivize.

We discuss when cryptoeconomic models don't make sense, how the type of consensus algorithms a blockchain chooses can affect behavior in that system and which consensus mechanisms excite them now.

We also dive into whether or not it's desirable for a cryptoeconomic system to depend on a small number of knowledgeable participants, how to manage on-chain governance so networks don't vote themselves into a "black hole," and what disciplines are helpful in designing smart cryptoeconomic systems. Recognize someone with a shout out: Zooko Wilcox, the founder and CEO of the Zcash company, explains why he wanted to create the privacy coin Zcash, why he believes privacy is essential to decentralization, and how encryption is the way censorship-resistance can be created on a technical level.

We talk about the revelation that the NSA was targeting Bitcoin users by gathering details on their devices and how even Zcash users could be targeted the same way, but why Zooko believes most people are more concerned about other threats.

He also describes he would feel if he knew that criminals were using Zcash for horrible crimes. The transaction that Zooko and I dissect during the episode: Arianna Simpson, managing partner of investment firm Autonomous Partners, discusses this week's news that Cambridge Analytica had used data from Facebook to perhaps manipulate the election and whether that could create an opening for blockchain-based decentralized social networks. Why Arianna isn't worried about the downturn: We discuss some of the ways BitGo has resolved this issue, whether that still leads to single points of failure, and what the company's recent acquisition of Kingdom Trust a "qualified custodian" as defined by the Investment Company Act means for the space -- hint, it may have to do with ETFs.

We also discuss the recent violent crimes against people in crypto and how everyday people should go about protecting their funds. New York Times article on crimes against crypto holders: We also discuss central bank cryptocurrencies, how the dollar could be knocked off world reserve currency status, rogue governments issuing cryptocurrencies, the Telegram ICO, ways in which blockchain can be applied to problems such as climate change and how the media is covering crypto.

Paul's article on SEC subpoenas: Michael's essay on China's desire to end the dollar's global dominance: Wyoming now has five blockchain-specific laws. Caitlin Long, cofounder of the Wyoming Blockchain Coalition, describes what these laws are, what they mean, and how our least populous state became a crypto leader. The former chairman and president of Symbiont explains what this could mean for any project that aims to launch a utility token, whether or not ICOs held in Wyoming would only be available to Wyoming residents, and what big issue she thinks remains for the SEC to address.

To read the laws: Thank you to our sponsors, Onramp http: She talks about privacy in financial transactions, how "immutable" blockchains might conflict with a new EU privacy law granting people the "right to be forgotten.

Thank you to our sponsors: As a former government official, current board member of Coinbase and professor at the Stanford University Graduate School of Business, Kathryn Haun has a unique and varied view of the crypto space. She doesn't necessarily see the SEC subpoenas as a reason to be alarmed and compares it to her work as a federal prosecutor.

We also discuss the FinCen letter and why her take is different from the fear we've seen in the marketplace. SEC issues 80 subpoeast: Big Ideas From The Worlds Of Blockchain And Cryptocurrency 2 days ago star star star star star add Jesse Powell, CEO of crypto asset exchange Kraken, explains why he publicly rejected then-Attorney General Eric Schneiderman's request for information from crypto exchanges, why he felt it was a publicity stunt and why Kraken, which stopped serving New York customers after New York's Bitlicense was introduced, doesn't see the market as a top priority.

How Should Ethereum Be Governed? Thank you to Bridge Alternatives and the Time Summit for the panel! Big Ideas From The Worlds Of Blockchain And Cryptocurrency 1 May star star star star star add Kyle Samani and Tushar Jain, cofounders of Multicoin Capital, dive deeply into their sometimes controversial and unpopular opinions on how the crypto revolution will play out.