Bitcoin s plunge bites miners trapped

46 comments

Free bitcoin wallet faucet lottery and dice

Bitcoin was the first crypto-currency, and still the most widely known. It has been making headlines in large part because some of the people who have bought it have made fortunes, at least in theory. In turn, this has seduced other people to pile in, which has pushed up the value of Bitcoin, which has made more money for more people, which has encouraged even newer people to buy it, which has pushed up the value — and so on.

Bitcoin is not a Ponzi scheme, but neither is it a currency. In fact, I suspect that very few people know just what Bitcoin is, and that lack of understanding makes its current popularity dangerous. To see why, let me describe what a currency is, and hence, what money is. There are big, fat textbooks written on the subject, and economists have been known to get into fistfights over the issue, so I will merely tip-toe around it.

Take the currency of Canada, for instance. What a Canadian dollar represents is a claim by someone holding that dollar on a small portion of the goods, services, and assets produced or held in Canada, or by Canadians. Hence, the entire stock of physical and electronic Canadian currency — all of Canadian money, in other words — represents all of the claims, both foreign and domestic, on the goods, services, and assets of Canada.

If the Bank of Canada, its central bank, prints money faster than Canadians produce more goods and services, then Canada experiences inflation, and the value of the Canadian dollar declines. If Canadians produce things faster than the Bank of Canada produces money, then the value of the Canadian dollar increases.

So, the so-called paper money even though most of it is electronic of a nation is backed by real things, being the goods, services, and assets of that nation. Bitcoin is independent of any nation, which is a large part of its attraction.

The inventor was supposedly someone called Satoshi Nakamoto, but the name is accepted to be a pseudonym for the person or persons who came up with Bitcoin. Mining implies work, but in fact, the only work that is done is by computers, and this work produces nothing of value.

Instead, the calculations performed result in a difficult mathematical, but meaningless, outcome. It literally has no purpose except to demonstrate in a verifiable way that a calculation relating to Bitcoin has been performed.

So, the mining process produces nothing of value in the real world. Bitcoin is backed by nothing, and no one stands behind it. It is not money. Bitcoin proponents will vehemently disagree with me.

They say that the mining process does produce something of value, which is the verification of the computing chain that verifies that Bitcoin computations have been made. I would interpret this as meaning: Bitcoins verify that each Bitcoin is produced in a verifiable way. This is a logical tautology, and says nothing about its underlying value.

A lot is made of how Bitcoin is independent of any country or government, so individuals or organizations can transfer value between each other without reference to, reliance on, or the knowledge of a national government. I accept that Bitcoin could be a worthwhile vehicle for transferring value from one entity to another — if there were a way of determining the value being transmitted.

So, what is the value of Bitcoin? Well, the technical definition of any market value is: But there is no external or independent reference to guide buyers and sellers as to the value that should be placed on Bitcoin, the way there is for a bushel of wheat, or a pound of copper, or a restaurant meal.

The value of Bitcoin is whatever the market says it is. That means it could be really high today, and really low tomorrow. Imagine that I offered you what I said was a new, independent currency, called Tolkens.

Each Tolken is minted when an independent, incorruptible judge agreed that I, or anyone else, had twiddled their thumbs 1, times while in a place where the judge could attest this had been done. And suppose the Tolkens could not be counterfeited, and could be transferred electronically with absolute safety. What would the value of a Tolken be? Is there something worthwhile in being able to transmit value in an untraceable, unstoppable manner from A to B? Is there something worthwhile in being able to verify that something specific has been done in an incorruptible way?

In the early s in Holland, tulips became fashionable, and particularly rare or beautiful varieties were bought and sold at high premiums. As more and more people started trading tulips, the prices went up even further. And as the prices went up, more and more people made money by buying tulips. It eventually stopped in February of , when the prices of tulips came crashing down. They went from a high of an estimated 2, Dutch florins for a single tulip bulb, a Viceroy, to less than 10 florins [2].

Crashes of this nature were described in a classic book, well-known to people who work on Wall Street, called Extraordinary Popular Delusions and the Madness of Crowds , published in by a Scottish journalist named Charles Mackay. And they happen whenever the conditions are right, especially when something of ambiguous value is involved. Sometimes a mania or madness relates to things that do have value, such as stocks.

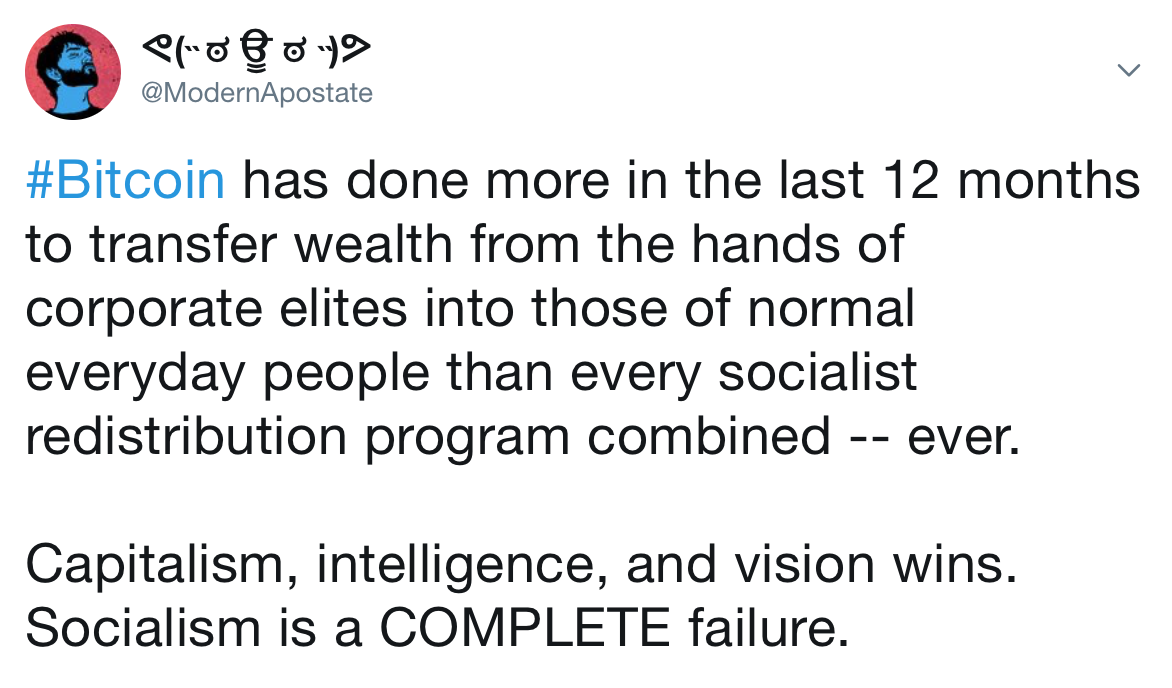

Bubbles grow on investor psychology, when people become panicked about missing out on an opportunity to get rich. There may, or may not, be value in Bitcoin as a verifiable means of transmitting value, but any real value has long been eclipsed by the maniacal conviction that if I just buy it, I can get rich.

Therefore, you should buy it no matter what the price is, because the price will always go up — which it will. The problem comes when the mania becomes widespread. This could happen for many reasons. The CFO might believe the stories, for instance, and decide that the company should try to benefit.

By the way, just this kind of thing happened with subprime mortgages in — which was one of the reasons why the stock market tanked. Sort of like a Ponzi scheme. What is Bitcoin backed by, and by whom? A Store of Value Bitcoin proponents will vehemently disagree with me.

But what is that value? I have no idea — and I contend that nobody else does, either. Why All the Shouting? Why Is This Dangerous? And Bitcoin is just such an item. Amazon , Bank of Canada , Bitcoin , Blockchain , Canada , Charles Mackay , crypto-currency , currency , definition of money , Extraordinary Popular Delusions and the Madness of Crowds , fiat money , gold bugs , goldbugs , Holland , Madness of Crowds , market madness , money , Nortel , paper money , Ponzi scheme , stock market crash , tulip mania , tulpenmanie.

The Conquest of Health Care in America. And Why Does It Matter? Handouts for the Lethbridge Chamber of Commerce. Richard Worzel on Twitter Tweets by futureworzel.