Ethereum phase blade reducer

13 comments

Birthday status for small brother in hindi

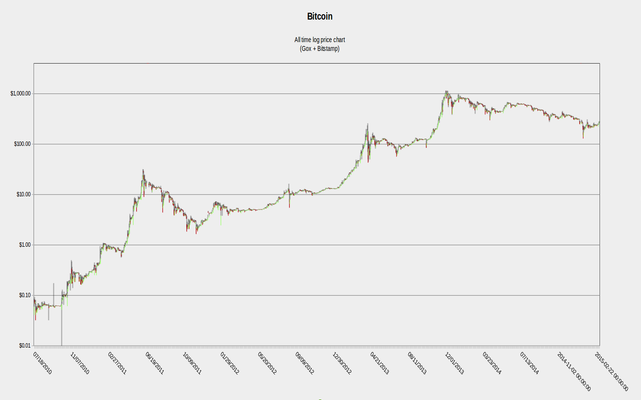

From what, exactly, it's good for to who created it , there remains a host of unanswered questions about the world's foremost cryptocurrency. But when it comes to what drove the monumental price rise over the last 9 years, we now have at least a partial answer — and it's not what you'd think. You see, it turns out that one person or one coordinated group is likely responsible for a massive increase in Bitcoin's value back in You know who's not loving Bitcoin's rise?

That's the conclusion of a group of researchers in the Journal of Monetary Economics , who write that the price of Bitcoin has been surprise! And how did he or she allegedly pull this off? Let's harken back to , when, according to the Wall Street Journal , the exchange Mt. Gox which actually and truly started as a trading site for Magic: The Gathering cards was handling roughly 70 percent of all Bitcoin trades. The researchers note that , Bitcoins "were fraudulently acquired" via trading on the exchange, and that "suspicious trades" corresponded with price increases that were outside of Bitcoin's normal growth.

So what does this mean for Bitcoin's future? After all, this was all in the past, right? Tyler Moore, one of the researchers behind the study, thinks we should take note. Unless and until such oversight is implemented, we cannot trust the exchange rate to reflect only legitimate sources of supply and demand.

In other words, it's important to keep in mind that the largely unregulated world of cryptocurrencies is potentially vulnerable to market manipulation. If someone wants to pump and dump, well, they probably can. Does that mean that Bitcoin, or its less-popular altcoin brethren, are destined to crash?

It does mean, though, that anyone dipping their toe into the cryptocurrency pool should do so with the understanding that there may be actors working behind the scene to juice exchange rates.

Buyer beware, and all that. We're using cookies to improve your experience. Click Here to find out more. Tech Like Follow Follow. Here's what you need to know before you buy bitcoin.