Bitcoin cli commands for windows 10

20 comments

Reddcoin chart live

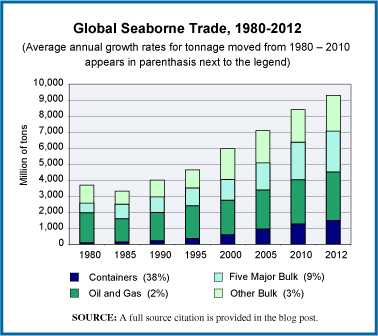

The Baltic Dry Index BDI , which is issued by the Baltic Exchange on a daily basis, evaluates the price for shipping services and it results from the interplay between supply and demand. The demand varies with the amount of cargo that is being traded or moved by sea while the supply depends on the tonnage capacity which enters the market and exits it. Since the supply is generally inelastic i. This continuous collapse of the dry bulk market is related both with the increased growth of the world fleet as well as the softening of the world economy and seaborne trade.

This continuous surplus of the supply growth over the demand growth has kept the market under pressure and dropped it to the lowest levels ever. It seems very difficult to make safe forecasts in shipping, even in the short term, and major industry players or famous economists have failed in their past opinions or market decisions. Not only a lot of exogenous parameters influence the market, but also decision makers usually take decisions which are behavioral rather than rational and subsequently these decisions may change the market equilibrium in the long term.

However, we can take a clearer picture of the forward expectations by looking on the prospects of the world imports and exports as well as the imports and exports of China. These data which seem to have a high correlation with BDI, along with the development of the dry bulk fleet may give a clearer picture of where the market stands and where it is going.

During the first 7 months of about This volume is very close to the all-year demolition levels of On the other hand, the orderbook is highly decreasing and today is estimated at about Therefore, for the time being, the supply indicators look quite promising since it is the first time after a period of about 8 years that the growth of supply is expected to be almost zero since the tonnage capacity during is expected to grow with about 2 million dwt only, much lower than the 15 million increase of The world GDP has shown a slowdown since and its growth decreased from 5.

As we can see from the following diagram, the BDI is influenced by the world GDP especially during periods of big slowdown or a high while it seems that its influence is less when the GDP remains stable and this is because in these case BDI may be affected from other parameters.

For example, despite the fact that the GDP remains stable for the period after with some slight improvement, this is not reflected in the BDI since during these period the newbuidling bulkers entered the market and the new supply could not be absorbed. Going forward, according to the IMF, the world GDP is expected to remain at about those levels with some small improvement at about 3.

China has played an important role in the development of the dry bulk industry being a major importing and exporting country and its recent slowdown is very alarming. Due to the fact that China is the largest buyer of the two major dry bulk commodities it seems there is very high dependence of the dry bulk market on the Chinese GDP and Chinese imports.

Especially as far as the Chinese imports are concerned, it seems the BDI does have a very high correlation see diagram 3 in such a way to believe that the growth of the Chinese imports lead the dry bulk market. The dry-bulk seaborne trade in is expected to remain at about the same levels as in maybe with a slight growth of about 0.

Especially is expected to be an important year for the dry bulk market since, the growth of the dry bulk seaborne trade is expected to be higher than the growth of supply while the growth of supply is expected to be negative, something which has not happened for at least a decade now, creating promises for a healthier With the world economies remaining in weak condition and the financial crisis still affecting various aspects of the world trade, if we assume that the growth of supply will remain at current levels, the market is expected to remain depressed during the second part of maybe with a slight improvement due to seasonal demand and stockpiling before the end of the year.

Taking into consideration that there are not positive signs from the demand side, we need to see a much higher increase of the demolition activity, cancellation of new orders and delay of expected deliveries in order for the supply side to assist the market come into equilibrium and become healthier from the second half of onwards.

Therefore, the main future scenarios as follows:. Demolition is further increased, new deliveries are delayed and new orders are not placed. The supply is expected to be decreased negative growth by about 1. Dry bulk seaborne trade is improved during with a growth of about 2. The above will improve BDI from the 2nd half of at levels similar to with the prospects being even more positive for Due to the low scrap prices and the lower average age of the fleet, demolition is decreased, while due to the very low prices for newbuildings, shipowers keep on placing new orders.

In this case the supply will remain stable in or maybe slightly increase with a growth of about 0. Due to this market uncertainty, the emerging countries do not proceed with new investments.

Further to this, the demand will not grow and remain at levels similar with In this case, BDI is expected to remain in at historical low levels similar to with high volatility due to seasonal factors, congestion or maybe laying-up trend. In this case, some recovery will not be expected earlier than the second half of Demolition remains stable during the second half of and , new deliveries are facing some slippage and the orderbook is slightly increased from Shipowners who seek investment opportunities.

The tonnage supply will experience a small decrease of about 0. Chinese economy remains at about the same levels maybe with some small increase on the growth of its imports while the global imports and exports to be slightly improved at about 3. In this case, the demand will be higher than supply and it will improve BDI from the 2nd half of at levels similar to , though still at low levels. In this case the prospects will look more positive for provided that the orderbook will not materially increase again, China will not experience a further slowdown and the world economy will not face any new shock.

In the meantime, we already help Charterers, Shipowners and Brokers to find the right cargo for the right ship. Just place your open inquiries and find suitable positions. Get started for free. Like what you're reading? Get the latest updates first. How can we make safe forecasts? Ship chartering is easy with us Just place your open inquiries and find suitable positions.

Subscribe to our blog articles Analytics, inspiration and fresh ideas for ship chartering community.