Sec rejects rule change for bitcoin etf

19 comments

Bitcoin qt encrypt wallet chainsaw

Therefore we will concentrate only on a few of them. In this post we will discuss the down payments and down payment requests. A down payment is a payment made or received before the physical exchange of goods or services.

Upon the receipt of goods or delivery of services the down payment is cleared against the final invoice. A Down payment is normally preceded by a down payment request, although this is not a required condition. To configure down payments made, we follow the menu path below: However, whatever applies to them applies to the others as well.

It is assumed that you have already created these Alternative Reconciliation accounts, if not create them with FS The alternative reconciliation GLs should have the following characteristics.

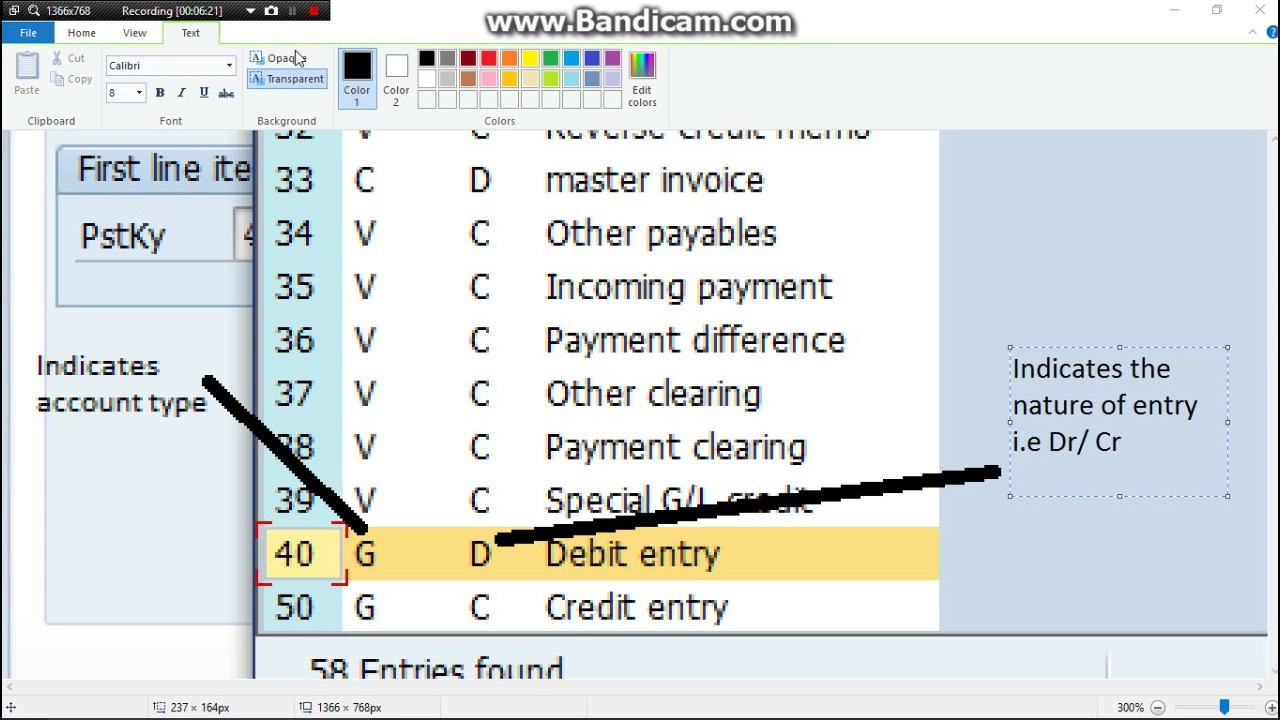

Special GL Account alternative reconciliation account for down payments made is assigned the field status group G One special GL Account can be assigned to more than one normal vendor reconciliation account. Now click on Properties to configure the Special GL properties. Therefore, there is no debit or credit entry with noted item transactions. There is only a one line record on the vendor for information purpose only, because you are just recording a request to pay and nothing else.

This is the case with down payment requests and bill of exchange payment requests in the standard system. If this indicator is set, the system gives an alert that a down payment exists when you try to process a transaction on an affected vendor or customer. For example you post a down payment on a vendor and then subsequently you try to process an invoice on the same vendor, the system will issue the warning that a down payment exists on this vendor.

It is more relevant to set this flag when configuring the down payment and not the down payment request. If for any reason you want to define your own posting keys you can do so. The same explanation as in the case of the down payment request see above applies. The only important difference is that commitment warning is flagged here, and what means as explained above is that, the system will issue the warning that a down payment exists on this vendor if you want to process anything on it.

Another difference is that we have not set the noted item flag here because a down payment updates the accounting books unlike a payment request. Here we are referring to down payments received from customers through sales activities as opposed to purchasing or procurement activities.

To configure down payments received, we follow the menu path below: Or use transaction OBXR. Alternatively as in the case of down payments made we can use transaction FBKP. To continue, click on Properties to configure the Special GL properties. The fields here have the same explanation as in the case of the vendor down payment request see above.

The major difference is in the posting key. If you are going to be creating down payment requests with reference to PO, then additional configuration settings have to be maintained in MM. Usually this activity should be carried out by your basis team.

Use transaction SFW5 to activate this business function. The activation of this function module, has the impact of adding an additional tab Payment Processing in the ME21N transaction creation of a purchase order and also an additional field Down Payment Category.

With this setting you can process down payment from MM. Use transaction OBC4 or follow the menu path: Double click on Material Management Group. Set the purchase order field to optional entry. With this setting, the Purchase order field in your F screen will be active, which should enable you to create a down payment request with reference to purchase order WRTPO.

You populate in this field with the purchase order number of the PO that relates to your down payment request. This has already been discussed in paragraph 2 above. This account is needed if you display down payments gross in the customer account.

Use transaction OBXB or follow the menu path: To activate the sales order field for the filed status group of your alternative reconciliation account, follow the menu path: Double click on Additional Account Assignments. Set the sales order field to Optional Entry. Click on Maintain Field Status. I will only list the processes involved and the transaction codes or menu path to the transaction.

Please refer to the blog post I wrote on this, which was published in eursap. Alternatively directly clear the down payment through the payment program. This is regardless of whether you executed the down payment through the payment program or processed it manually. We would love to hear your comments and suggestions. By the way you are invited to visit the SAP Store and other stores directly from here, or through the affiliate links on the left sidebar of the home page and blog posts, for the easiest way to buy your SAP Software and other cool products.

Keep writing such kind of information on your page. Im really impressed by your blog. I am confident they will be benefited from this website. Due to this I am unable to do the entry. This means you either have not entered the amount of the down payment or entered a different amount.

Error message F means your document has not balanced. Note also that apart from the execution of the down payment manually F ,you can also make the down payment using the automatic payment program F Your email address will not be published. Dear sir, I like to know real time project notes with seneraios. Leave a Reply Cancel reply Your email address will not be published.