Live bitcoin trading symbols

36 comments

Cpu hours per bitcoin value

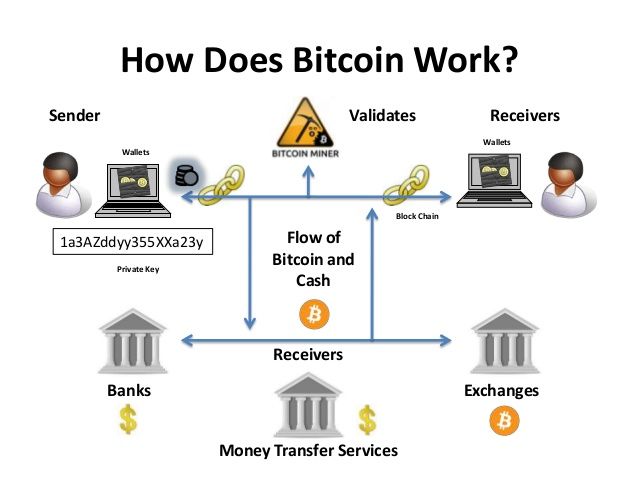

A few weeks ago, we unveiled our most exciting feature. Revolut Crypto allows users to effortlessly buy, hold and exchange cryptocurrencies in any of the 25 fiat currencies supported by the app. As soon as we launched, we were bombarded with questions from our community who wanted to know how Revolut Crypto works behind the scenes, learn where our exchange rates come from, and discover how we could provide instant access to crypto.

Traditionally, cryptocurrencies are bought via online exchange websites. You can think of these as the digital equivalent of your local farmer's market, but for virtual currencies. Similar to how farmers and locals meet at the market on the weekend, buyers and sellers get together on virtual exchanges such as Coinbase or Bitstamp to buy and sell their juicy crypto produce.

On the exchange, people indicate how much cryptocurrency they would either like to buy or sell, and how much for. This is known as placing an order. For example, Bob wants to sell his Bitcoin. Hence, the price a seller quotes on the exchange is known as the ask price.

Once the order is placed, the exchange will look through its order book trying to find a matching order to complete the transaction. Thus, the price quoted for a buy order is known as a bid price. As soon as a match is found, the transaction is automatically completed and both orders are filled. Since market participants quote prices on the exchange, there will always be at least 2 different prices - one for buying bid price , the other for selling ask price.

On the right, the orange line shows all the available SELL orders the exchange is constantly trying to match with the green BUY orders, on the left. These lines move in realtime to reflect existing orders being filled and accommodate new orders being placed every second.

The vertical line in the middle is called the Mid Market Price , or mid rate, which gives the average value based on all the prices advertised for all the different buy and sell orders for that specific currency pair.

When you search for any crypto live rates on Google, you are usually quoted a mid market rate. Most orders get filled somewhere in between the market rate and the outer limits of the graph, where both order price and size increase. To provide exposure to cryptocurrencies in a matter of seconds, Revolut has partnered up with a number of market leading exchanges. When you buy crypto via the Revolut app, you are quoted live rates on the exchange screen.

These rates are streamed directly from the exchanges we work with and are calculated based on the current ask price. We use the ask price because you are effectively buying from sellers on the exchange who send Sell orders quoting an ask price, or in other words, the minimum amount they're willing to sell their crypto for. These rates are computed as a Volume Weighted Average Price, before our 1. This means that we provide the average price of a currency pair that is exchanged over a certain period of time.

The resulting rate is displayed on screen and, once you commit to the exchange, that rate is locked in.

Exchanges require at least some basic knowledge of financial markets and general trading principles. For example, if you place a buy order for a large amount of crypto at the mid market rate, there is a high chance that your order will never be filled. Revolut removes all of the complexities associated with using an exchange and simplifies the process by offering live rates for buying and selling crypto. This has to do with the 2 main rates quoted on the exchanges - the bid and ask prices.

When you buy crypto, you are quoted the ask price, but when exchanging from crypto back into fiat sell crypto , you receive the bid price. Since the bid and ask prices are never the same, this explains the rate difference you see on screen. When you swap currencies effectively switching from 'buy' to 'sell' mode the price you see is made up of the various bid rates. These bid prices are once again computed as a Volume Weighted Average Price, with a flat 1.

If you're familiar with online cryptocurrency exchanges, then you probably noticed that most exchanges only support a limited number of fiat currencies if any , usually GBP, USD and EUR. Revolut Crypto, however, allows you to transact to and from crypto in any of the 25 supported currencies - a first for Europe!

This Euro value is then sent to the exchange and used as the base price to give you the correct amount of Bitcoin for your PLN. This process is also known as Cross Currency Triangulation. By now, you should have a good idea of how the world of cryptocurrencies works. Let's sum up what we've learned:. Stay up to date! How do you buy crypto? What is the Mid Market Price? It's very hard to buy at the Mid Market Rate because order sizes tend to be very small.

What happens when I buy crypto via Revolut? Revolut is perfect for those who want a quick, easy and frictionless way to transact in crypto. Why does the rate change when I swap currencies on the exchange screen? How do you calculate a rate for a non-traded currency pair? Let's sum up what we've learned: Cryptocurrencies are a type of digital money with no physical shape or form They are bought and sold from market participants on online exchanges People on the exchange set the price based on supply and demand The bid or buy price will be different to the ask or sell price Online price trackers e.

Subscribe to Revolut Blog Stay up to date!