Bitfinex data center

27 comments

Key points the define a legit bitcoin binary options brokersbitcoinfree currency trading any reviews

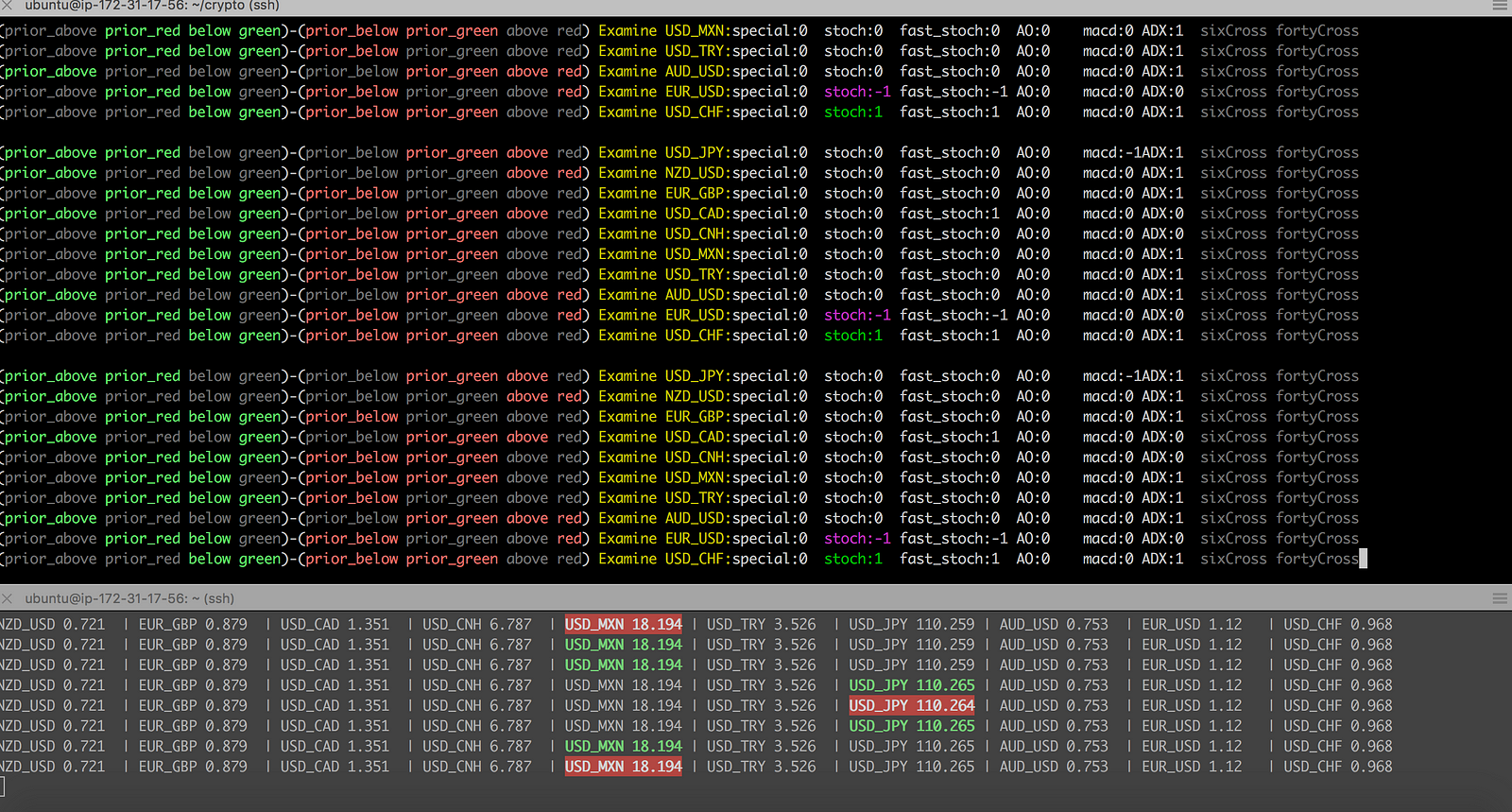

On May 6, , the stock market collapsed. Within 20 minutes most of the losses were won back, and on the 36th minute the rates returned to their previous levels. The main cause of the collapse was bots — automated cryptocurrency trading platform that manage financial assets. They are used by high-frequency traders who quickly identify small price differences in the market and automatically buy and sell shares.

These bots have long been working on crypto-exchange markets. It is quite true that if you bought or sold bitcoins or ethereum on one of the websites, then you made a deal not with a crypto-currency enthusiast from Silicon Valley, but with software on a server in Shanghai.

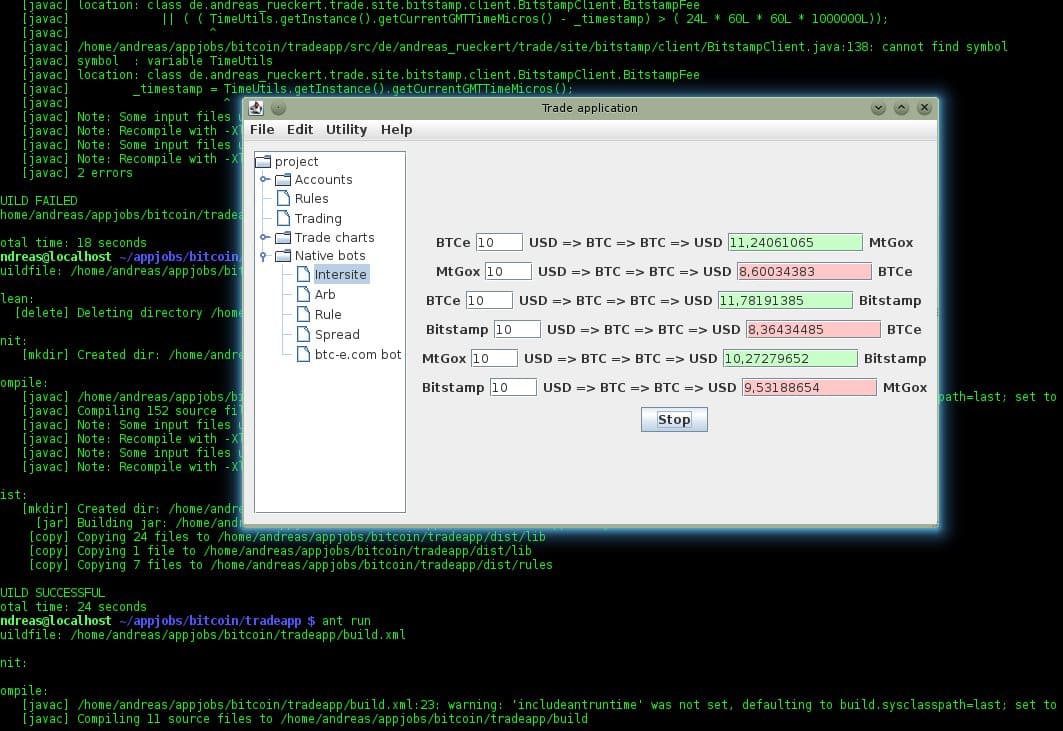

First bot Lee was simple: The program automatically bought a crypto currency on one exchange and sold it to another one. The profit, according to Lee, was small: Relatively simple software eventually brought Lee six-figure profit. They use the exponential moving average to build algorithms, monitor the state of the market for a certain period and, based on this, make decisions. Such crypto trading strategies are not easy to configure, and none of them can be created a bot.

Zenbot is an open source platform that can be downloaded from GitHub. You can change the code yourself to create automatic trading rules based on the chosen strategy. Another bot, Cryptotrader, is a simpler solution, but you will need to pay. The leading cryptocurrency trading platform for today is Haasbot, which is popular among professionals.

Its cost for beginners is 0. Earning on this platform will require serious investment. It is difficult to estimate the percentage of crypto-currency transactions that bots make, not people.

Bitcoin is relatively anonymous and unregulated, so traders do not report on their trading volumes. In this regard, the actual question is what influence bots have on the market.

The simple algorithm of Joseph Lee is able to make new platforms with small trading volumes more stable, providing them with liquidity. This scheme has long been used on stock exchanges. During the collapse in , the protective systems built into trading algorithms also worked, which helped to stop the fall when it exceeded the preset level of volatility. The problem is that the crypto-currency markets are generally more volatile and their dynamics are more difficult to predict.

They are largely influenced by events that bots can not analyze, such as statements about new crypto currency restrictions in China. Also, there is always the possibility of hacking a bot.

Perhaps the development of bots will really make the crypto-currency market more stable. So, they will be able to smooth out the difference between prices on different exchanges, to prevent arbitration and to stop falls- as well as provoke them. At first you should sign up at miningrigrentals. You can sign up at Bleutrade at the following bleutrade. You can sign up at Novaexchange at the following link: Accept the terms of use, fill all fields and ….

Your own algorithmic trading bot for use with the Bleutrade exchange. DigitalTrip is a browser 3D game to get DigitalPrice for free. Collect as many coins as possible each round.

DigitalPoints is a second cryptocurrency that will support the capital and work with PoS. This will make the users who …. Home Trading How do the coin trading bot affect the of crypto-currency market. How do the coin trading bot affect the of crypto-currency market Instructions on mining of DP classic by example of miningrigrentals. Instruction on DP classic trade at Novaexchange You can sign up at Novaexchange at the following link: Bleutrade-Bot October, Your own algorithmic trading bot for use with the Bleutrade exchange.