Vendrig lexmond trading

26 comments

Zcash mining software mac

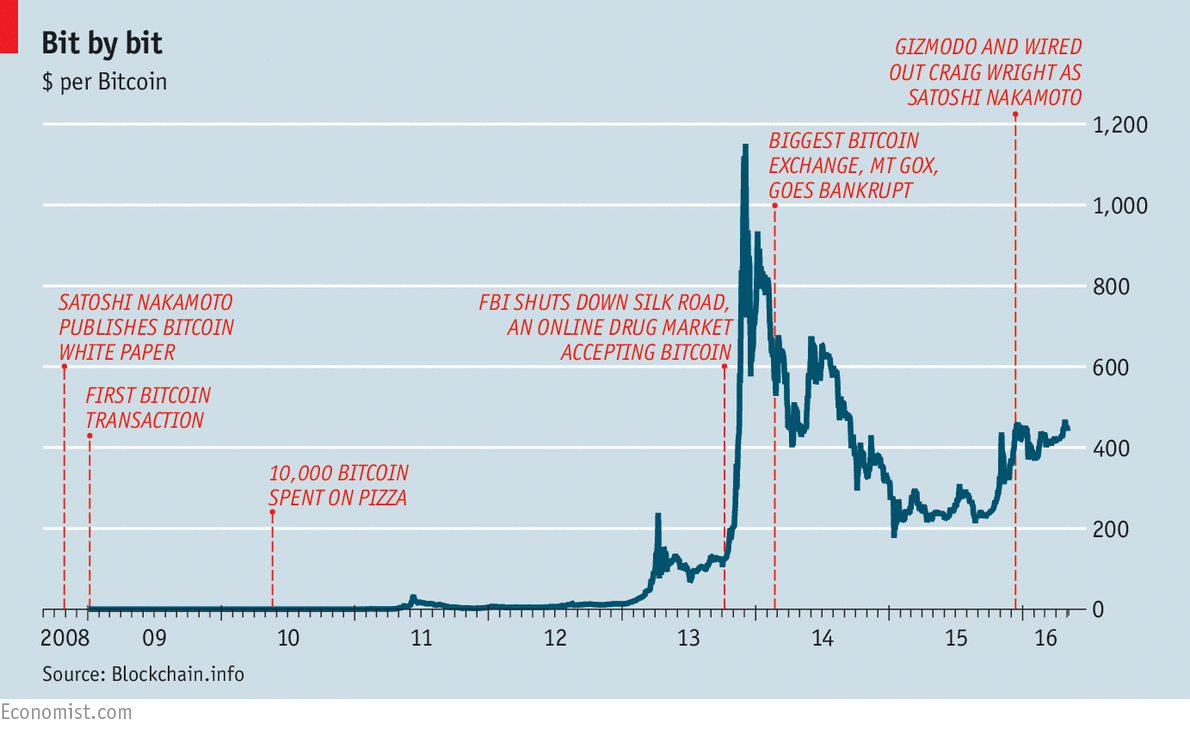

Create account Login Subscribe. Moallemi 16 December Cryptocurrencies have caught the attention of industry, academia, and the public at large. This column analyses an economic model of a cryptocurrency system featuring user-generated transaction fees, focusing on Bitcoin as the leading example. The Bitcoin system requires significant congestion to raise revenue and fund infrastructure or risk collapse in the long term. Moreover, the current design of the system — specifically the processing of large but infrequent blocks of transactions — makes it less efficient at raising revenue.

A cryptocurrency is a digital currency stored on an open and decentralised electronic payment system. Following Nakamoto , cryptocurrencies have caught the attention of industry, academia, and the public at large, with Bitcoin being the most prominent. There are hundreds of cryptocurrencies, many running on large and reliable decentralised computer networks. An innovative computer science design called the blockchain has enabled this wave. The blockchain supports the creation of a decentralised electronic payment system that can be trusted in aggregate, although none of the system's servers is individually trusted.

This novel blockchain design relies on a combination of cryptography and game-theory based incentives. These incentives should be of interest to economists, especially those focusing on market design. The blockchain design enables Bitcoin and other cryptocurrencies to function similarly to conventional electronic payment systems such as PayPal, Venmo, FedWire, Swift, and Visa. The governing organisation ensures the system is trusted, and it is responsible for maintaining the required system infrastructure.

It also decides how, and how much, participants pay for using the system. These electronic payment systems are natural monopolies in that they enjoy economies of scale and network effects. Consequently, they are often regulated or outright owned by government agencies in order to mitigate the welfare loss associated with their monopolistic positions.

The innovation in Bitcoin's blockchain design is its ability to operate an electronic payment system without a governing organisation. Rather, a protocol sets the system's rules, by which all constituents abide.

Absent is a central entity that maintains the infrastructure. Any internet-connected computer with enough memory and processing capacity can serve as a miner.

Participating miners need to exert computational efforts, and are rewarded for their service to the system. Miners follow the rules of the protocol because it is in their self-interest to do so; when they believe others follow the protocol they will maximize their expected profits by following it as well.

Thus, the protocol is difficult to change as changes require collective agreement on a new protocol. Unlike other payment systems, Bitcoin is a two-sided platform with pre-specified rules.

Its two main constituencies are the users who hold balances and engage in electronic transactions, and miners who maintain the system's infrastructure. A simplified description of the system is as follows. Coin owners broadcast messages in which they announce payments they wish to make. Each transaction is a cryptographically verified message. The miners vet newly received transactions for legality they verify conformity with syntax rules, ownership, absence of double spending, etc.

Each miner maintains the ledger of all past transactions the blockchain where transactions are arranged in blocks. Every ten minutes, on average, the Bitcoin system randomly selects one miner to add a block of transactions to the ledger, processing all the transactions within that block.

When the selected miner adds a block to the ledger, he is said to have mined the block. Equilibrium between many small miners ensures that all miners are in consensus, and only legal transactions are processed. The Bitcoin protocol limits the block size to 1MB, and thereby the number of transactions within a block. Therefore, the system's throughput is bounded, and does not depend on the number of miners.

To provide proper incentives, the system compensates miners for their effort by rewarding miners when they are selected to mine a block. The reward consists of newly minted coins and the transaction fees paid by the transactions processed in the block. The protocol specifies how many newly minted coins are awarded in each block. This number is cut in half approximately every four years. In contrast, transaction fees are not fixed by the protocol; users choose the transaction fees they pay.

Thus, the blockchain design carries an economic innovation in that no participant has the power to set or modify fees or rules of conduct or otherwise control the system. Users and miners are price-takers. Users are provided protection from monopoly pricing: However, for the system to function properly it must raise sufficient revenue from the users to fund the required infrastructure. In a recent paper, we translate the above description to an economic model that allows the analysis of the long run behaviour of the system, when miners are compensated solely from transaction fees Huberman et al.

The analysis aims to answer two sets of seemingly disparate questions:. The absence of a Bitcoin-controlling organisation renders both questions non-trivial. The model asserts a single answer to both questions: These very fees fund the miners.

This answer raises follow-up questions regarding social efficiency, stability, robustness and parameter choice. The equilibrium behaviour of users and miners creates the distinctive features of the transaction fees, revenue, and infrastructure level. Miners prefer to process transactions with higher fees, but cannot affect the transaction fees chosen by users. Therefore, in equilibrium a miner selected to process a block will choose to process the transactions with the highest fees.

The total revenue from fees paid by users is equal to the total payment to miners. Thus, even if the system as a whole is a monopolist, it provides its service at cost. Users compete for service priority by paying transaction fees, as if processing priority was auctioned by the miners. Because of the stochastic nature of the system, even if the system has sufficient capacity on average, some transactions will suffer from delays.

Higher fees secure higher priority and therefore less delay. Analysis of the implied congestion-queueing game shows that, in equilibrium, transaction fees are equal to the additional delay costs imposed on others.

Thus, absent congestion and delays, users need not pay transaction fees, and transaction fees increase with the level of congestion. Moreover, this trade-off is quite sharp: Pertaining to ii , Figure 1 depicts the theoretical and actual relation between average daily block size and the corresponding average transaction fee; congestion is associated with block size being close to 1MB.

Moreover, it is empirically clear that significant congestion is associated with meaningful revenue generation. Figure 1 Average fee per block and block size, model-based and actual, 1 April to 30 June The Bitcoin system offers an alternative to regulating a monopoly or controlling prices via market competition.

Bitcoin can be a monopoly in the sense that all potential users are using the Bitcoin system. But even then, its service will not be priced at the monopoly price.

Instead, pricing is determined in equilibrium. However, the equilibrium price varies with congestion and is unlikely to be optimal. Significant congestion and costly delays are necessary for raising revenue. In addition, there are additional social costs of running the Bitcoin system. The total social cost of the Bitcoin system can be lower or higher than the dead-weight loss of monopoly.

Absence of sufficient congestion can be disastrous for the system. Without sufficient congestion, users pay almost no transaction fees, generating almost no revenue to fund miners. As miners exit, the system becomes less reliable, leading users to leave the system, thereby reducing congestion further.

Because the system's throughput does not depend on the number of miners, the miners' entry and exit choices do not help balance the system. Without an alternative way to maintain the miners, the system will collapse. This point is critical in the context of current debates to scale or increase the capacity of the Bitcoin system in order to ameliorate congestion experienced by users.

If the capacity of the system is successfully scaled in a way that eliminates or even significantly reduces congestion, it will also eliminate transaction-fee revenue and imperil the long-term sustainability of the system.

The analysis suggests two simple design modifications to the protocol. First, the system can target an appropriate level of revenue by controlling its capacity. Currently the capacity is fixed one 1MB block every 10 minutes , and therefore revenue and the cost to users vary with the level of demand. Instead, the system can adjust its capacity according to demand to achieve a consistent level of congestion and revenue.

Second, our analysis shows that raising a target revenue level requires imposing less delay costs on users if blocks are smaller. The parameter choices in both the present design of the Bitcoin system as well as proposed future variants call for the processing of relatively large blocks many transactions relatively infrequently minutes between blocks.

Under such parameter configurations, significant delays are necessary for the generation of target levels of fee revenue. Thus, it would be beneficial to redesign the system with the smallest block sizes possible given engineering constraints , and maintain throughput through frequent small blocks.

This would allow the same level of revenue to be generated with much less delay imposed on users. Finally, we pose the question of characterizing set of feasible revenue-generating mechanisms for distributed blockchain systems and identifying the optimal one. Revenue- generating rules must provide proper incentives for miners to process transactions, and transaction fees must be verifiable by third parties.

We discuss some possible mechanisms that can be implemented by the protocol. At the time of this writing, , BTC are newly minted and awarded to miners annually. The Bitcoin system deploys substantial resources.

It, and the blockchain protocol at its core, have inspired multiple imitations and applications. Its apparent functionality and usefulness should further encourage economists to study this marvellous structure and its future and futuristic descendants. Financial markets Frontiers of economic research. Bitcoin , cryptocurrencies , blockchain , digital currency.