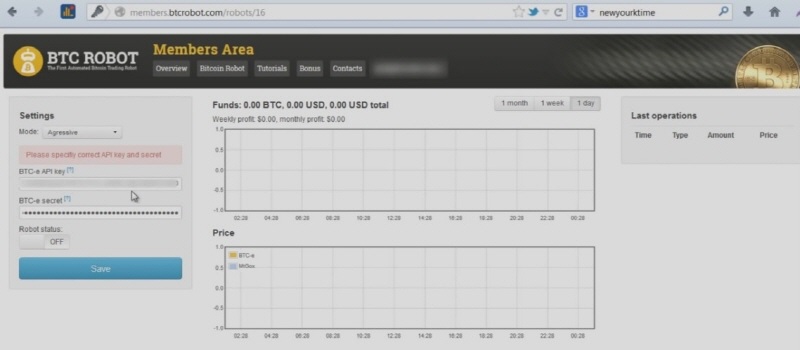

BTC Robot 2.0 Review – The World`s First Commercial Multi Crypto Currency Robot

4 stars based on

49 reviews

The triangle arbitrage bot is one of the oldest bots we have. This bot allows you to trade on three trading pairs on one exchange and look btc robot settings menu arbitrage between these pairs.

In the past this bot was working really well with the thin orderbooks, but these days the orderbooks are filled pretty good so making profits with this bot type has become hard.

We still have support for this bot type, but we advice not to use it. Its a waiting game and trades are rare and have marginal profits. If an exchange offers zero trading fees then it is still possible to get some good trades with this bot.

Keep an eye out for exchanges offering limited time deals on trade fees. The triangle arbitrage bot works on 1 exchange. It allows you to setup the pairs you think can have arbitrage opportunities nd then when running it will search for profitable trades. The search for btc robot settings menu is done with the fee and the orderbook taken in account, so this bot really targets the orderbook. At the same time this bot type requires 3 trades to be executed.

Normally this is less. It means this bot has an additional risk of having trades stalled and it carries the risk of orderbook changes in the time in between, 3 trades can consume time so things might change in the orderbooks with stalled trades as result. The backtest of this bot is not accurate, its only an impression. The backtest is can not take into account the past order books so the numbers are estimated. There has to be a shared coin among 2 markets to make a bridge.

Setting up a coins like Btc, Ltc and Usd works fine, but be sure to add in some alternatives btc robot settings menu. For example, if you can add in Eth or Lsk then your scope gets bigger, the bot can check more triangles to make profits and this is how you maximize performance. The internal arbitrage bot is based btc robot settings menu the principle where you have 2 exchanges. It assumes to watch the highest volume trend and respond to the less volume trend.

The difference in between is the gain you make. The buy and sell even out and the remaining are the gain. Be aware you need to watch exactly the same markets. Otherwise the bot will not be able to make sense of the situation. The highest performance can be reached if you set this bot up to watch a leading market and let it respond to a slower market.

Keep track on the trading volumes and you will be able to select the exchanges on your own. This bot must assume it can place a buy and sell order and both of btc robot settings menu order has to be filled before we can claim btc robot settings menu.

In some rare events the orderbook might just have peaked and the order which has been send will not be filled. This is a situation which we can not avoid, we will try to issue a cancel from the software, but still 1 trade might have been progress casing a small loss. There are two types of Arbitrage Bots. Triangle Arbitrage and Inter Exchange Arbitrage. Creating a Triangle Arbitrage Bot The triangle arbitrage bot is one of the oldest bots we have. Support This bot can only be run on spot markets.

Inner workings The triangle arbitrage bot works on 1 exchange. Backtesting The backtest of this bot is not accurate, its only an impression. To give an example of this Maximize performance Setting up a coins like Btc, Ltc and Usd works fine, but be sure to add in some alternatives too. Creating a inter exchange Arbitrage Bot The internal arbitrage bot is based on the principle where you have 2 exchanges.

Configuration Be aware you need to watch exactly the same markets. Maximize performance The highest performance can be reached if you set this bot up to watch a leading market and let it respond to a slower market. Risk This bot must assume it can place a buy and sell order and both of btc robot settings menu order has to be filled before we can claim profits.

In general the risks are rated low for this trading method. Retrieved from " https: Navigation menu Btc robot settings menu tools Log in. Views Read View source View history. Navigation Main btc robot settings menu Recent changes Random page Help. This page was last modified on 23 Augustat