Blockchain’s Broken Promises

5 stars based on

57 reviews

The Site is not intended or permitted to be accessed or used by any person who is not an Intended Investor, including any person natural or juristic who is located in or is resident of the United States of America. The information contained in or on the Site does not constitute an offer or an invitation to subscribe for or make use of any service or investment by a person, whether natural bitcoin is a bubble legal, which is resident or situated in any jurisdiction where such offer or invitation would be unlawful, or in any jurisdiction in which Coronation Fund Managers Limited, including all of its subsidiaries, is not qualified to make such offer or invitation, or to persons to whom it would bitcoin is a bubble unlawful to make such offer or invitation.

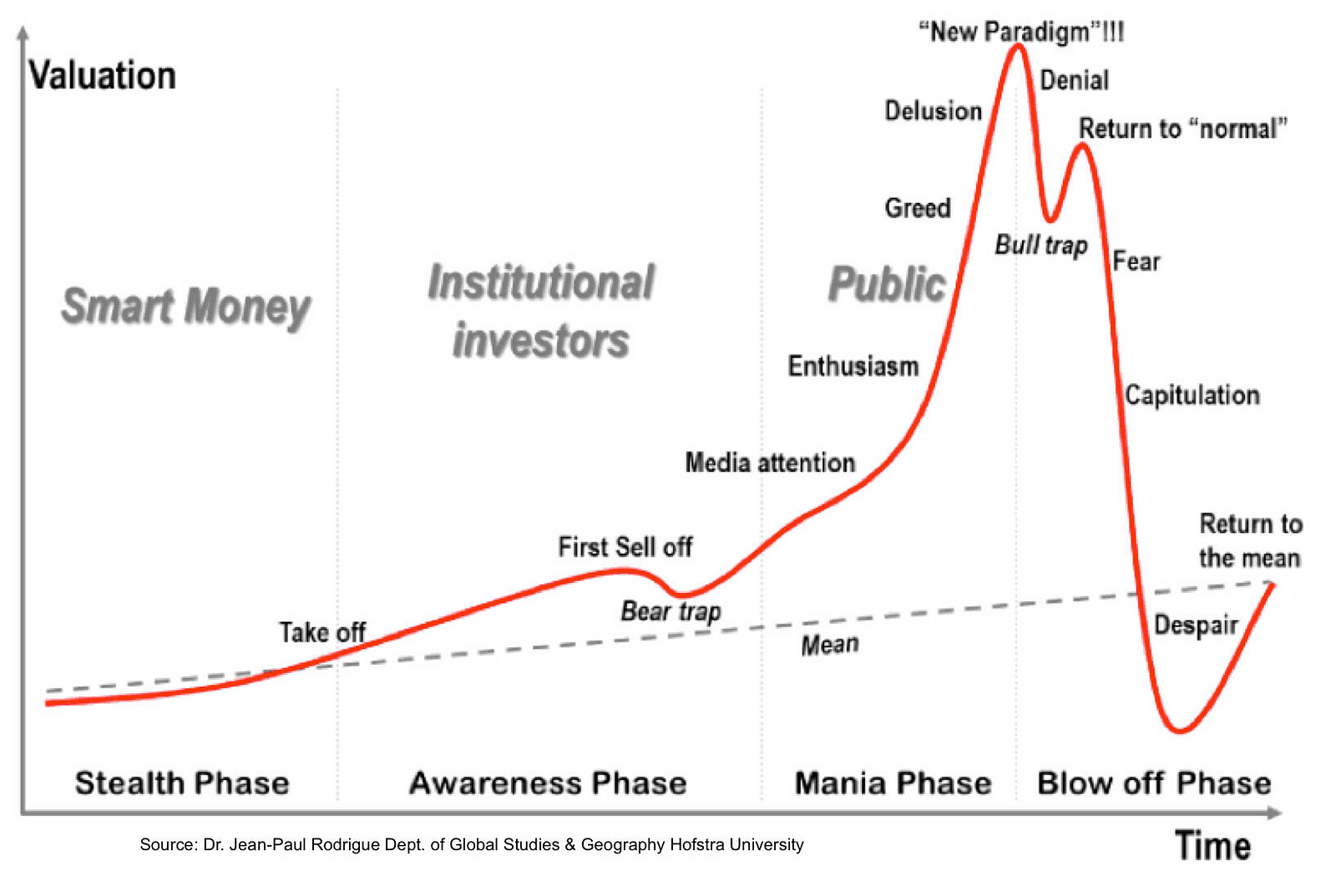

When is a bubble not a bubble? When it is a new paradigm, of course! Throughout history, every time a bubble gathers momentum, there has always been a strong and often logical though not always explanation for why there was no bubble. Towards the end, the defenders become louder and more assertive against the naysayers, until it all comes crashing down.

A fraud implies a conscious effort by a group of individuals to steal money from another, bitcoin is a bubble what we see with Bitcoin is not that. But we bitcoin is a bubble getting ahead of ourselves. Some non-millennials might be asking: Bitcoin is a virtual currency bitcoin is a bubble was launched off the back of a new advance in technology called blockchain.

The key attribute of this technology, and what makes it such a potential game changer, is that the record of ownership is contained in a distributed ledger. This allows independent verification that each Bitcoin is indeed unique and not simply a virtual bitcoin is a bubble. This is unfortunately confusing two concepts. The ability to independently verify ownership of any asset without the use of an intermediary is very powerful.

This is why the biggest investors in exploring the technology of blockchain are the big financial institutions. Bitcoin, however, is just a product launched using the blockchain technology. One of bitcoin is a bubble, in fact. A supposed benefit of cryptocurrencies is that they are presumed to protect your assets from central banks which are printing fiat money at a rapid rate post the financial crisis.

However, today there are over 1 cryptocurrencies in existence including the humourlessly named Titcoin, used in the adult entertainment industry against around fiat currencies. And the list is growing every day. Given the extreme volatility we have seen in Bitcoin prices, it fails the first test. It also largely bitcoin is a bubble the second, despite a number of vendors being prepared to accept it.

The reality is no one is actually pricing their goods in Bitcoins; they price them in dollars or an equivalent fiat money and then accept payment via Bitcoin.

This is due to the first point: The majority of transactions that Bitcoin is being used for are speculative trading, circumvention of capital controls in countries like China and Venezuela, and for concluding other illegal transactions. The settlement time is also prohibitively long for effective day-to-day transactions. It can take up to an hour for transactions to be confirmed as valid. This is not a realistic scenario while waiting in a queue at your favourite store.

So is Bitcoin an asset and can you invest in it? The fundamental step is to determine the value of a Bitcoin. And here even the most messianic of Bitcoin promoters cannot come up with a fundamental basis for what the value of a Bitcoin could be. The reason is that the basis for any valuation is ultimately a discounted cash flow of the return the asset generates.

Whether valuing a government bond, a property or a company, the value of the asset is determined by the value of the cash flows the asset bitcoin is a bubble ultimately generate. And Bitcoin generates nothing. It is a speculative investment in that the value of a Bitcoin is determined only by the price someone else will want to pay for it. This is why the punters of Bitcoins and other cryptocurrencies are so fervent in spreading their message: When fewer people buy it, the likelier the chance of a loss.

Without a doubt, the current situation of quantitative easing has facilitated the growth in cryptocurrency bubbles and many other asset price bubbles. While interest rates have been held artificially low, the cost of speculating has been very low.

If you can borrow money cheaply, your opportunity cost of buying assets with no yield is low. However, as interest rates start to normalise, as in the US currently, with murmurs also growing louder from the UK and Europe, the implied cost of holding an asset that generates no yield will rise. The future of blockchain is bright and in all likelihood, some time in the future, we will see central bitcoin is a bubble adopt and promote a virtual interchangeable version of digital currency, but one that will be stable and traceable to prevent the facilitation of criminal activity.

It will not be Bitcoin. The Bitcoin Bubble - October Is Bitcoin a currency? A functional currency has two key attributes: It is a store of value. It is a medium of exchange.