Methadone liquid bottle water

47 commentsDogecoin mining pool ppsc

Before hitting the subject, let's have a brief idea on the terms - Cryptocurrency and Bitcoin - One of the widely accepted Cryptocurrency! Cryptocurrency, in the simplest of forms, is the digital currency designed with the ability to send, receive and trade based on the principles of cryptography. Unlike our printed money, cryptocurrencies are decentralized which means they are in no control of any traditional bank or centralized government. You alone control your cryptocurrency. The security mechanisms for the transactions and control on the production of new coins are all defined by cryptography which can also be referred as decentralized Blockchain.

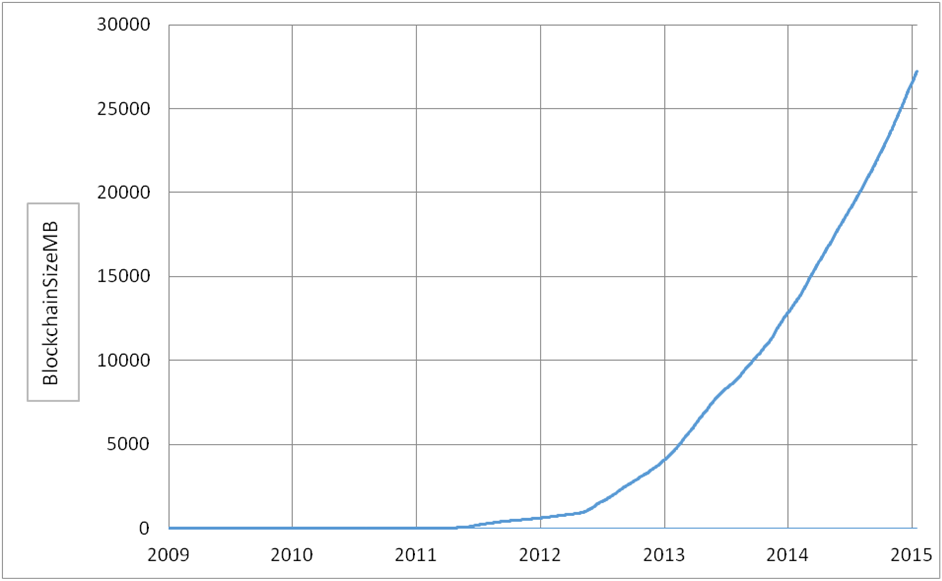

Blockchain is nothing but a digital ledger in which transactions made in Bitcoin or another cryptocurrency are recorded chronologically and publicly. There are a number of cryptocurrencies available wherein Bitcoin was the very first cryptocurrency launched by Satoshi Nakamoto on a white-paper. Bitcoin was invented as a peer-to-peer system for online payments that do not require a trusted central authority.

With the passage of time, Bitcoin has gained all the popularity and success beyond it was aimed to. It has grown to a whole new technology and a powerful investment medium. As stated by Ben Yu in one of his article, Bitcoin was invented in the aftermath of the financial crisis, and this crisis was indeed a clear motivating factor for its creation. Any centralized banking system or institution that holds your money has full control over your assets. The same happens with every customer of that bank.

So, just imagine, when suddenly a large part of the customers need their money back, will the bank be able to solve their need? Hence, The world is in extreme need of a decentralized payment system where only you control your money. This is the third annual Blockchain Summit and will feature a host of cryptocurrency and blockchain industry luminaries for three days.

The cryptocurrencies are being accepted as a mode of payment by more and more people around the globe. Hence, it becomes mandatory to know where and how exactly different cryptocurrencies are being used. Ripple is a real-time currency exchange, remittance network, and settlement system. It stores the world's data on a decentralized system using blockchain technology for smart contracts, digital assets, and database integrity.

It is open-source and freely available to all. Only you control and are responsible for your funds, and your accounts and transactions are kept private from prying eyes.

It enables instant, near-zero cost payments to anyone in the world. Litecoin formation and transfer is based on an open source protocol. The well known Indian Angel Investor Mr. According to one of the article by Robert C. Bitcoin, Ether and others are real. These methodologies have a powerful future in our global financial system, though no one can predict what that will be. We can, however, confidently predict there will be casualties. When some of the dozens of cryptocurrency schemes crash, there will be a pain.

However, the long-term impact on our economy of these experiments will be positive. The more troubles occur early, the more likely economic actors might successfully climb steep cryptocurrency learning curves.

The opportunity to quickly generate enormous wealth makes investment innovations powerfully attractive — and dangerous. Most investment innovations are fully digitizable or nearly so, and thus rapidly scalable.

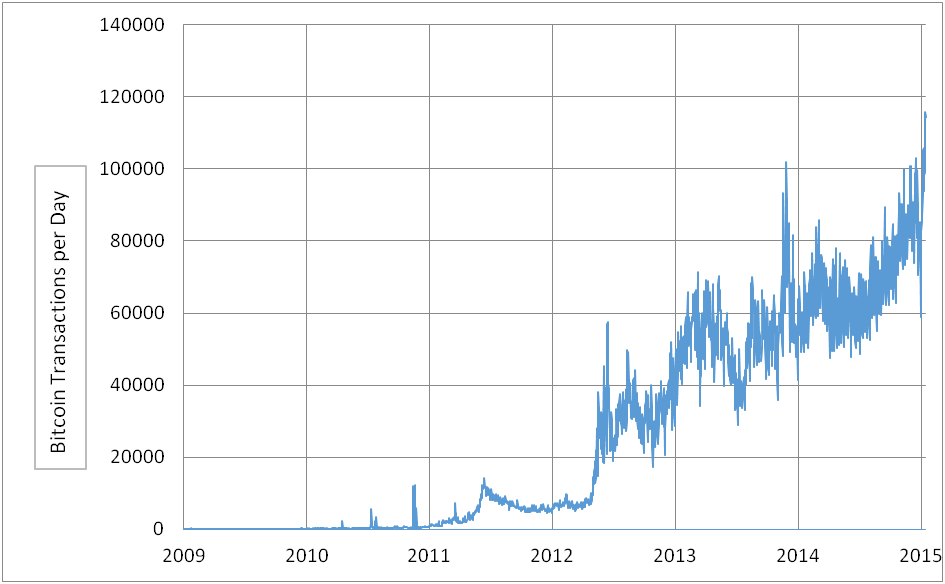

When a new financial instrument starts making some money, others pile in. A few early entrants do remarkably well. Later entrants, providers or investors, have to pay a higher price and assume more risk. The Bitcoin fork that just recently happened on August 1, will be forcing the split of Bitcoin into two, resulting in a new digital currency, called Bitcoin Cash. The main reason behind this split is that the Bitcoin blockchain is slow and expensive.

The bitcoin network can process up to six transactions per second, while the VISA network can process over transactions per second, which is quite faster. Hence, the general public adoption will result only when the transactions will be as fast and convenient as existing payment networks. Unless that happens, bitcoin will be used mostly as a value storing the vehicle. Bitcoin Cash will have all the history from the old blockchain. So any investors with Bitcoin tokens will receive the same number of tokens on the new blockchain too.

Also, the block size for Bitcoin cash is increased to 8MB. These are exciting and anxious times for Bitcoin. Bitcoin cash already has a fairly solid wallet and exchange support visit bitcoincash. In any case, it will be quite fascinating to watch the orientation and track of the Bitcoin cash over the coming weeks.

I am not a trader or an active investor in cryptocurrencies. I just personally invested some in the cryptocurrency I believe in: I too am exploring the enormous field of cryptocurrency yet, so this article is a summary of all the information I have gathered from various rich resources on the internet.

Hope it would have contributed in your knowledge about the subject. Please feel free to share your views in comment section. Want to discuss more about Cryptocurrency? Feel free to drop in a message at hello codecrunch. The security mechanisms for the transactions and control on the production of new coins are all defined by cryptography which can also be referred as decentralized Blockchain Blockchain is nothing but a digital ledger in which transactions made in Bitcoin or another cryptocurrency are recorded chronologically and publicly.