5961 exmouth market clerkenwell ec 130

48 comments

Liquid robotics crunchbase daily

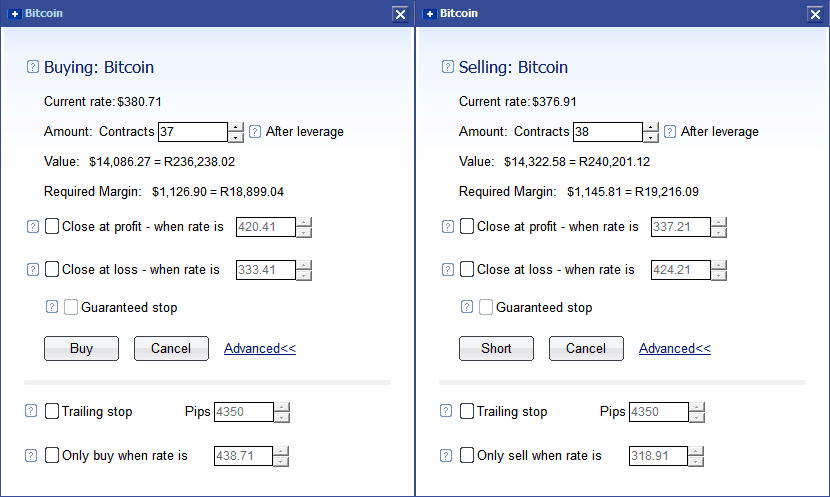

To limit potential losses, it's a good idea to know how stop-losses work when working with margin. We've posted a guide on this here. Given the two terms above, if you were to hold a leveraged position on an exchange - this process of borrowing money is referred to as margin trading. A common question is: When your position loses the amount you put in multiplied by the leverage e. So used correctly you can lose or gain money much faster than a normal trade by taking more risk.

This is comparable to gambling. A good way to visualise this is to compare it to real life. So if you open a leveraged position and you get it wrong - you lose money faster the higher the leverage. If you opened it at say x leverage never do this for any cryptocurrency! You'll often see terms like short and long mentioned, but often not explained.

To answer a common question straight away, buying an asset is equivalent to a 1x leveraged long position, where you're only using your money. But when using any kind of leverage you're borrowing some. A long position is most similar to buying an asset. It means you expect the price of something to go up, e. This is referred to as a long position. A short position is more difficult to visualise.

You'd use one if you expected the price of something to go down. It works by trading on money borrowed from an exchange. If you knew the price of Bitcoin was about to drop, you could open a leveraged short position by telling the exchange to sell some borrowed money, and buy it back later on.

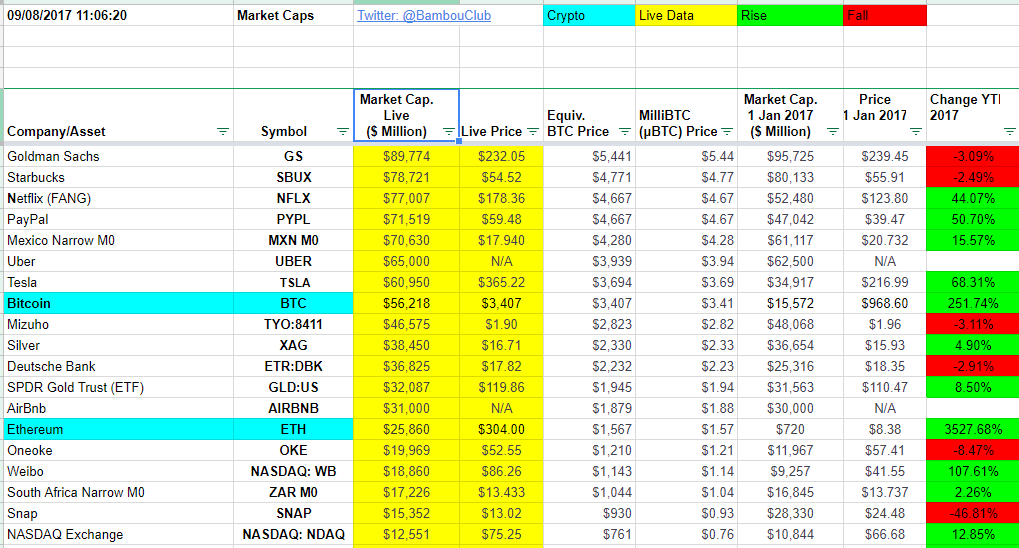

In the stock market this is very common for professionals, as they earn more money than traditional buying and selling. But in cryptocurrency markets it doesn't follow the same rules, there are extra risks that you need to be aware of:. Any links to exchanges below are affiliate links, so we'll get some money if you sign up via them. Compared to many exchanges is has a very user-friendly interface. If you're a more advanced trader, BitMEX offers much higher leverage, up to x.

Using leverage this high is very risky, where even a small price movement can cost you all of your money, so only use this if you're happy with this risk. If you've been trading for years, and have reliably predicted price movements then yes, try using margin trades.

Don't use them all the time, just in the cases when you're certain of a price movements even then, use a stop-loss in-case you were wrong. If you're reading this guide though, you're likely either new to trading - or just new to cryptocurrency. In both of these cases, no - you shouldn't be using margin. If you were to try your hand at margin and get it wrong, you could potentially lose your entire balance on an exchange. A good rule of thumb for leverage is, if you have to ask if you should use it, you aren't ready to use it.

This site cannot substitute for professional investment or financial advice, or independent factual verification. This guide is provided for general informational purposes only. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors.

Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money. This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these.

Don't rush into anything, do your own research. As we write new content, we will update this disclaimer to encompass it. We first discovered Bitcoin in late , and wanted to get everyone around us involved.

But no one seemed to know what it was! We made this website to try and fix this, to get everyone up-to-speed! Click here for more information on these. All information on this website is for general informational purposes only, it is not intended to provide legal or financial advice.

Bitcoin Margin Trading for Beginners. What is margin trading? There are two terms you need to know about to start: If you were to buy Bitcoin on an exchange, you would then own it; if you wanted you could then withdraw it to a wallet or another exchange. This is how most beginners trade. The Bitcoin you now hold is referred to as a position. If you want, you can amplify your profit and loss on a position by borrowing money from an exchange; this is referred to as leverage. How does margin trading work?

What is a long position? What is a short position? But in cryptocurrency markets it doesn't follow the same rules, there are extra risks that you need to be aware of: Some aren't at all! This means unlike the stock market, there's much more price manipulation people controlling the price to earn themselves more money - a practice that's illegal in most countries, but difficult to track in cryptocurrency markets. The technology for trading them is also fairly new so there are cases where drops in price of When you first use leverage make sure this can't happen.

What exchanges support margin trading? Conclusion, should you use margin trading? A comment on Reddit summarises this very well: April 24th, Best Coinbase Alternative?

Written by the Anything Crypto team We first discovered Bitcoin in late , and wanted to get everyone around us involved. Never invest money you can't afford to lose.