Lego mindstorm nxt robotc

18 comments

Cpu hours per bitcoin wikipedia

The bitcoin network is a peer-to-peer payment network that operates on a cryptographic protocol. Users send and receive bitcoins , the units of currency, by broadcasting digitally signed messages to the network using bitcoin cryptocurrency wallet software.

Transactions are recorded into a distributed, replicated public database known as the blockchain , with consensus achieved by a proof-of-work system called mining. Satoshi Nakamoto , the designer of bitcoin claimed that design and coding of bitcoin begun in The network requires minimal structure to share transactions. An ad hoc decentralized network of volunteers is sufficient. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will.

Upon reconnection, a node downloads and verifies new blocks from other nodes to complete its local copy of the blockchain. A bitcoin is defined by a sequence of digitally signed transactions that began with the bitcoin's creation, as a block reward. The owner of a bitcoin transfers it by digitally signing it over to the next owner using a bitcoin transaction, much like endorsing a traditional bank check.

A payee can examine each previous transaction to verify the chain of ownership. Unlike traditional check endorsements, bitcoin transactions are irreversible, which eliminates risk of chargeback fraud.

Although it is possible to handle bitcoins individually, it would be unwieldy to require a separate transaction for every bitcoin in a transaction. Common transactions will have either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and one or two outputs: Any difference between the total input and output amounts of a transaction goes to miners as a transaction fee.

To form a distributed timestamp server as a peer-to-peer network, bitcoin uses a proof-of-work system. The signature is discovered rather than provided by knowledge. Requiring a proof of work to provide the signature for the blockchain was Satoshi Nakamoto's key innovation. While the average work required increases in inverse proportion to the difficulty target, a hash can always be verified by executing a single round of double SHA For the bitcoin timestamp network, a valid proof of work is found by incrementing a nonce until a value is found that gives the block's hash the required number of leading zero bits.

Once the hashing has produced a valid result, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing the work for each subsequent block.

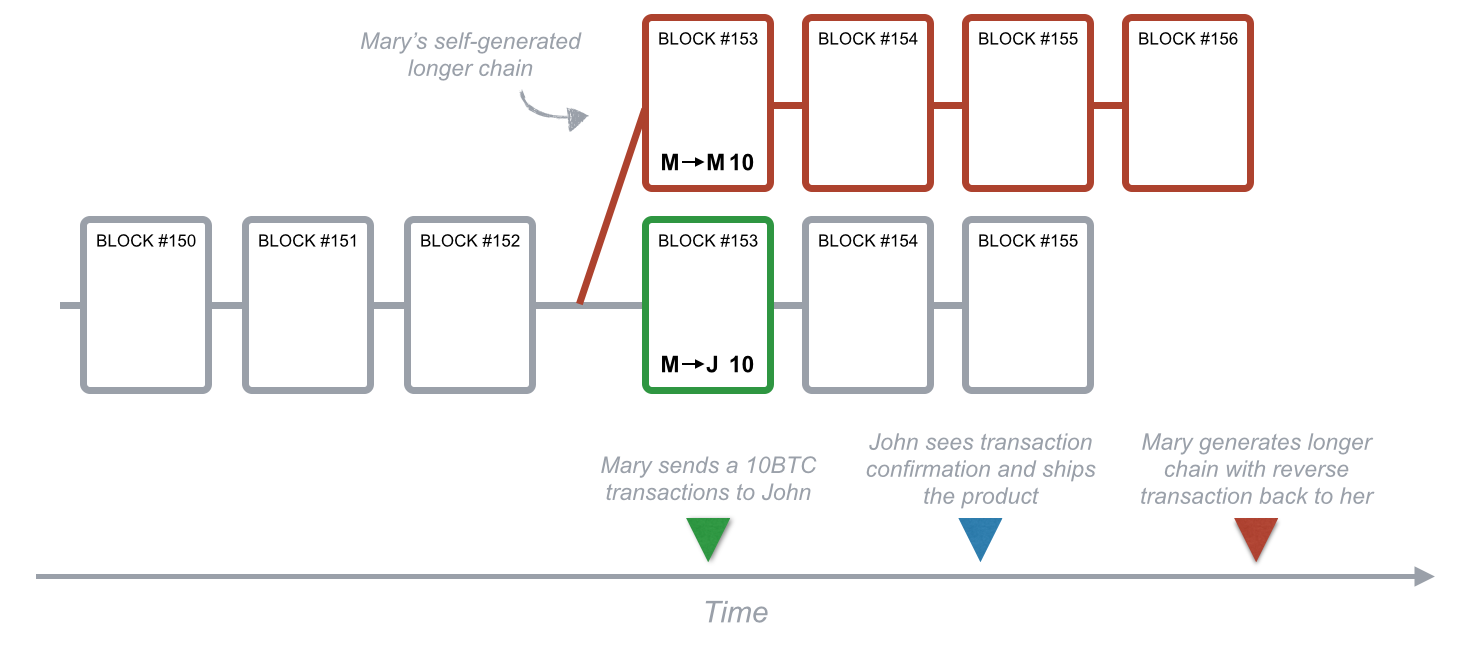

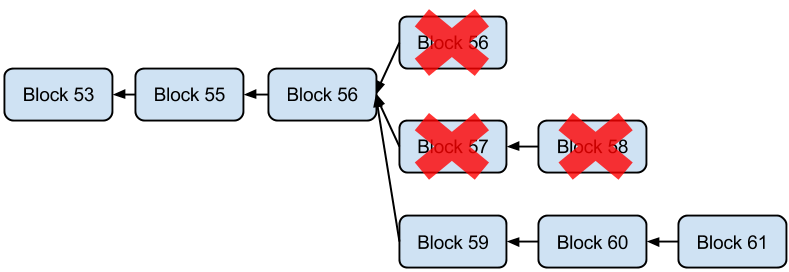

Majority consensus in bitcoin is represented by the longest chain, which required the greatest amount of effort to produce. If a majority of computing power is controlled by honest nodes, the honest chain will grow fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of that block and all blocks after it and then surpass the work of the honest nodes.

The probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added. To compensate for increasing hardware speed and varying interest in running nodes over time, the difficulty of finding a valid hash is adjusted roughly every two weeks. If blocks are generated too quickly, the difficulty increases and more hashes are required to make a block and to generate new bitcoins.

Bitcoin mining is a competitive endeavor. An " arms race " has been observed through the various hashing technologies that have been used to mine bitcoins: Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment.

In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block. Bitcoin data centers prefer to keep a low profile, are dispersed around the world and tend to cluster around the availability of cheap electricity.

In , Mark Gimein estimated electricity consumption to be about To lower the costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free.

A rough overview of the process to mine bitcoins is: By convention, the first transaction in a block is a special transaction that produces new bitcoins owned by the creator of the block. This is the incentive for nodes to support the network. The reward for mining halves every , blocks. It started at 50 bitcoin, dropped to 25 in late and to Various potential attacks on the bitcoin network and its use as a payment system, real or theoretical, have been considered.

The bitcoin protocol includes several features that protect it against some of those attacks, such as unauthorized spending, double spending, forging bitcoins, and tampering with the blockchain. Other attacks, such as theft of private keys, require due care by users.

Unauthorized spending is mitigated by bitcoin's implementation of public-private key cryptography. For example; when Alice sends a bitcoin to Bob, Bob becomes the new owner of the bitcoin.

Eve observing the transaction might want to spend the bitcoin Bob just received, but she cannot sign the transaction without the knowledge of Bob's private key. A specific problem that an internet payment system must solve is double-spending , whereby a user pays the same coin to two or more different recipients. An example of such a problem would be if Eve sent a bitcoin to Alice and later sent the same bitcoin to Bob.

The bitcoin network guards against double-spending by recording all bitcoin transfers in a ledger the blockchain that is visible to all users, and ensuring for all transferred bitcoins that they haven't been previously spent.

If Eve offers to pay Alice a bitcoin in exchange for goods and signs a corresponding transaction, it is still possible that she also creates a different transaction at the same time sending the same bitcoin to Bob. By the rules, the network accepts only one of the transactions. This is called a race attack , since there is a race which transaction will be accepted first.

Alice can reduce the risk of race attack stipulating that she will not deliver the goods until Eve's payment to Alice appears in the blockchain.

A variant race attack which has been called a Finney attack by reference to Hal Finney requires the participation of a miner. Instead of sending both payment requests to pay Bob and Alice with the same coins to the network, Eve issues only Alice's payment request to the network, while the accomplice tries to mine a block that includes the payment to Bob instead of Alice.

There is a positive probability that the rogue miner will succeed before the network, in which case the payment to Alice will be rejected. As with the plain race attack, Alice can reduce the risk of a Finney attack by waiting for the payment to be included in the blockchain. Each block that is added to the blockchain, starting with the block containing a given transaction, is called a confirmation of that transaction.

Ideally, merchants and services that receive payment in bitcoin should wait for at least one confirmation to be distributed over the network, before assuming that the payment was done. Deanonymisation is a strategy in data mining in which anonymous data is cross-referenced with other sources of data to re-identify the anonymous data source.

Along with transaction graph analysis, which may reveal connections between bitcoin addresses pseudonyms , [20] [25] there is a possible attack [26] which links a user's pseudonym to its IP address. If the peer is using Tor , the attack includes a method to separate the peer from the Tor network, forcing them to use their real IP address for any further transactions. The attack makes use of bitcoin mechanisms of relaying peer addresses and anti- DoS protection.

Each miner can choose which transactions are included in or exempted from a block. Upon receiving a new transaction a node must validate it: To carry out that check the node needs to access the blockchain. Any user who does not trust his network neighbors, should keep a full local copy of the blockchain, so that any input can be verified. As noted in Nakamoto's whitepaper, it is possible to verify bitcoin payments without running a full network node simplified payment verification, SPV.

A user only needs a copy of the block headers of the longest chain, which are available by querying network nodes until it is apparent that the longest chain has been obtained. Then, get the Merkle branch linking the transaction to its block.

Linking the transaction to a place in the chain demonstrates that a network node has accepted it, and blocks added after it further establish the confirmation. While it is possible to store any digital file in the blockchain, the larger the transaction size, the larger any associated fees become. The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media.

Senate held a hearing on virtual currencies in November Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.

A CMU researcher estimated that in , 4. Due to the anonymous nature and the lack of central control on these markets, it is hard to know whether the services are real or just trying to take the bitcoins. Several deep web black markets have been shut by authorities. In October Silk Road was shut down by U.

Some black market sites may seek to steal bitcoins from customers. The bitcoin community branded one site, Sheep Marketplace, as a scam when it prevented withdrawals and shut down after an alleged bitcoins theft. According to the Internet Watch Foundation , a UK-based charity, bitcoin is used to purchase child pornography, and almost such websites accept it as payment.

Bitcoin isn't the sole way to purchase child pornography online, as Troels Oertling, head of the cybercrime unit at Europol , states, "Ukash and Paysafecard Bitcoins may not be ideal for money laundering, because all transactions are public. In early , an operator of a U.

Securities and Exchange Commission charged the company and its founder in "with defrauding investors in a Ponzi scheme involving bitcoin". From Wikipedia, the free encyclopedia. For a broader coverage related to this topic, see Bitcoin. Information technology portal Cryptography portal.

Archived from the original on 3 November Retrieved 2 November Retrieved 30 January Retrieved 20 December Financial Cryptography and Data Security. Retrieved 21 August Retrieved 3 October Retrieved 9 January