Hosted bitcoin miner

45 comments

Bacteria jabon liquido concentrado

We'll know that bitcoin has made it to the next level not when editors all want to write about it, but rather when editors don't want to write about it. Something of a milestone was reached very early in the morning of Friday, November 29, a time when most Americans were either sleeping off their Thanksgiving excesses or out seeking Black Friday bargains. If only briefly and theoretically, at that point in time a bitcoin was worth more than an ounce of gold.

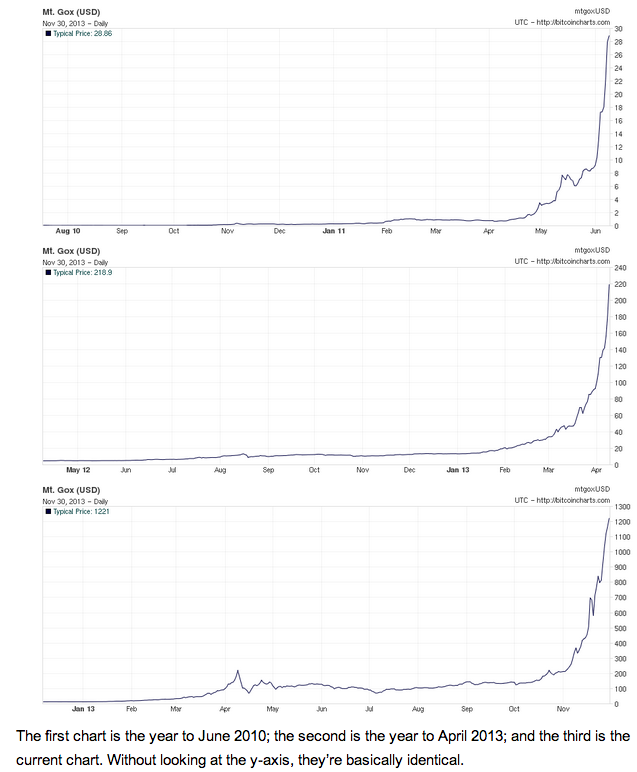

Bitcoin, by its nature, is a highly volatile asset, which is prone to astonishing run-ups in price. Check out these three one-year charts of the bitcoin price:. The first chart is the year to June ; the second is the year to April ; and the third is the current chart. To put it another way, there is nothing surprising about what bitcoin is doing right now; it has done it many times in the past, and it will probably do it in the future as well.

The latest bright idea from Alderney — that the tiny island population: The dollar was backed by gold, once; the Argentine peso was backed by the dollar. Neither lasted, and if the burghers of Alderney ever change their mind about the bitcoin backing, or it gets hacked or stolen, the owners of the physical bitcoins are going to have no recourse.

What, then, would the coin be worth? And the most you could sell it for, in terms of its fundamental value, is the value of one bitcoin. All of which is to say that the FT is splashing all over its front page a crazy bitcoin scheme which is never going to happen. The company would essentially need to hand over its bitcoins to Alderney, would probably have to help fund the cost of manufacturing the coins out of gold, and would get essentially nothing in return for the huge risk it was taking that all its coins would become worthless.

One of the less reported aspects of the bitcoin story is the way in which editors tend to be much more excited about it than reporters, who are generally more skeptical, and who worry that their own reporting will only serve to inflate the bubble even further.

This is something which should worry the bitcoin faithful, if they really want to see bitcoin become a broadly-used global currency. After all, press coverage of bitocins runs in lockstep with the bitcoin price: The largely unspoken assumption behind all such stories: And with respect to bitcoin in particular, its most exciting aspect is not its value, but rather its status as an all-but-frictionless international payments mechanism.

After all, if your bitcoins are doubling in value every few days, why on earth would you want to spend them? If and when those long flat areas last for years rather than months, bitcoin might start becoming a boring, credible currency. As Joe Weisenthal points out, stability at a high price is more bullish for the bitcoinverse than stability at a low price, because the higher the market capitalization of bitcoin, the greater the amount of commerce that can be transacted in it.

Waiting for bitcoin to get boring By Felix Salmon. Check out these three one-year charts of the bitcoin price: Are Heloc defaults about to spike? When loans beat grants.