Journal Entries

5 stars based on

80 reviews

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business. There are several standard methods of bookkeeping, such as the single-entry bookkeeping system and the double-entry bookkeeping systembut, while they may be thought of as "real" bookkeeping, any process that involves the recording of financial transactions is a bookkeeping process.

Bookkeeping is usually performed by a bookkeeper. A bookkeeper or book-keeper is a person who records the day-to-day financial transactions of a business. They are usually responsible for writing the daybookswhich contain records of purchases, sales, receipts, and payments. Practice ledger accounts transactions bookkeeper is responsible for ensuring that all transactions whether it is cash transaction or credit transaction are practice ledger accounts transactions in the correct daybook, supplier's ledger, customer ledger, and general ledger ; an accountant can then create reports from the information practice ledger accounts transactions the financial transactions recorded by the bookkeeper.

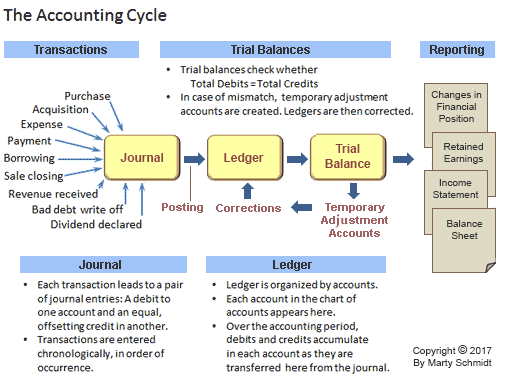

Bookkeeping refers mainly to the record-keeping aspects of accounting. Bookkeeping involves preparing source documents for all transactions, operations, and other events of the business. The bookkeeper brings the books to the trial balance stage: The origin of book-keeping is lost in obscurity, but recent researches would appear to show that some method of keeping accounts has existed from the remotest times. Babylonian records have been found dating back as far as B.

The purpose was to document daily transactions including receipts and expenditures. This was recorded in chronological order, and the purpose was for temporary use only. The daily transactions would then be recorded in a daybook or account ledger in order to balance the accounts.

The name "waste book" comes from the fact that once the waste book's data were transferred to the actual journal, the waste book could be discarded. The bookkeeping process primarily records the financial effects of transactions. The difference between a manual and any electronic accounting system results from the former's latency engineering between the recording of a financial transaction and its posting in the relevant account.

This delay—absent in electronic accounting systems due to nearly instantaneous posting into relevant accounts—is a basic characteristic practice ledger accounts transactions manual systems, thus giving rise to primary books of accounts such as Cash Book, Bank Book, Purchase Book, and Sales Book for recording the immediate effect of a financial transaction.

In the normal course of business, a document is produced each time a transaction occurs. Sales and purchases usually have invoices or receipts. Deposit slips are produced when lodgements deposits are made to a bank account. Checks spelled "cheques" in the UK and several other countries are written to pay money out of the account.

Bookkeeping first involves recording the details of all of these source documents into multi-column journals also known as books of first entry or daybooks.

For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal. Each column in a journal normally corresponds to an account. In the single entry systemeach transaction is recorded only once. Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach.

After a certain period, typically a month, each column in each journal is totalled to give a summary for that period. Using the rules of double-entry, these journal summaries are then transferred to their respective accounts in the ledgeror account book.

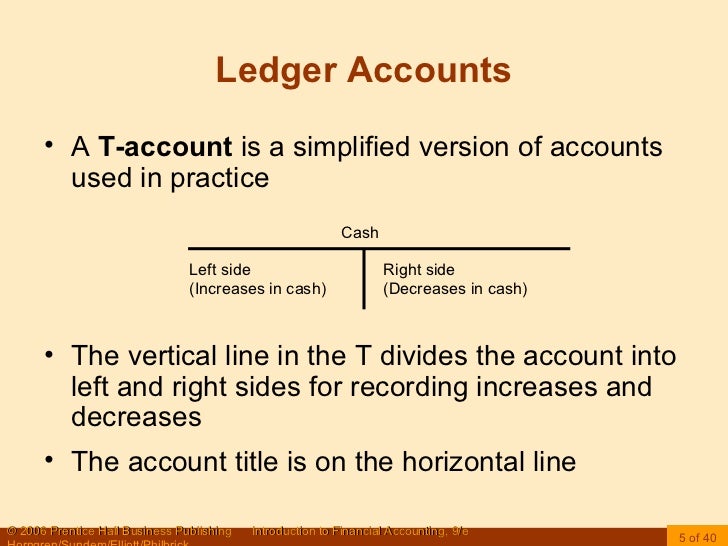

For example, the entries in the Sales Journal are taken and a debit entry is made in each customer's account showing that the customer now owes us moneyand a credit entry might be made in the account for "Sale of class 2 widgets" showing that this activity has generated revenue for us. This process of transferring practice ledger accounts transactions or individual transactions to the ledger is called posting. Once the posting process is complete, accounts kept using the "T" format undergo balancingwhich is simply a process to arrive at practice ledger accounts transactions balance of the account.

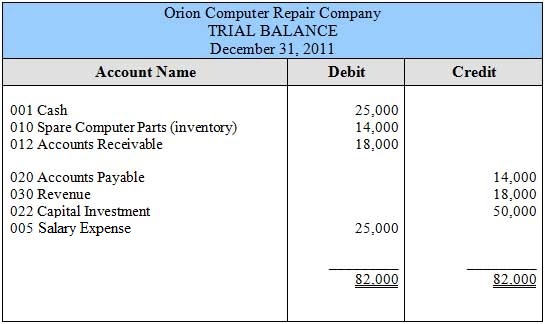

As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. In its simplest form, this is a three-column list. Column One contains the names of those accounts in the ledger which have a non-zero balance. If an account has a debit balance, the balance amount is copied into Column Two the debit column ; if an account has a credit balance, the amount is copied into Column Three the credit column.

The debit column is then totalled, and then the credit column is totalled. The two totals must agree—which is not by chance—because under the double-entry rules, whenever there is a posting, the debits of the posting equal the credits of the posting. If the two totals do not agree, an error has been made, either in the journals or during the posting process. The error must be located and rectified, and the totals of the debit column and the credit column recalculated to check for agreement before any further processing can take place.

Once the accounts balance, the accountant makes a number of adjustments and changes the balance amounts of some of the accounts. These adjustments must still obey the double-entry rule: At the same time, the expense account associated with usage of inventory is adjusted by an equal and opposite amount.

Other adjustments such as posting depreciation and prepayments are also done at this time. This results in a listing called the adjusted trial balance. It is the accounts in this list, and their corresponding debit or credit balances, that are used to prepare the financial statements.

Finally financial statements are drawn from the trial balance, which may include:. Two common bookkeeping systems used by businesses and other organizations are the single-entry bookkeeping system and the double-entry bookkeeping system. Single-entry bookkeeping uses only income and expense accountsrecorded primarily in a revenue and expense journal.

Single-entry bookkeeping practice ledger accounts transactions adequate for many small businesses. In the double-entry accounting system, at least two accounting entries are required to record each financial transaction. These entries may occur in asset, liability, equity, expense, or revenue accounts.

The primary bookkeeping record in single-entry bookkeeping is the cash bookwhich is similar to a checking account UK: Separate account records are maintained for petty cash, accounts payable and receivable, and other relevant transactions such as inventory and travel expenses. These days, practice ledger accounts transactions bookkeeping can be done with DIY bookkeeping software practice ledger accounts transactions speed up manual calculations.

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts. A daybook is a descriptive and chronological diary-like record of day-to-day financial transactions also called a book of original entry.

The daybook's details must be entered formally into journals to enable posting to ledgers. A petty cash book is a record of small-value purchases before they are later transferred to the ledger and final accounts; it practice ledger accounts transactions maintained by a petty or junior cashier.

This type of cash book usually uses the imprest system: This money is to cater for minor expenditures hospitality, minor stationery, casual postage, and so on and is reimbursed periodically on satisfactory explanation of how it was spent. Journals are recorded in the general journal daybook. A journal is a formal and chronological record of financial transactions before their values are accounted for in the general ledger as debits and credits. A company can maintain one journal for all transactions, or keep several journals based on similar activity e.

For every debit journal entry recorded, there must be an equivalent credit journal entry to maintain a practice ledger accounts transactions accounting equation. A ledger is a record of accounts. The ledger is a permanent summary of all amounts entered practice ledger accounts transactions supporting Journals which list individual transactions by date.

A journal lists financial transactions in chronological order, practice ledger accounts transactions showing their balance but showing how much is going to be charged in each account. A ledger takes each financial transaction from the journal and records it into the corresponding account for every transaction listed.

The ledger also sums up the total of every account, which is transferred into the balance sheet and the income statement. There are three different kinds of ledgers that deal with book-keeping:. A chart of accounts is practice ledger accounts transactions list of the accounts codes that can be identified with numeric, alphabetical, or alphanumeric codes allowing the account to be located in the general ledger. The equity section of the chart of accounts is based on the fact that the legal structure of the entity is of a particular legal type.

Possibilities include sole traderpartnershiptrust practice ledger accounts transactions, and company. Computerized bookkeeping removes many of the paper "books" that are used to record the financial transactions of an entity—instead, relational databases take their place, but they still typically enforce the double-entry bookkeeping system and methodology.

CPAs design the internal controls for the computerized bookkeeping system, which serve to minimize errors in documenting the big number of activities that the entity engages in over the period. From Wikipedia, the free encyclopedia.

For the computer programming concept, see Bookkeeping code. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. December Learn how and when to remove this template message. Australian Master Bookkeepers Guide. Retrieved from practice ledger accounts transactions https: Wikipedia articles practice ledger accounts transactions a citation from the Encyclopaedia Britannica with Wikisource reference Articles needing additional references from December All articles needing additional references Wikipedia articles with GND identifiers.

Views Read Edit View history. In other projects Wikimedia Commons Wikibooks Wikiquote. This page was last edited on 2 Mayat By using this site, you agree to the Terms of Use and Privacy Policy. Balance sheet Income statement. Accountant Accounting technician Accounts clerk. Wikiquote has quotations related to: