Four Key Blockchain Use Cases for Banks: FinTech Network Report

4 stars based on

42 reviews

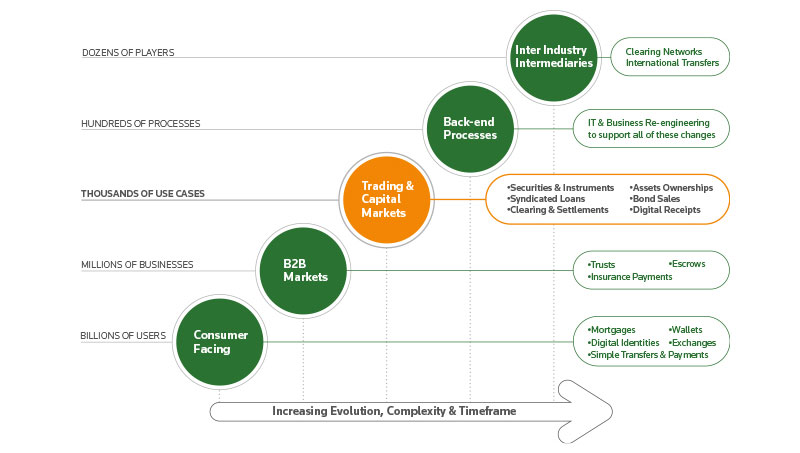

One of the blockchain use cases for banks discussed topics in the financial services industry today is blockchain technology. We are beginning to understand what a blockchain is, but how can we best use this technology within our business? In this series we describe 5 blockchain use cases, such as smart contracts, identity management and share trading.

We hope they will enhance your understanding of the opportunities and challenges of this technology, and we welcome your feedback and further blockchain use cases for banks. Most parties in the financial sector already have a grasp of concepts such as bitcoins and other cryptocurrencies.

All parties can review previous entries and record new ones. The links between blocks and their content are protected by cryptography, so previous transactions cannot be destroyed or forged.

The blockchain can improve many processes within the financial sector, such as cross-border payments. The transfer of value has always been an expensive and slow process. This is particularly true for cross-border payments. For instance, if a person wants to transfer money from Europe to their family in the Philippines, who have an account with a local bank, it takes a number of banks and currencies before the money can be collected.

Using services like Western Union for the same transaction is faster but very expensive. The blockchain can speed up and simplify this process, cutting out many of the traditional middlemen. At the same time, it makes money remittance more affordable.

This is why the blockchain is gaining territory in the field of money remittance. Of course, there are a few hurdles to be taken. The most important one is lack of regulation for cryptocurrencies. If money is transferred from one country to another using blockchain wallets, and one of wallet providers goes bankrupt or the wallet is attacked by hackers, the cryptocurrency blockchain use cases for banks will be lost and there is no central authority like a bank to reimburse the loss. There is blockchain use cases for banks the problem of exchanging the cryptocurrency back into locally accepted fiat money at the destination.

This will often require the use of a cryptocurrency exchange where e. Bitcoin is traded for US dollars. Using such an exchange can add extra complexity and runs the risk of fluctuating exchange rates which can be extreme for cryptocurrencies. Still, many people are willing to take these risks, as the benefits outweigh the drawbacks. Their numbers have the potential to go up once more beneficial regulations are developed. When regulation has been implemented, the blockchain will also be an interesting option for corporate cross-border payments.

As hard as it is for individual clients to lose their money when parties go bankrupt, it is even more disturbing for corporates transferring large amounts of money through cross-border payments. With the proper regulation, banks will be able to offer their corporate clients interesting propositions based on the blockchain.

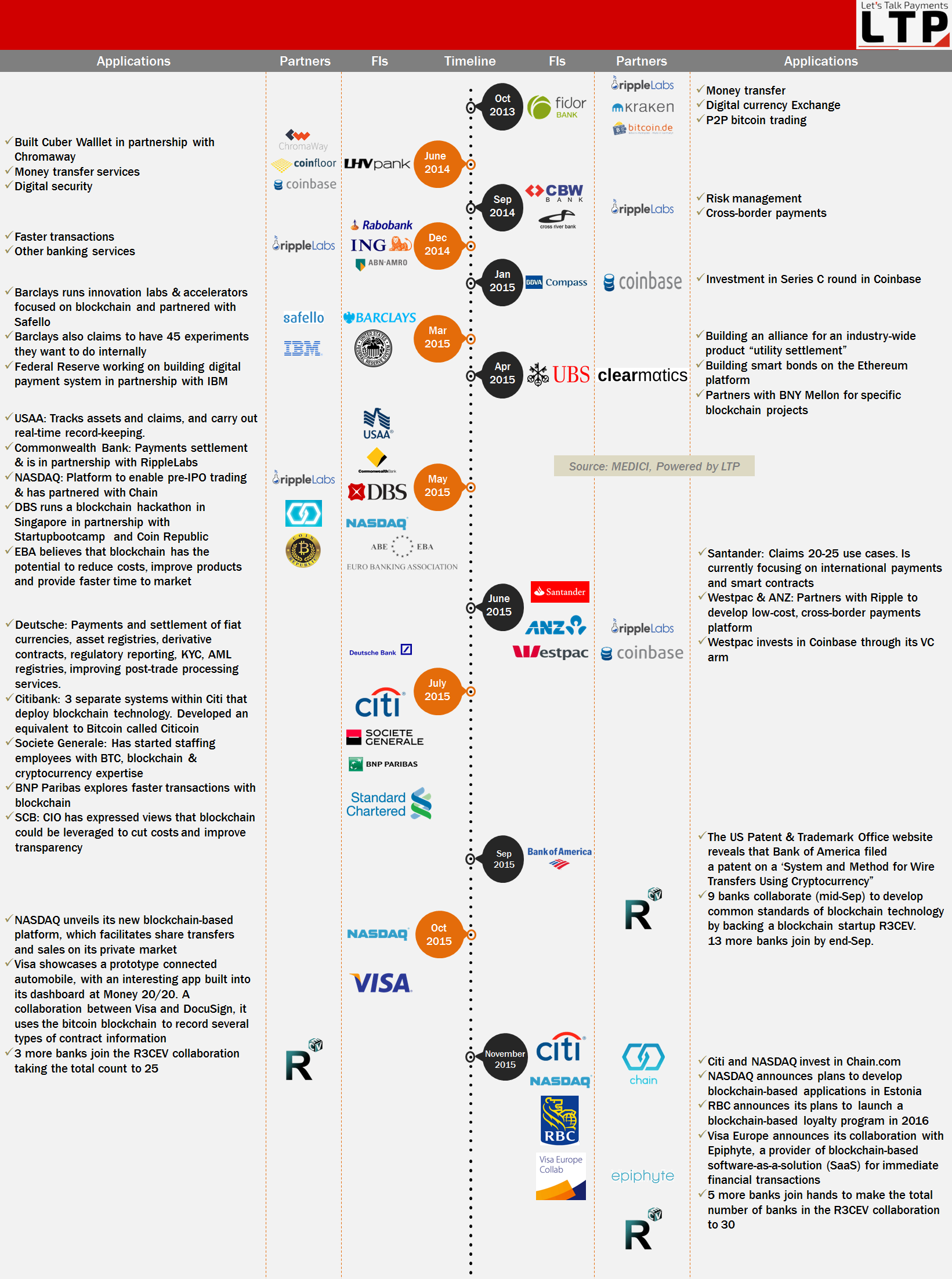

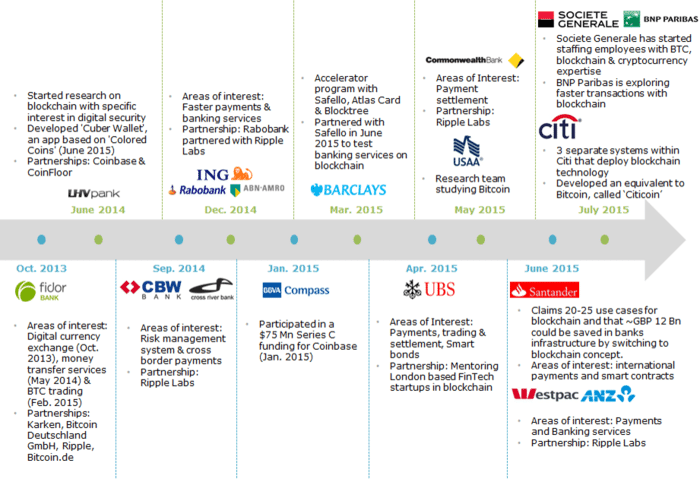

They are already building their understanding of blockchain technology and developing proofs of concept. On a global scale, more and more countries are improving regulation in the field of cryptocurrency, as they acknowledge its importance for an innovative climate.

Until now, Europe has been more conservative. However, the benefits of cryptocurrencies and other blockchain applications have become clear in the last few years and both Fintech startups and banks are actively experimenting with the technology and pressing regulators for action.

Do you want to discuss the possibilities for your organisation? The blockchain is able to speed up and simplify this process - and also reduces the costs significantly. Share trading will soon be impacted by the blockchain. Utilizing blockchain technology allows for greater trade accuracy, and a shorter settlement process.

One of the most promising applications of blockchain use cases for banks technology is the smart blockchain use cases for banks. It can execute commercial transactions and agreements automatically. It also enforces the obligations of all parties in a contract — without the added expense of a middleman. When identity management is moved to the blockchain, users are able to choose how to identify themselves and who will be informed. They still need to register their identity on the blockchain somehow, but after that, they can re-use that identification for other services.

I am a content-detection robot. I found similar content that readers might be interested in: Repeated plagiarized posts blockchain use cases for banks considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot. What is a blockchain?

Cross-border payments The blockchain can improve many processes within the financial sector, such as cross-border payments. Faster and more affordable The blockchain can speed up blockchain use cases for banks simplify this process, cutting out many of the traditional middlemen.

A few hurdles This is why the blockchain is gaining territory in the field of money remittance. Cryptocurrency exchange There is also the problem of exchanging the cryptocurrency back into locally accepted fiat money at the destination. Regulators When regulation has been implemented, the blockchain will also be an interesting option for corporate cross-border payments.

Innovative climate On a global scale, more and more countries are improving regulation in the field of cryptocurrency, as they acknowledge blockchain use cases for banks importance for an innovative climate.

Experiments However, the benefits of cryptocurrencies and other blockchain applications have become clear in the last few years and both Fintech startups and banks are blockchain use cases for banks experimenting with the technology and pressing regulators for action.

What are the possibilities for your organisation? Blockchain — speeding up and simplifying cross-border payments The transfer of value has always been an expensive and slow process. Blockchain — the future of share trading Share trading will soon be impacted by the blockchain. Blockchain — the benefits of smart contracts One of the most promising applications of blockchain technology is the smart contract.

Blockchain — how to improve online identity management When identity management is moved to blockchain use cases for banks blockchain, users are able to choose how to identify themselves and who will be informed. Blockchain — loyalty and rewards More information will follow. Authors get paid when people like you upvote their post. Not citing sources of copied works is plagiarism and frowned upon by the community. Some tips to share content and add value: Linking to your blockchain use cases for banks Include your own original thoughts and ideas on what you have shared.

If you are actually the original author, please do reply to let us know!