Bitcoin market capitalization quarterly 2012-2018

4 stars based on

32 reviews

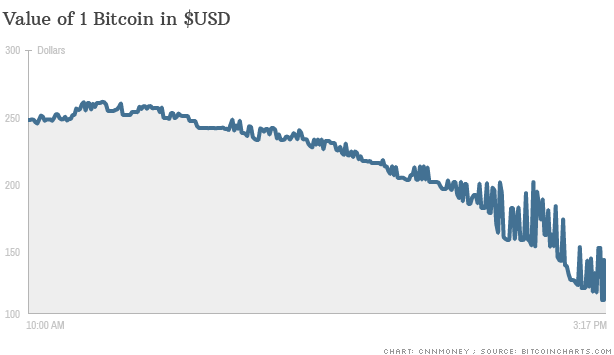

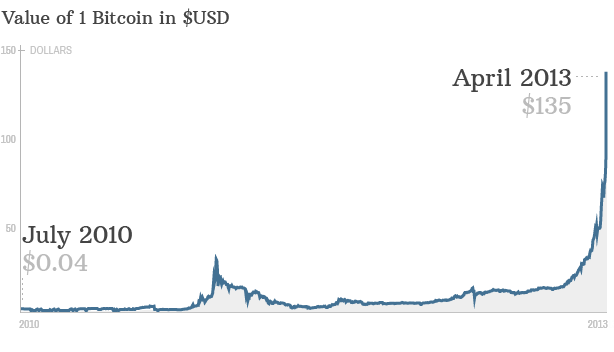

Sizing up Bitcoin is a tall order. A digital store of value, a revolutionary payment platform, or the promise of a completely new, blockchain-based financial system. The truth is that Bitcoin is all of those things, but whether bitcoin market share value succeed as all three — or any of them — bitcoin market share value to be seen. Bitcoin's price increased tenfold in and moved into the media mainstream. But for all the headlines and Bitcoin market share value billionairesthe underlying technology mostly stood still.

A significant and highly controversial upgrade of its software fell through. And the earlier, minor upgrade still bitcoin market share value widely used yet. The most important problem these upgrades were supposed to fix bitcoin's biggest problem—that it's escalating popularity had exposed an underlying issue with Bitcoin's distributed database.

The issue limited just how much Bitcoin could process at any one time, making the network congested and transactions expensive not to mention power-hungry. Put simply, while Bitcoin has exploded in value and popularity, the base technology has remained stagnant. And that casts a shadow on its future — right when competition among cryptocurrencies is on fire. With this issue unresolved, Bitcoin lately hasn't evolved in the direction its founder or founders — we don't know his identity Satoshi Nakamoto had originally envisioned — for Bitcoin to become a peer-to-peer digital cash payments system.

Sure, you can use Bitcoins for payments, but with transaction fees going through the roof and Bitcoin's bitcoin market share value constantly rising, it's just not a very good way to pay for things online. No wonder big online retailers such as Amazon aren't exactly lining up to introduce Bitcoin payments. The 1 thing most commonly purchased with bitcoin is the future regret that you didn't keep your bitcoin. Some Bitcoin pundits, including most of its core development team, argue that moving slow, and with full consensus of the Bitcoin community, is the right way to go — certainly better than making rash changes and exposing the network to attacks.

But Bitcoin's development process has been glacially slow; the scaling debate, which culminated with the failed Segwit2x fork, has been going on for years. Some big changes have happened, but not on Bitcoin's blockchain.

Instead, several projects "hard forked" from Bitcoin, taking over its blockchain history but making changes to the bitcoin market share value. The most prominent of these, Bitcoin Cash, initially seemed bitcoin market share value be a hastily put together project, but recently it gained support of some cryptocurrency pioneers. Roger Ver, an early Bitcoin investor and owner of Bitcoin.

I'll do my best to use https: BitcoinCash is that Bitcoin. Is it possible for a Bitcoin bitcoin market share value to take over and become the de facto "real" Bitcoin? Yes, according to Sirer. It would be a slow process, as the vision behind one project runs into technical difficulties or is bitcoin market share value to falter economically, others will emerge to fill the same needs.

Despite the danger presented by Bitcoin forks, the original Bitcoin bitcoin market share value still the one everyone is talking about, mainly due to the price rise.

Millions of people invested for the first time inas exchanges such as Coinbase saw unprecedented growth. Institutional bitcoin market share value are getting interested. Predictions about Bitcoin's price are getting crazier by the day. These predictions are problematic for several reasons. First, for every expert claiming Bitcoin's price will soar you'll find another who claims the cryptocurrency is worth zero.

Secondly, most of these predictions aren't based on sound fundamental analysis because Bitcoin has no easily definable fundamentals.

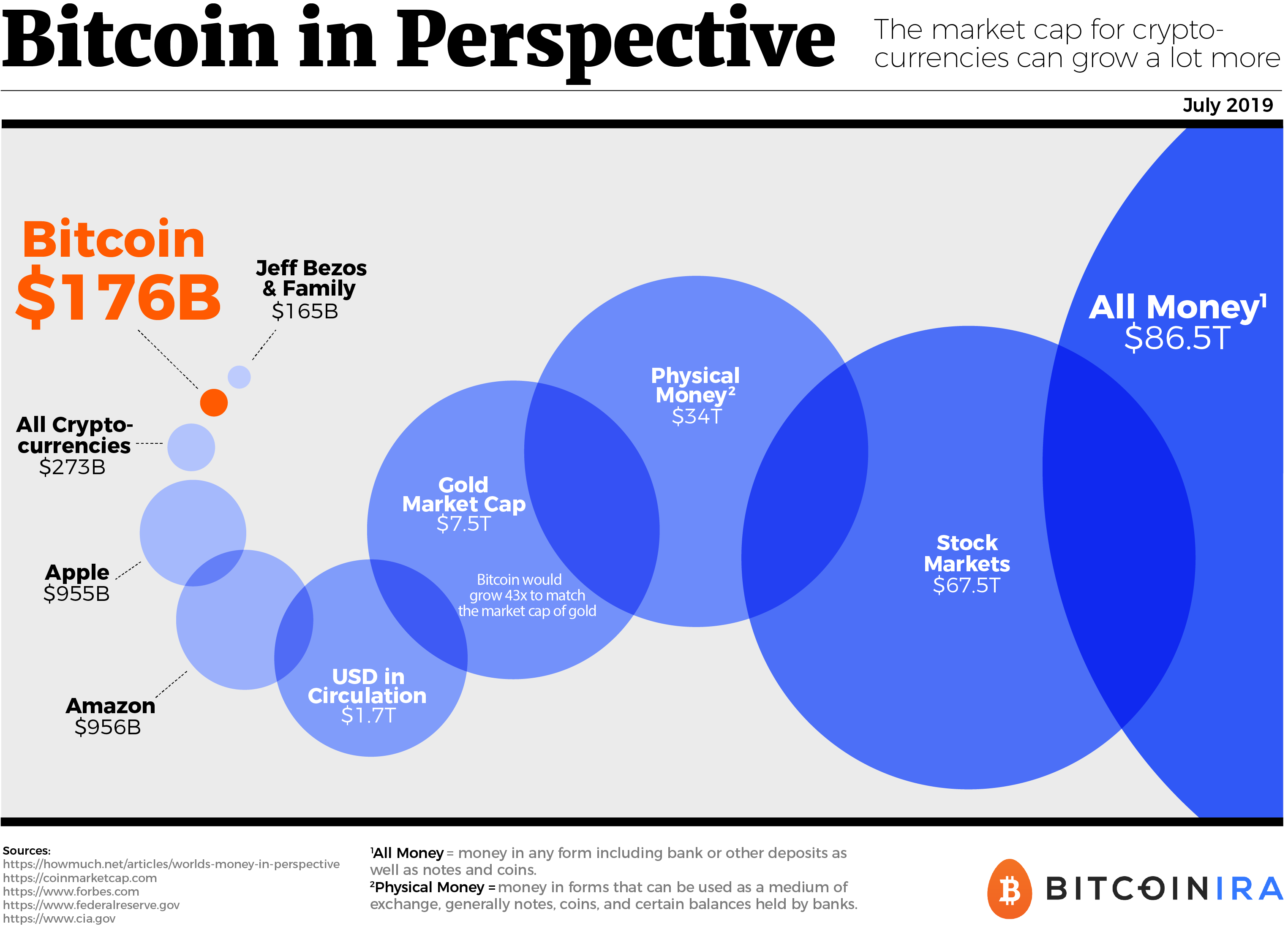

When assessing the value of a company, you can compare price with earnings or take dividend yield as indicators of value. Unlike a company, Bitcoin doesn't generate revenue; it doesn't pay out dividends. Unlike gold, it has no industrial use and cannot be turned into shiny pendants. The few metrics that we do have are of questionable value.

Bitcoin's scarcity there will only be 21 million bitcoins minted is important but one could argue that other cryptocurrencies, which are being created daily, create a coin inflation of sorts.

Commonly cited Metcalfe's lawwhich roughly says that a network's value goes up with the number of users on the network, would make sense if Bitcoin users were actually using it as a payment system. If you're bitcoin market share value enough, you'll always find a metric by which Bitcoin still has plenty of room for growth.

Dreams about Bitcoin replacing all fiat currency one day aside, the answer for Bitcoin's price rise is simple: It's a radical new technology with untapped potential that has the first mover advantage and plenty of good old hype. This, however, cannot go on forever if the technology itself doesn't move forward, and Bitcoin's usefulness is presently dubious at best. It could be just a matter of time — and money. It's early days for the entire blockchain space, and perhaps all that's needed is a little patience.

Marco Krohn, co-founder of Genesis Mininghas a bullish but careful take. If you want to call Bitcoin a bubblethe line is not short. But determining what, exactly, comprises the bubble, and when it will burst, isn't easy. A new breed of cryptocurrencies has risen, many of whom have solved Bitcoin's shortcomings. Ethereum, the second largest cryptocurrency by market cap, is a far better platform.

Monero offers more in terms of privacy. Cardano, a recent newcomer that swiftly rose to a multi-billion market cap, says it has solved the scalability problem that ails most cryptocurrencies. Will one of these eclipse Bitcoin in the future? We might see the privacy coins benefit. And we might see a new crop of highly scalable coins. Krohn also sees the focus on privacy as an important trait of some cryptocurrencies.

The largest pretender to the cryptocurrency throne is Ethereum, bitcoin market share value, compared to Bitcoin's singular focus on bitcoin market share value and security, is the world's crypto playground. While Bitcoin's development was stalling, Ethereum powered an entire new class of crowdfunded startups.

And while some of these ICOs were apparent scamsthere are now hundreds of freshly-funded blockchain-based startups working to solve this or that problem in a decentralized fashion. Most will fail, but if even a small percentage builds a viable business, it'll be a huge boost for Ethereum. On the other hand, Ethereum itself has had bitcoin market share value share of devastating bugs and hacks ; most recently, a digital kitten collecting game has brought the entire network to a halt.

Unlike Bitcoin's bickering developer team, Ethereum's developers are exploring a myriad of solutions to fix the issues as quickly as possible. So even if Bitcoin is a bubble, the cryptocurrency space looks like it's just taking off.

Bitcoin's price may rise and fall in the future — perhaps dramatically — but the revolution has begun. According to Sirer, price is the least important aspect of Bitcoin. We're using cookies to improve your experience. Click Here to find out more.

Tech Like Follow Follow.