Devcoin for bitcoin

30 comments

Download youtube to mp3 bitcoin botmintpal cryptsy bittrex btce and many others

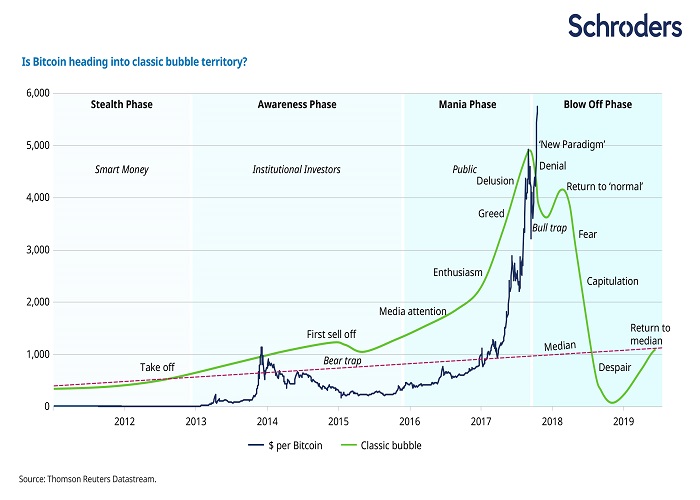

Updated January 18, Bitcoin will not replace national currencies and cryptocurrency prices are in one of the biggest bubbles in history, which is set to burst, warn analysts from Capital Economics.

In a page research note, London-based economists Vicky Redwood and Kerrie Walsh outline in detail their reasons for believing that bitcoin does not have a bright long-term future, even if the blockchain technology behind it does.

Ms Redwood, in particular, should know a thing or two about currencies, having worked at the Bank of England after studying at Oxford and the University of Warwick. The note was released after the bitcoin price plunged by around a quarter in about a day , with other major cryptocurrencies such as Ethereum and Ripple falling by even more.

One of the biggest problems with cryptocurrencies is that they do not have what analysts call an "intrinsic value" — unlike shares, they do not pay dividends; unlike housing, there is no potential rent; unlike gold, they are not physically useful or even pretty. Cryptocurrency devotees counter this by arguing that so-called "fiat currencies" — money issued or backed by central banks — are also intrinsically worthless. But unlike dollars, for example, bitcoin is not backed by a credible authority, such as a central bank or government," the report countered.

Some argue that bitcoin's value will be in supplanting gold as the world's preferred safe haven store of wealth. However, that would assume that bitcoin was the sole accepted cryptocurrency, whereas its dominance is currently being challenged by more than a thousand rivals. The economists also warn that few current bitcoin investors appear to have done such calculations and risk analysis before speculating. But, take a moment of pause for some dubious national pride, as bitcoin still has a long way to go to beat one of the world's biggest ever major bubbles, that of Australian resources firm Poseidon in Accordingly, they rose times over the space of just a few months.

For instance, any company that even mentions the word 'blockchain' sees an immediate jump in its value," they noted. This happened recently when Kodak's share price surged after the struggling imaging company announced it was launching its own cryptocurrency. This avalanche of new cryptocurrencies is a key reason why the economists believe there is a bubble in many of the existing ones. The good news is that, aside from draining the savings of a handful of millennial enthusiasts and wealthy tech speculators, Capital Economics believes the wider fallout will be limited.

Bitcoin's market capitalisation is still small; it is not held by institutions; and it has little correlation with other financial markets," they noted. As for their claim that the possibility of bitcoin replacing fiat currencies is "rubbish", the economists point to some of the reasons why governments moved away from the gold standard to floating exchange rates. A widespread adoption of bitcoin could prompt a re-run of the problems seen under the gold standard.

But the analysts do see a potential role for central bank digital currencies CBDCs , despite Australia's Reserve Bank governor talking down the idea recently.

Allowing businesses and households to bypass banks for simple transactions could also boost economic growth. Outside the financial sector, the underlying blockchain technology behind bitcoin also has a wide range in uses, from facilitating transactions and trade, to maintaining government records such as tax, health and property transfers.

First posted January 18, If you have inside knowledge of a topic in the news, contact the ABC. ABC teams share the story behind the story and insights into the making of digital, TV and radio content.

Read about our editorial guiding principles and the enforceable standard our journalists follow. Here are your thoughts. By Carla Howarth and Ros Lehman. By business reporter Michael Janda.

Capital Economics says claims bitcoin will replace fiat currencies are "rubbish". Pump turns to dump — bitcoin and cryptocurrency prices plummet. Banks 'unwilling to work' with Bitcoin traders amid regulation concerns.

Shares skyrocket on new photo currency. Bitcoin, Ethereum and Ripple prices since January What bitcoin says about us Bitcoin is a formula almost guaranteed to end in tears, but still speculators pile in to the bubble, writes Ian Verrender. Bitcoin's rise dwarfs the US housing bubble or dotcom boom, and even the 17th century's Tulipmania.

Holdings of bitcoin are concentrated amongst a few large owners. Will the Bitcoin bubble burst? The boss of JPMorgan Chase said if his staff were caught trading bitcoin he would "fire them in a second" and it's a "fraud". Why we buy cryptocurrency despite the risks Will those who've made cryptocurrency profits pay their tax? Meet the investors sticking with bitcoin despite the market crash Iceland will soon use more energy mining bitcoins than powering its homes What bitcoin crash?

Aussies eye initial coin offerings This is what happens to your bitcoin when you die Bitcoin buying among students so prevalent one school held a meeting Will Bitcoin go the way of MySpace and floppy disks? What the bitcoin bubble tells us about ourselves TGIF! But don't spend your bitcoin on beer Bitcoin explained: The digital currency making millionaires.

Top Stories Bishop takes aim at ex-ambassador's 'profoundly ignorant' criticisms Gichuhi's political career facing abrupt end after less than one term with Liberals 'My instinct was to save her': So why are men in physically strenuous jobs at risk of dying earlier? Man accused of murders, bombings was fuelled by feud with ex-wife, court told 'Can you kill?

Man accused of murdering wife 'asked lover to find hitman' 'It's just like she's letting go': Mother dies just three days after Sharon Mason's killer freed from jail photos Man accused of burning woman's genitals with branding iron Scientists transfer memory from one snail to another. Connect with ABC News. Got a news tip? Editorial Policies Read about our editorial guiding principles and the enforceable standard our journalists follow.

Who is Thomas Markle? The police officer who saved girl involved in Surabaya attack Pilot and instructor suffer critical burns in NSW light plane crash US retailer Gap apologises for 'erroneous' map of China T-shirt Kodiak bear's birthday ice cream outing goes wrong Former primary school teacher pleads not guilty to indecent dealings with children Gazans bury dead after bloodiest day of Israel border protests Julie Bishop throws support behind female Liberal 'fighting fund' Parents using children in attacks 'not a one-off', analysts say.

Just In Pope says he's thought about when to 'leave his flock' Gazans bury dead after bloodiest day of Israel border protests 'My instinct was to save her': The police officer who saved girl involved in Surabaya attack NT police commissioner's travel agent fraud strategy 'seemed reasonable' to minister, court hears Couple tasered by police fight to keep damages Hobart homelessness up 21 per cent, figures reveal, but government rejects data US retailer Gap apologises for 'erroneous' map of China T-shirt Pilot and instructor suffer critical burns in NSW light plane crash Parents using children in attacks 'not a one-off', analysts say Victorian Parliament detects almost 6, hacking attempts on its IT systems.

Most Popular Palace calls for 'respect' amid reports Meghan Markle's dad won't attend wedding Photographers flock to Mount Wellington as lake reappears Dozens killed, thousands injured in Gaza amid anger over US embassy opening Superman actress Margot Kidder dies aged 69 Gichuhi's political career facing abrupt end after less than one term with Liberals Cashless welfare card trial causing 'horrible' financial stress, participants say Bishop takes aim at ex-ambassador's 'profoundly ignorant' criticisms A monster black hole has been discovered, and it's growing very fast audio photos Who is father-of-the-Royal-bride Thomas Markle?

Trinity Grammar headmaster steps down after haircut saga. Friendly embrace or deliberate insult? Trump's embassy opening does both No, women don't need to 'take a break' from the pill Why that selfie with a wild animal is a bad idea Why a universal basic income wouldn't stop people working Ugly Geelong-Collingwood encounter exhibit A in the case against modern AFL Oversight of self-managed super funds to be reduced in budget shock.

Media Video Audio Photos. Connect Upload Contact Us. Change to mobile view.