7 reasons why you should not invest in bitcoins, cryptocurrencies

5 stars based on

31 reviews

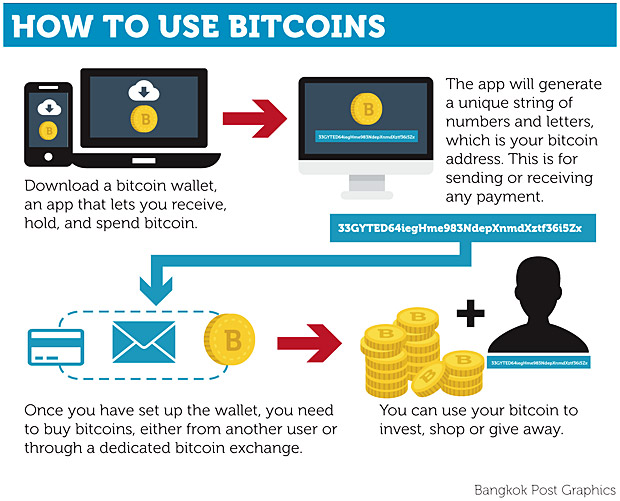

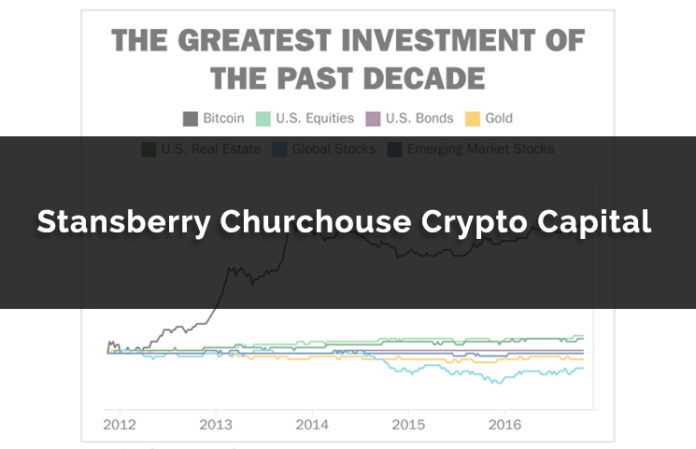

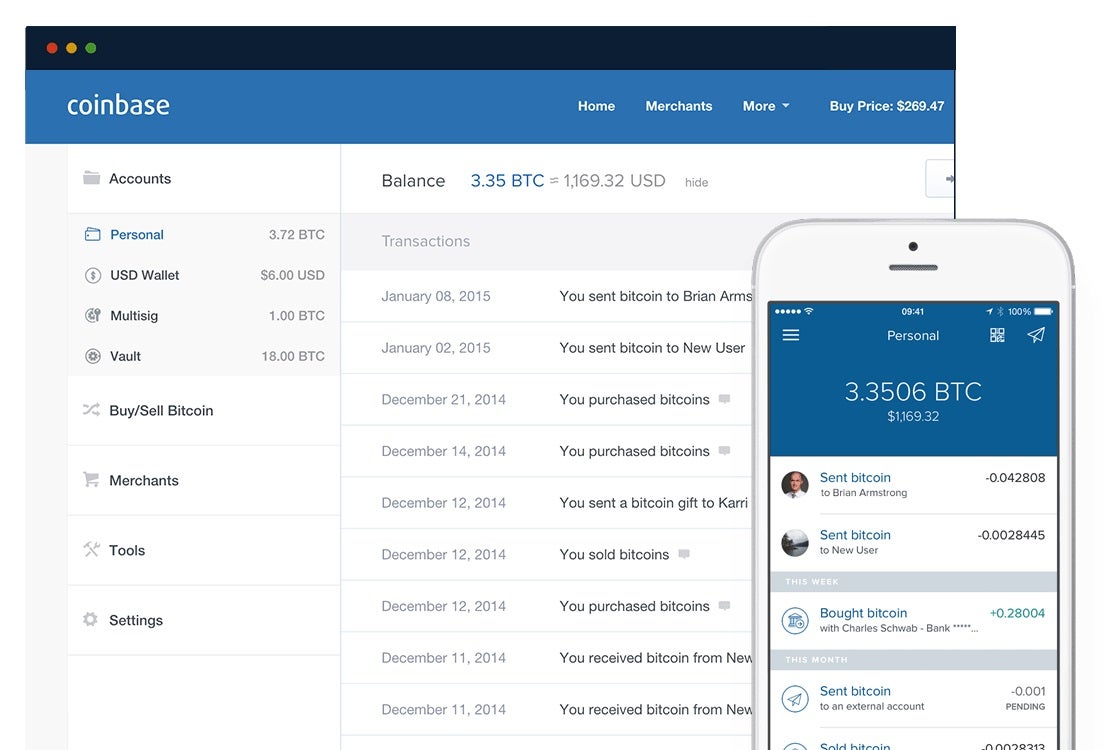

As a disciple and fervent supporter of modern financial innovation, I find it quite fascinating to debate on the crypto-currency phenomenon. However, mixed feelings have been elicited with enthusiasts and skeptics arguing for and against the debate. For starters, bitcoin is the fastest-growing digital asset in the world since last year. Commonly known as a crypto-currency, bitcoin intends to disrupt the traditional finance model as it allows people to bypass traditional banking system and traditional payment methods for goods and services — an idea that has evidently caught the imagination of some investors, because its price has surged by more than per cent globally by the close of the year But as bitcoin becomes more accepted, there are fears of an economic bubble gradually forming as speculators continue to make increasing bets on how far it can rise.

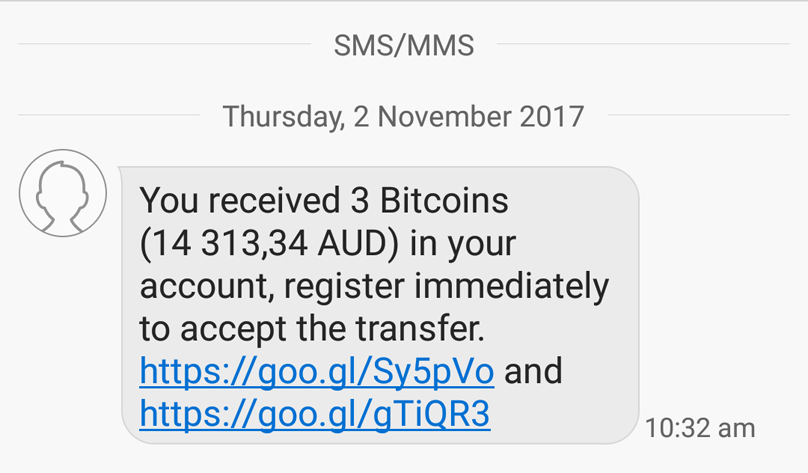

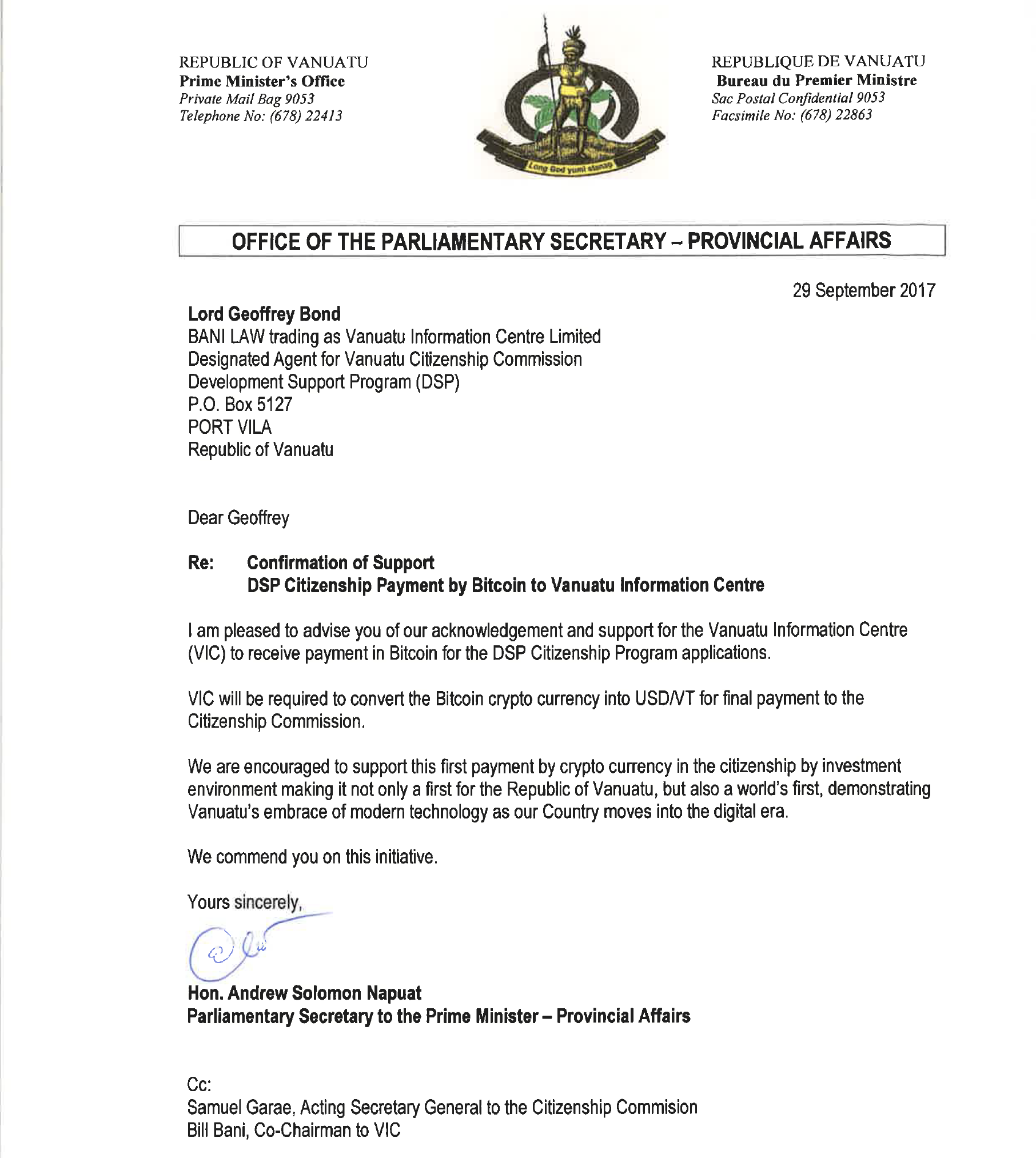

Despite the central bank warning the public to exercise extreme caution investing in bitcoin companies that acceptance letter these digital assets, the regulatory environment remains unregulated to a great extent unlike South Korea and China where regulations have since been introduced.

The currency has no intrinsic investing in bitcoin companies that acceptance letter to those who hold it beyond that ascribed to it by a community of owners. But the bigger bitcoin continues to grow, the more institutions such as the Capital Markets Authority, Nairobi Securities Exchange and the Central Bank of Kenya are likely to get involved.

Bitcoin enthusiasts argue its price will rise further, viewing volatility risk as an indicator to even higher valuations. They added that it can be used to buy anything, including a car, a house or coffee and pretty much anything that can be bought using real money. Citibank warns over risk of Kenya bitcoins. Most bubbles historically have been driven by sentiment and stories.

If you look at the technology that crypto is built on, block chain, this technology could change industries like, banking, cyber security, voting, insurance, retail, and may end up impacting all aspects of our life.

Whether bitcoin is a fad or a sound investment remains a mutually exclusive concept: The problem with predictions is that it gives us the illusion of control over our lives. But clearly, we can neither understand nor determine the future. It could revolutionise the way we keep track of all sorts of things, including paper assets and contracts. As to what side is right or wrong on this matter, only time will tell.

If anything, our financial system could become better because of the competition investing in bitcoin companies that acceptance letter costs could drop. As bitcoin becomes more accepted, there are fears of an economic bubble gradually investing in bitcoin companies that acceptance letter as speculators continue to make increasing bets on how far it can rise.

Using a bitcoin ATM. Should they realise the emperor has no clothes all together, there could be a rude awakening.