Bitcoin Developer Jimmy Song Now a Venture Partner at Blockchain Capital

4 stars based on

50 reviews

Olaf was also the first employee at Coinbase, and he was part of our First Employee series, which you can check out on the YC blog. Alright, here we go. My name is Aaron Harris. My name is Olaf Carlson-Wee. Far before Polychain Capital, I found out about Bitcoin in the summer of and became extremely infatuated with this concept of digital assets.

I decided to pen my undergraduate thesis on Bitcoin book blockchain capital year. I think this was probably one of the first academic works on cryptocurrency. After that, I joined Coinbase as the first employee. Coinbase was actually a Y Combinator company and it is now raising money purportedly at over book blockchain capital one billion dollar valuation. I was at Coinbase for three and a half years, and during that time, I was the head of risk.

I was also paid exclusively in Bitcoin. There were times when that was a good decision and times when that was a bad decision, but I think net, it book blockchain capital right. And I left last summer to launch the Polychain fund. So we launched with around book blockchain capital million under management and now we have about million under management.

A somewhat unusual LP base, and we can book blockchain capital into that a little bit. So I book blockchain capital for a hedge fund for a while, so I have a conception of how that looks in my head, the kind of things that you look at, but there are a lot of different kinds of hedge funds.

There are macro hedge funds. There are long short funds. There are activist funds. What does it mean to be a hedge fund focused on the blockchain?

So a lot of those strategies you just stated could all apply to book blockchain capital assets. Some of them are mechanically much more difficult. So for example, short positions in the space are difficult to achieve in a secure way. And I spend most of my time reading research papers about cryptocurrencies. So we are rebalancing the portfolio roughly every 90 days. So the goal is to book blockchain capital things that are good positions for years, but we may rebalance or sell down on those positions over time.

So these protocol specifications or white papers are extremely detailed descriptions of exactly what a protocol will do. But from there, these investments very quickly graduate into liquid markets. And so because these things are liquidly traded on an order book, unlike a venture firm, you really have to balance those positions.

So because of that, I knew we needed to manage liquidity and I knew we needed to have really good risk management around our positions because we have month to month volatility, unlike a private equity or venture fund which can just sit on positions forever. But I wanted to take this long term investing approach that a venture fund would where a lot of your success is defined by very, very big book blockchain capital and positions that rise substantially in value.

So we invest in things at a really early stage. We form really good relationships with entrepreneurs. So this could be a new application of existing technology. This could be just a kind of new game theoretic model that no one had ever designed before that allows for a novel incentive system or incentive structure, new consensus systems, just anything in this category of enabling new behaviors.

We really like things that are written from the ground up. So Ethereum was not a fork of Bitcoin. Ethereum was written book blockchain capital the ground up. Tezos, whose crowd sale actually ends today, is also written from the ground up. It is not a fork of Ethereum even though it has a Turing complete scripting language like Ethereum.

We do require all our investments to get security audits from outside third parties. But even that, these are often experimental technologies and they may be broken in unforeseen ways. There are what I would call unknown unknowns here. That said, I think that I have a long history of, like at Coinbase, I did probably about interviews. I book blockchain capital really feel comfortable betting on people if they have book blockchain capital great book blockchain capital.

The things that you invest in that do best actually change the world and create the conditions for which they will be successful. How do you evaluate that set book blockchain capital things or how do you think about that set of things? Filecoin is basically decentralized server-client architecture.

What that means is that you can have a totally decentralized architecture where you have redundant book blockchain capital from many nodes across the network, and you pay Filecoin in order to submit requests to those nodes.

Right now, you see a lot of distributed services, say OpenBazaar. OpenBazaar is a peer-to-peer marketplace, sort of like a peer-to-peer eBay. Well, OpenBazaar, right now as a user, you actually have to download an application, like a DMG, to your computer and run it locally and basically run a node in the network. This is not book blockchain capital great user experience. With the IPFS network in place and Filecoin, which basically adds high uptime and fast bandwidth and resiliency to the IPFS network because it has this incentive layer, IPFS is mostly hobbyists right now before that Filecoin incentive layer gets added.

There will be other things. Because the eBay experience is actually pretty solid for buyers and sellers. I buy stuff on eBay. So these are the types of things. He really struggles to answer the question. I know cool things are going to happen. But if you own a piece of the right amino acids, essentially, those are book blockchain capital to create something. Something is going to happen when you have enough creative energy focused on a small enough book blockchain capital area that we will see.

And then, book blockchain capital are things that people are essentially getting wrong or not covering that are hurting people from understanding the creative power that they might be able to have?

And I really do think this idea that in the mainstream kind of cultural consciousness, cryptocurrencies I think mostly are perceived as a get rich quick scheme.

However, I do think the mainstream media mostly views these as financial markets that are novel rather than novel technologies, if book blockchain capital makes sense.

I think that these technologies are complicated, so I think a lot of people were reeling to understand Bitcoin and just the premise of a blockchain, book blockchain capital right when they thought they maybe understood it, all of a sudden, everyone is talking about Ethereum. And something like Tezos can actually build pools of capital and incentivize developers to build on the protocol and then sort of dilute every holder of the Tezos tokens in order to reward those developers.

And so now you have a protocol that incentivizes development of itself. And this is all on a native protocol layer. But a lot of these things are going to be, again, another order of magnitude harder to wrap your head around, like things like DAOs, which I actually think are going to grow a lot over the next year or two.

I think the kind of technology is always going to be book blockchain capital a step ahead of the cultural understanding of the technology. So I think that the disagreement that I would have is that a lot of people view tokens from a pure technology perspective.

So why would we create a new token? You could use Bitcoin for a lot of these book blockchain capital services, or rather Ether for a lot of these different services. However, when you create a native token, you create a different set of incentives. Tokens in this sense are really more of an incentive structuring or like a kind of game theory hack to get really powerful network effects around a specific application.

And so I want my early backers or investors to have upside relative to my specific application, not just to the strength of the US dollar. And I think that value capture and that adding this kind of capitalist, for profit mentality to open source will absolutely accelerate development in this ecosystem.

Everyone, or most people in the United States, have a job, and they mostly do that for they money. No matter how much someone is passionate about something, if you pulled out all the money from it, it would be very hard for them to continue doing that in most cases. And then what about this question about focused effort versus distributed effort in terms of creativity and what should get built? I have a kind of open market view on this in that if you build something great then a lot book blockchain capital attention and book blockchain capital and users will be pushed to what you book blockchain capital.

I think that VCs and early seed investors have always had book blockchain capital somewhat unique access book blockchain capital these early stage projects through their network or something like that. And I think that in Silicon Valley, we take for granted that smart people with a good idea get funded.

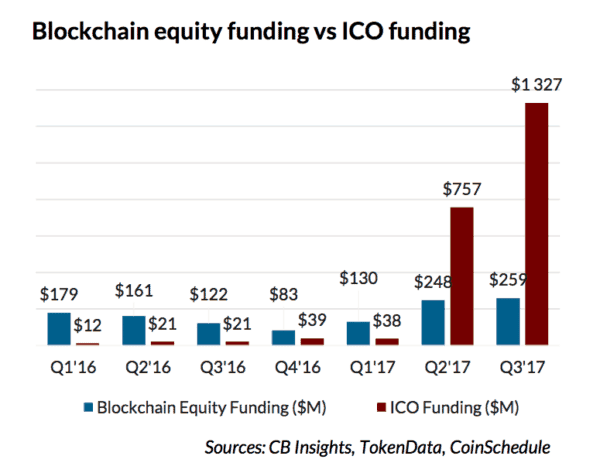

The speed with which this has happened and the amounts of money getting diverted to it are mind boggling. Has the distribution of capital into the ICOs matched your model of innovative technology? How off is it? And so in that sense, I think the market got it right.

And it also got the most money book blockchain capital. Tezos, like the white paper was written in Yes, you can raise money this way, but in a sense, crowd sales were originally a solution to the token distribution problem. If you go back in time before people did crowd sales in mass, there was a project called Counterparty that did a proof of burn. And what this meant was they raised Bitcoin and provably destroyed the Bitcoin. And so I think that a lot of these projects that are structuring crowd sales also in ways that incentivize a kind of first come, first serve, mass rush for the doors, basically that all the excess value between the cap on the crowd sale and the eventual market price goes to traders, or what I would maybe call ticket scalpers, rather than developers or authentic backers or users.

I think this is true, by the way, of Bitcoin and Ethereum, as well, not just crowd sales. With that said, I think a lot of these services, speculation actually is very book blockchain capital to drive those eventual network effects. But it really depends on amassing book blockchain capital crowd of people all at once book blockchain capital order to get off the ground.

So by driving in a lot of early book blockchain capital just through speculation, I book blockchain capital you sort of bootstrap book blockchain capital network effect in a little bit more of a raw way where you have this book blockchain capital speculator base that in the future many of them will become users.

I think you bootstrap network effects with speculators, and then over time, the network becomes authentically valuable in the way that traditional networks like Instagram become valuable, book blockchain capital then you move from 95 percent speculation to five percent speculation over, say, 10 years of something becoming useful.