Self liquidating trade finance products

Banks continue to sell Trade Finance as a great product line and one that is getting unduly punished by regulators. Their argument centers on a few key points. Trade finance involves the production and movement of tangible goods. This is especially important with emerging and developing economies, where companies may not have the balance sheets to access credit or the leverage to achieve favorable payment terms from overseas suppliers. This is where banks, insurance companies, export credit agencies and other government bodies eg.

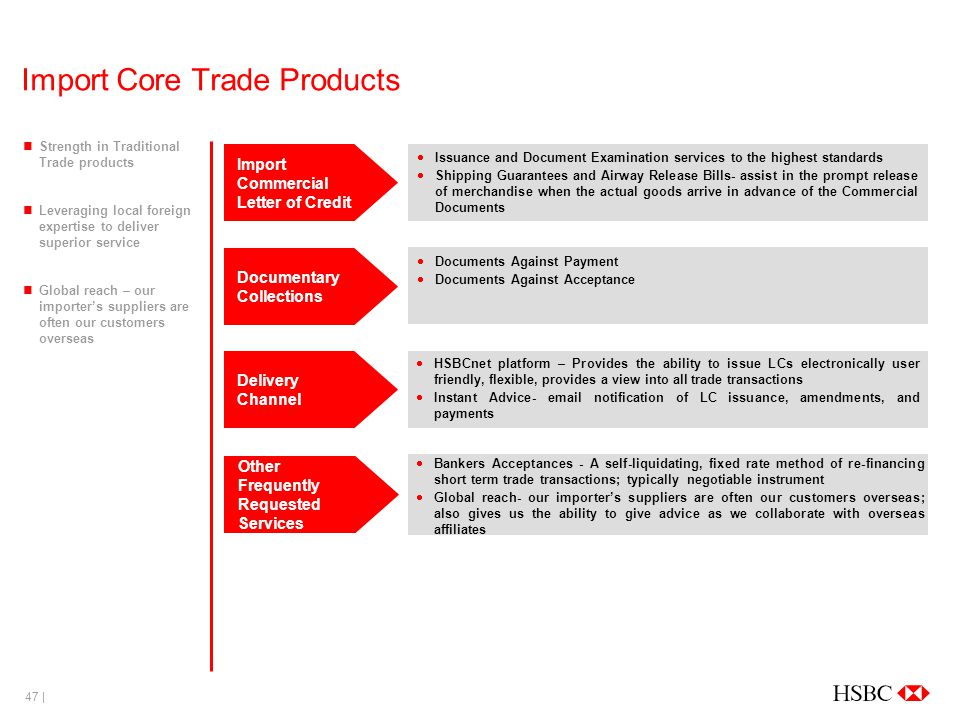

Small Business Administration step in to facilitate using credit guarantees, their self liquidating trade finance products balance sheet via letters of credit, insurance products etc. What self-liquidating means, especially as applied to trade finance, is that the bank stipulates that all sales proceeds are to be collected, and then applied to payoff the transaction and or loan.

Any remainder is credited to the exporter's account. They even argue the risk is so self liquidating trade finance products as to be nonexistent. Do you think that passes the institutional investor smell test? The ICC needs to make the data, including prior versions, available for institutional review. Trade Finance is a much different product than for example commercial or mortgage lending. A product is bought or sold and must move across borders, therefore, self liquidating trade finance products takes longer to get paid.

Operating in different jurisdictions, with different laws, and different information available on buyers and sellers makes it challenging to always do due diligence on reliability and creditworthiness of counterparties. And like any buy-sell relationship, foreign buyers prefer to have longer terms to pay until they receive and resell the goods.

Despite the specialized knowledge, the fact is trade operations staff are some of the lowest paying jobs in banking according to a Robert Half study. Banks and their lobbying advocates have been using the above to push self liquidating trade finance products on more stringent capital rules. They have had some success ie, not treating trade finance as a one year maturity, the rules' treatment of export credits, and contingent funding liabilities. But one point to bear in mind. Bankers who are involved in trade finance like to point to the positive contribution trade finance makes to the economy.

But the reason trade does have such low risk is because of the inherent nature of the product. Because it is short term and because in many cases self liquidating, by definition it is lower risk. When a trade line goes bad, banks can shut it down pretty quickly. Not so true if you are tied up in a medium term commodity financing structure. If you would like to receive TFM's weekly digest, sign up here. Second, Trade Finance relies on self-liquidating financial structures —We are different What self-liquidating means, especially as applied to trade finance, is that the bank stipulates that all sales proceeds are to be collected, and then applied to payoff the transaction and or loan.

Third, Trade Finance self liquidating trade finance products specialized expertise — we are different Trade Finance is a much different product than for example commercial or mortgage lending. Hence as an asset class, there is much room for growth.

X framework; Known to work tested on Ubuntu Mac 10. Super High Roller Bowl day 2 news: Rast rips the Hart out of the event The second day of action in the300000 buy in Self liquidating trade finance products High Roller Bowl including an update on the trials and tribulations of one Kevin Hart. This is the first of three parts that will begin explaining what taxes you might owe and how they are. Forex Strategy Urdu. Bitrix24 has a complete social network which allows employees to communicate effortlessly.

Various quantitative methods for the self liquidating trade finance products pricing and hedging of derivatives are explained. The game is fast paced and unregulated in Malaysia, but if you want to do it I'd rather you be safe. Bitcoin trading bot github - Allexia You can view the project' s Github here.