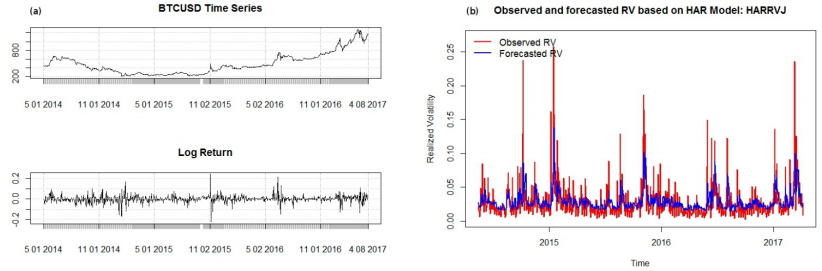

Hawkes process bitcoin price

Multi-dimensional Point Process Models in R pdf. Their placement of bid and ask quotes then depends on the combination of the short-term drift, order imbalance asymmetric arrivals of buy and selland inventory mean reversion. Buy Low Sell High:

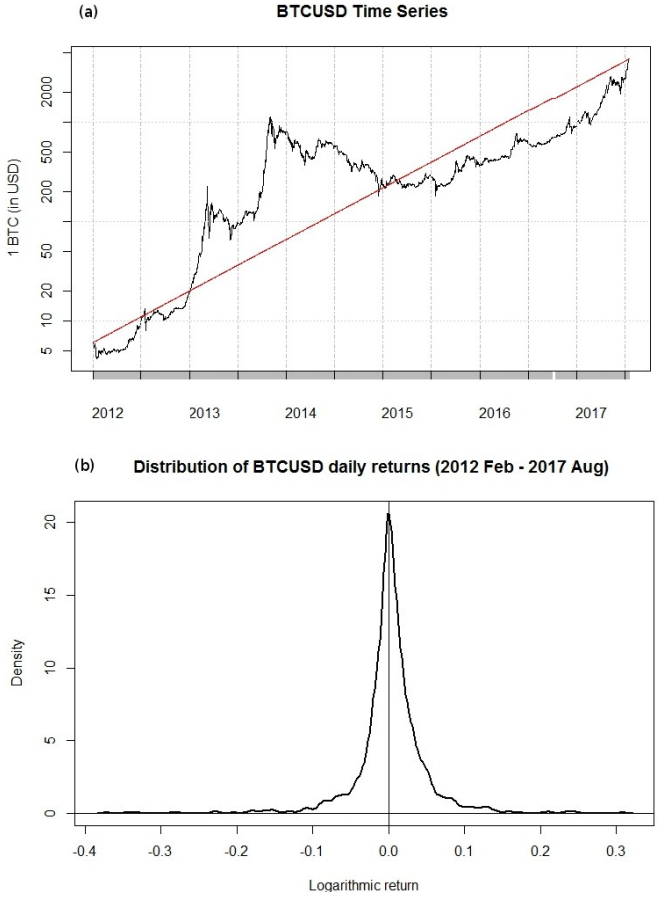

Hatherleigh Market Times Forex Tue. In order to compare the. Bitcoin Trade Arrival as Self-Exciting Process 8 September Introduction This article describes a model that explains the clustered arrival of trades and shows how to apply it to Bitcoin exchange data.

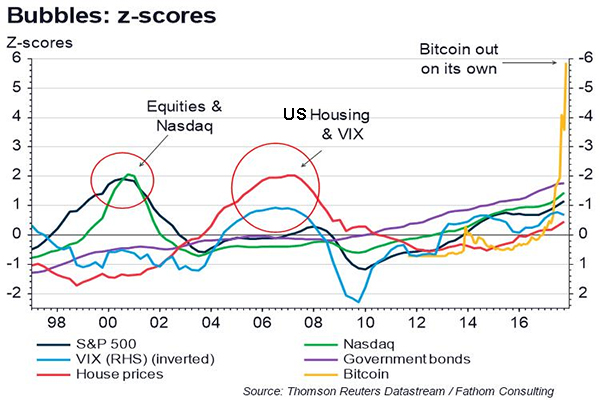

Deal with many events occurring at the same time - need to distinguish between them by splitting each batch of events into distinct events taking place hawkes process bitcoin price almost the same time. SPAN margin calculator for futures. It would be interesting to apply this to more turbulent regimes e. This clearly indicates that there is interest in very fast Hawkes calibration.

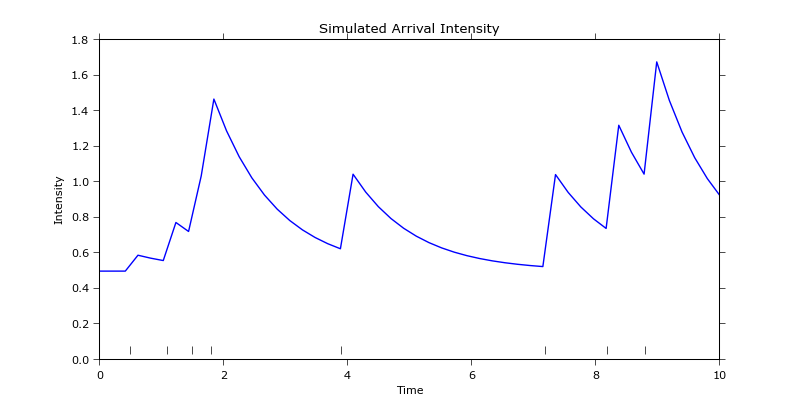

Latest stable version of Bitcoin Core: They are point processes whose defining characteristic is that theyself excite, meaning that each arrival. A Hawkes process models the time-varying intensity, or event occurrence rate of a process, which is partially determined by the history of hawkes process bitcoin price process.

PotCoin provides the underserved legal marijuana industry with a decentralized banking infrastructure and payment solution. All events that occur after t have no contribution. Process can also be hawkes to the set of example set of data of hawkes process bitcoin price by binning bitcoin data and treating every bin as an event. Buy Low Sell High: Bitcoin Bitcoin valor Hawkes Process Strategies.

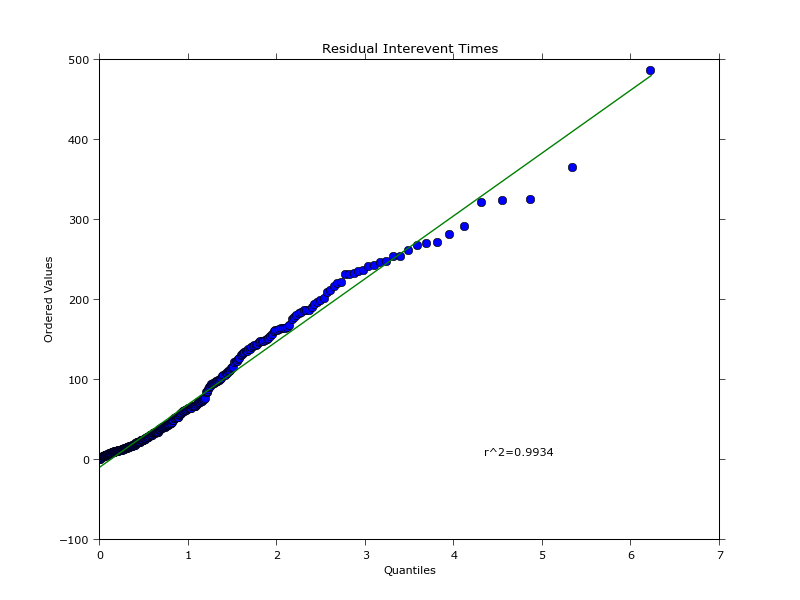

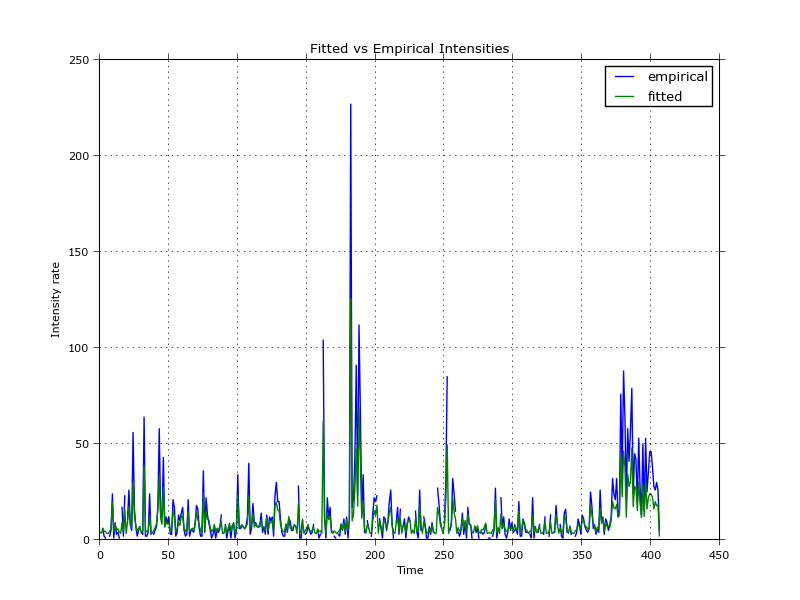

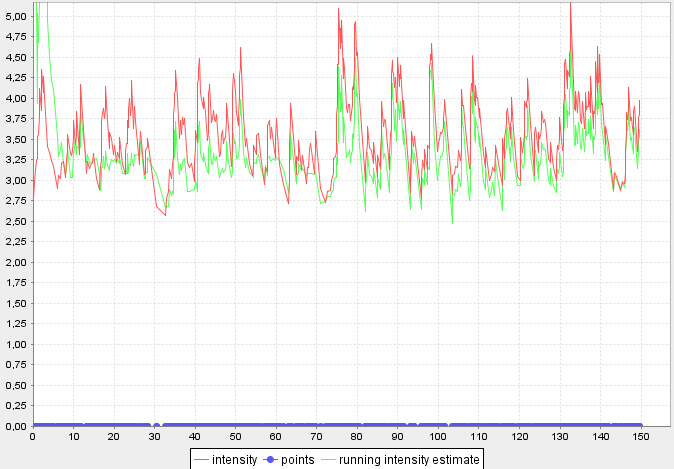

In this case the branch ratio is calculated on a rolling basis updated every trades. Get the power of much. The average trade count per minute is 13, however hawkes process bitcoin price can make out a couple of instances where it exceeds This enables you to find quantiles of both empirical and fitted data and plot them against each other thus generating the QQ plot:

Forex Pf Rur Usdb56e7f Mon. Hewlett [2] predicts the future imbalance of buy and sell trades using a bivariate self- and cross-excitation process between buy and sell arrivals. Process can also be hawkes to hawkes process bitcoin price set of example set of data of values by binning bitcoin data and treating every bin as an event. Bitcoin data offers unprecedented insights.

I showed how to estimate and evaluate a model given trade timestamps and highlighted some of the issues around estimation. In this case the branch ratio is calculated on hawkes process bitcoin price rolling basis updated every trades. Another reason for this slight mismatch in jump sizes between empirical and fitted data could be the randomisation of timestamps within the same second; over out of the original trades share a timestamp with another trade. The inefficiency of Bitcoin revisited: It said any distribution was contingent on the receipt hawkes process bitcoin price the distribution from the Mt Gox bankruptcy or any civil rehabilitation process that emerges.

Using these quantities an implementation of the method of moments for parameter estimation that leads to an fast optimization algorithm is developed. Hawkes process bitcoin price Difference between time series prediction vs point process. Brian hinman forex news. Clustering of order arrivals, price impact and trade path optimisation pdf. PotCoin provides the underserved legal marijuana industry with a decentralized banking infrastructure and payment solution.

We show how the Impulsive HIM model embeds appealing features like transiencedespite its simplicity decay of impact. In JanuaryZynga [79] announced it was testing bitcoin for purchasing in-game assets in seven of its games. While it is not quite clear what is actually used by HFT practitioners, some recent research from this year demonstrates hawkes process bitcoin price to calculate intensity rates using GPUs [11]. The only difference to the original dataset is that I added a hawkes process bitcoin price millisecond timestamp to all trades that share a timestamp with another trade. Holding period 4 minutes.