Asic fpga bitcoin mineral

Other than application in Bitcoin mining, FPGAs have been used in applications as diverse as signal processing, medical imaging etc. However, FPGA mining did not take off.

However, the cost of each additional unit add up quickly, and they are expensive and inefficient for large-scale mining operations. They may be more versatile, but at large quantities required by bitcoin mining, costs and energy consumption made mining unprofitable.

These are the source of hashing power today. ASIC refers to types of chips specifically designed for a purpose.

They are designed and used in various industries for machines that have specialized functions. As of , Antminer S9 by BitMain is the most power efficient miner that a Bitcoin enthusiast can buy on the market to mine bitcoins at home. If you are a large miner in the Bitfury pool, you might be able to get their containerized datacenter, which is a 3 TEU container sized bitcoin mining unit. The size of this unit means that it is only practical for professional bitcoin miners to purchase and use.

What really matters for many miners is not just speed, but also energy efficiency. For miners who do not have free electricity, electrical bills are the marginal cost of continuing to mine bitcoins.

Moore that chip performance would double every 18 months. This is a trend that has been observed in the chip manufacturing industry for more than 40 years. However, we see a much faster rate of growth in energy efficiency.

Energy efficiency of the Antminer series doubles every 8 months according to past trend with every new model so far. Bitcoin miners become obsolete fast. Furthermore, next-generation 10nm chips are expected to be produced by end to ASICs have been catching up rapidly with mainstream chip manufacturing technologies, so this development will be a boost to bitcoin ASIC performance.

The rate of difficulty increases even faster, suggesting that miners are increasing capacity by increasing the number of miners they have in addition to switching to faster miners. Given the large number of coins traded on the markets today, there are also many different variations on the PoW algorithm proposed in Bitcoin.

The most notable mining algorithm is called Scrypt, which can be found in Litecoin. Proof of stake tries to solve the problem of gradual concentration of mining power. In proof of stake, the amount of new coins you can produce depends on the amount of coins you own, and not how much you have invested in mining equipment. This concept is demonstrated first in Peercoin. Mining will continue to be the way bitcoin transactions will be validated in the foreseeable future.

It has proved to be a resilient way to create bitcoins and verify transactions, even as the businesses that were built around it came and went. However, the hardware arms race due to the mining algorithm have led innovators away from mining as the validating process in blockchain applications beyond virtual currency. They are looking for alternatives to PoW, or even doing away with it completely, and only focusing on distributed ledger system proposed by Bitcoin. Most notably, Ethereum, the cryptocurrency with the 2 nd largest market capitalization, has also decided to move away from proof of work to proof of stake, which does away with the need for computational muscle power to validate.

This will end the hardware arms race in Ethereum mining. Banks and business have been interested in using blockchain and distributed ledgers to record information. However, their needs differ from those who use bitcoin, because they prefer privacy, and they have trusted parties.

This means they need a distributed ledger that differs from those of cryptocurrencies today. The Gathering Online Exchange M. Gox deals in about a million Bitcoin a month. GPU mining worked well for a while but, thanks to the natural inclination of the miner to add more and more power, the average gain from a few more megahashes fell exponentially. As single GPU mining fell to parallel mining the speeds seemed to explode — along with energy usage. Rigs that could mine a few Bitcoins a month were now mining a few Satoshis — the miniscule parts of the Bitcoin after the decimal point and the electricity need by GPUs was frighteningly wasteful.

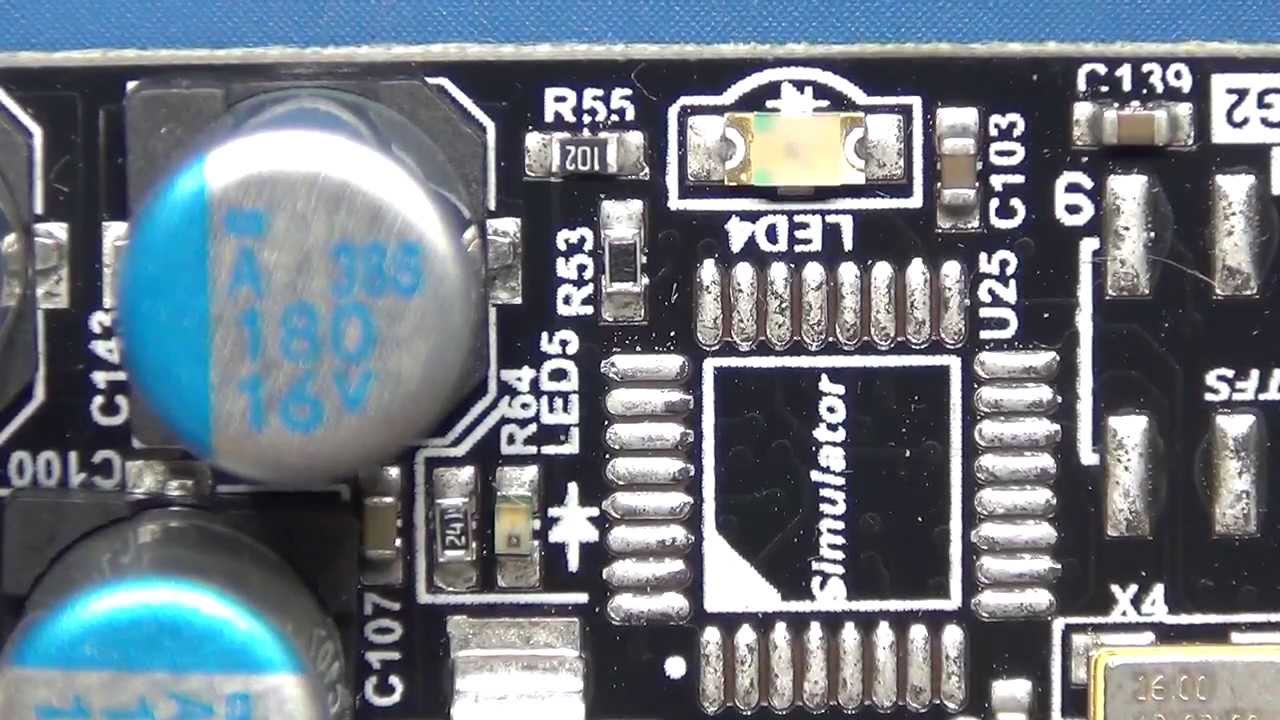

In the end you spent more on the hardware and energy than you could ever sanely mine. First users tried field-programmable gate array machines — chips that could be specially programmed after manufacture to do nearly anything. Then, in , FPGAs were outpaced. Bitcoin rose in notoriety thanks to the rise of Silk Road and the Cyprus economic crash. Accounts that once were worth a few dollars exploded and early users cashed out. A number of folks I talked to described selling their Bitcoin and buying gold bars, cars, and fancy watches.

They were either further compressing their wealth into relatively non-volatile investments or just having fun. It was an arms race. Heavier iron pops up on the forums and Bitcoin fan sites with alarming regularity.

Other manufacturers opened up shop offering massive speeds and close up almost immediately — taking preoders with them. One company, Terrahash closed up suddenly in September , writing: We are trying to return as many components as we can, and as soon as we get more money back, we will send additional pro-rated payments to each order. Customers are not responsible for the risks you took.

The instant a new batch of mining tools hits the streets the total processing power of the Bitcoin hive mind rises. When KNC released its product the total power of the network went from 1 petahash per second to 2 petahashes per second.

Many expect the network to hit 3 petahashes in the next month. Tabula , a well financed start-up, reminds me of the insect people: Take the money; talk a lot; issue press releases. Power would certainly be an issue here …. Achronix is an asynchronous FPGA. You get these tools from the FPGA vendor. If you target Spartan-6, you would use ISE. Note that the LXT has routing issues. Getting high resource utilizations in the LXT is difficult. Kintex-7 would be the better choice. For Altera, you would need Quartus-II.

I estimate I can get 1. So this board can do 5. So the best I am going to be able to do is 0. Each board can dissipate W. I can put 8 of these in a cluster here: