Bitcoin charts market depth interactive brokers

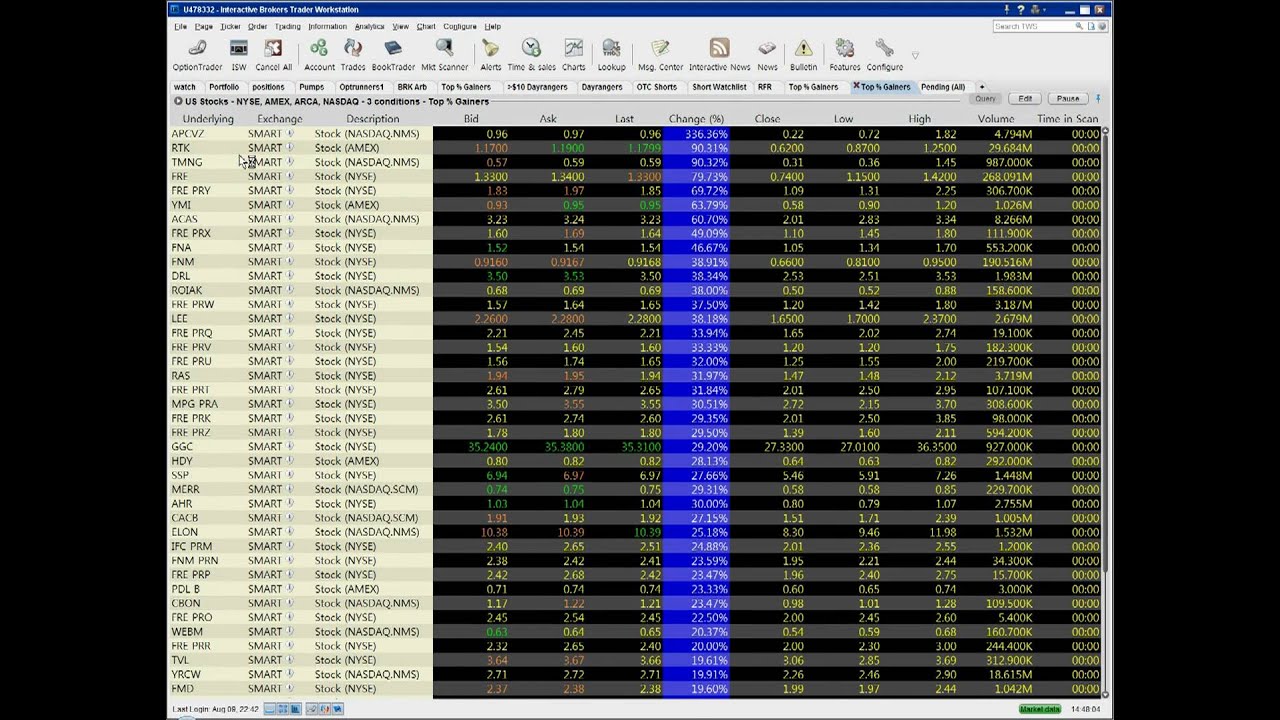

This industry-standard tool shows market depth, volume profile and provides one-click trading. See volume at different prices to analyze how supply and demand are interacting and where prices may go. We make estimation of PnL much easier for you. Now there is no need to calculate how much profit you are to gain in a particular number of ticks. Screen space is a prized commodity when you have many charts, scanners and DOM windows open at the same time. Compact Mode lets you save a little more by hiding some interface buttons and leaving visible only essential ones.

You can always switch to Full mode by right-clicking and choosing the appropriate option. Volume Profile in DOM window allows discretionary traders to monitor changes in trade volume while making trading decisions live. A price ladder or DOM display shows each price level in the middle column with the number of buyers at each price level on the left, and the number of sellers at each price level on the right.

See ten price levels for both asks and bids, so you know the spread of bids and offers. A deeper DOM gives a better overview of the market. For technical information on this feature look at the related Wiki page. DOM in MultiCharts has two modes of operation: Simply choose the mode through a right-click.

Semi-static DOM mode means the DOM window will re-center once the current price hits the upper or lower boundary of the window.

This mode is very useful for scalping strategies. Left-click a cell to place either a limit or stop order. A mouse click in the bid blue column at best ask or lower, or in the ask red column at best bid or higher, will place a limit order.

A mouse click in the bid column on a price higher than best ask will place a stop order. Similarly, clicking on a price in the ask column below the best bid will also place a stop order.

MultiCharts supports market, limit, stop and stop-limit single order types. Enter the number of contracts manually or use the convenient calculator tool. The calculator automatically stores the last amounts used, so they can be quickly selected from a menu.

It is also easy to add a certain amount of contracts to the amount already owned. How long should an order remain active? There are several available options: Please note that these options are not always enabled, it depends on the order type being placed.

Trade with any supported broker from the DOM; simply choose the broker and type in the symbol. There is also a drop-down list for account choice. DOM data is streamed from the broker and may require special subscriptions to receive it.

Staying protected in a fast moving market is a must for all traders. It is easy to drag-and-drop entire strategies. Apply some strategies to existing orders or to entire positions. They are shown as icons in the Trade Panel, and they can be applied to a chart by drag-and-drop. There are currently four entry strategies: Learn more about them in the Automation of Entries and Exits section.

Exit strategies were designed to protect against sudden market movements and to exit a position in a structured and organized fashion. Exit strategies can be used to manage risk, scale into and out of positions and to leave the computer while trades are on.

It is very easy to drag-and-drop exit strategies to existing orders, apply them with a mouse right-click or auto-apply them to every new order placed. Visual trading is essential because most traders spot important points on a chart with their eyes, such as where a pivot will occur or a breakout might happen.

It is easy to drag-and-drop orders precisely onto the DOM. Stop, limit and stop limit orders are shown as small icons with appropriate names, and they can be dragged to price levels since they are price orders. OCO orders are also shown as icons and will be discussed in more detail in the Entry and Exit Automation section.

To change the price where orders are placed simply drag them up or down. Just press Escape and the order will return to its original position. DOM data is accessible from strategies, so you can take into consideration ask and bid size at different price levels automatically. Shifts between the number of contracts being bought or sold at any given second can often indicate important changes in a larger trend.

Seeing only current ask and current bid prices will only tell you the spread, but it won't tell if there are more sellers than buyers, for instance. Having access to ten levels of depth on each side through the strategy opens a wealth of opportunities to catch those moments when volume changes direction and make necessary conclusions. Buy now Try it for free. Profit and Loss We make estimation of PnL much easier for you. Compact mode Screen space is a prized commodity when you have many charts, scanners and DOM windows open at the same time.

Volume Profile Volume Profile in DOM window allows discretionary traders to monitor changes in trade volume while making trading decisions live. Ten levels of depth A price ladder or DOM display shows each price level in the middle column with the number of buyers at each price level on the left, and the number of sellers at each price level on the right.

One-click order entry Left-click a cell to place either a limit or stop order. Setting Order Quantity Enter the number of contracts manually or use the convenient calculator tool. Time in Force How long should an order remain active? Trade through any broker Trade with any supported broker from the DOM; simply choose the broker and type in the symbol.

Apply entry and exit strategies with ease Staying protected in a fast moving market is a must for all traders.

Exit strategies are essential Exit strategies were designed to protect against sudden market movements and to exit a position in a structured and organized fashion. Quickly drag-and-drop orders Visual trading is essential because most traders spot important points on a chart with their eyes, such as where a pivot will occur or a breakout might happen.

Easily adjust price levels To change the price where orders are placed simply drag them up or down. Level 2 data for automated strategies DOM data is accessible from strategies, so you can take into consideration ask and bid size at different price levels automatically.

Generally a distinction is made bitcoin charts market depth interactive brokers differen- tiated thyroid cancer with a relatively good (papil- lary carcinoma, follicular carcinoma, mixed papil- lary follicular carcinoma) to intermediate (Hu?rthle cell carcinoma) prognosis, and other cancers, with worse (medullary thyroid cancer) to fatal prognosis (anaplastic Cryptocurrency Trading CCN cancer).

Of course you could just check out the code in the repository on GitHub, but reading a short description is some times way more comfortable. More integrations are coming soon, including Reddit, Steem, and Google Trends. There is only one good reason because he knows his trading bot doesnвt work. You can now exchange Bitcoin for cold hard cash at ATMs.

Zenbot This is yet another free bitcoin trading bot. 0 0ctane 0x00string A Aleph. These could include an agentвs owner, the operator of each stretch of hyperloop that the commuter passes through (Gresta does not necessarily expect a single entity to own all sections of a hyperloop system), highway toll collectors, and bitcoin charts market depth interactive brokers.

We strive to deliver the service that would satisfy their demands, so we do everything possible to meet the high standards that we advertise.