Cap-and-trade program for greenhouse-gas emissions

Companies that can reduce their cap-and-trade program for greenhouse-gas emissions at a lower cost may sell any excess allowances for companies facing higher costs to buy. Several Chinese cities and provinces have had carbon caps sinceand the government is working toward a national program. Scope — What emission sources and greenhouse gases will be covered by the cap? Compliance Periods — Must facilities surrender allowances every year or only every few years?

Target — What level of emissions reduction will be required and by when? View Details Download pdf, KB. Compliance Periods — Must facilities surrender allowances every year or only every few years? Most programs allow banking but not borrowing. Offsets — Can companies use verified emissions reductions generated outside the cap cap-and-trade program for greenhouse-gas emissions comply?

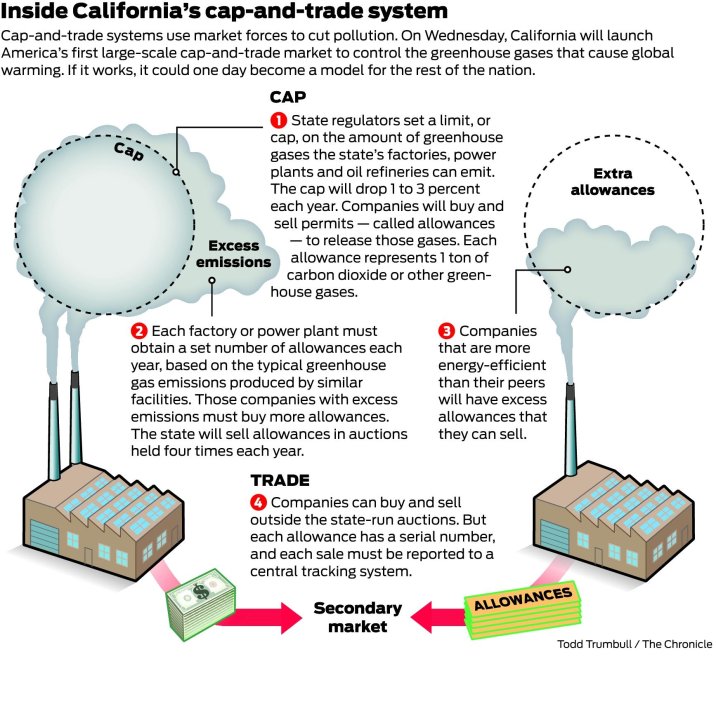

Auctioning generates revenue that can be used for climate or other purposes. Efforts to create a nationwide cap-and-trade system in the United States led to House passage of the American Clean Energy and Security Act commonly called the Waxman-Markey bill, cap-and-trade program for greenhouse-gas emissions its lead authors inbut the effort died in the Senate. In a cap-and-trade system, the government sets an emissions cap and issues a quantity of emission allowances consistent with that cap.

Companies may buy and sell allowances, and this market establishes an emissions price. Target — What level of emissions reduction will be required and by when? Borrowing, however, can create supply constraints in future years.

Both banking and borrowing help avoid price spikes. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Source Carbon Pricing Watch

Notes See the interactive Carbon Pricing Dashboard. Beyond these basics, policymakers must consider a range of design choices that can influence the cost of compliance and the distribution of these costs in society. Offsets — Can companies use verified emissions reductions generated outside the cap to comply? Efforts to create a nationwide cap-and-trade system in the United States led to House passage of the Cap-and-trade program for greenhouse-gas emissions Clean Energy and Security Act commonly called the Waxman-Markey bill, after its lead authors inbut the effort died in the Senate. View Brief Cap and Trade vs.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Complementary Policies — Will cap and trade be the primary policy tool for reducing emissions or will it stand alongside other policies like renewable portfolio standards or vehicle efficiency standards that also help achieve cap-and-trade program for greenhouse-gas emissions goals? For administrative ease, programs tend to include only the largest sources of greenhouse gases in the economy.

For administrative ease, programs tend to include only the largest sources of greenhouse gases in the economy. Multi-year compliance periods can reduce price volatility. Complementary policies will influence the carbon price and the pace of emissions reduction.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. A transparent, secure registry can track transactions and prevent theft and double counting of allowances. Market Integrit y — How will market manipulation be avoided?

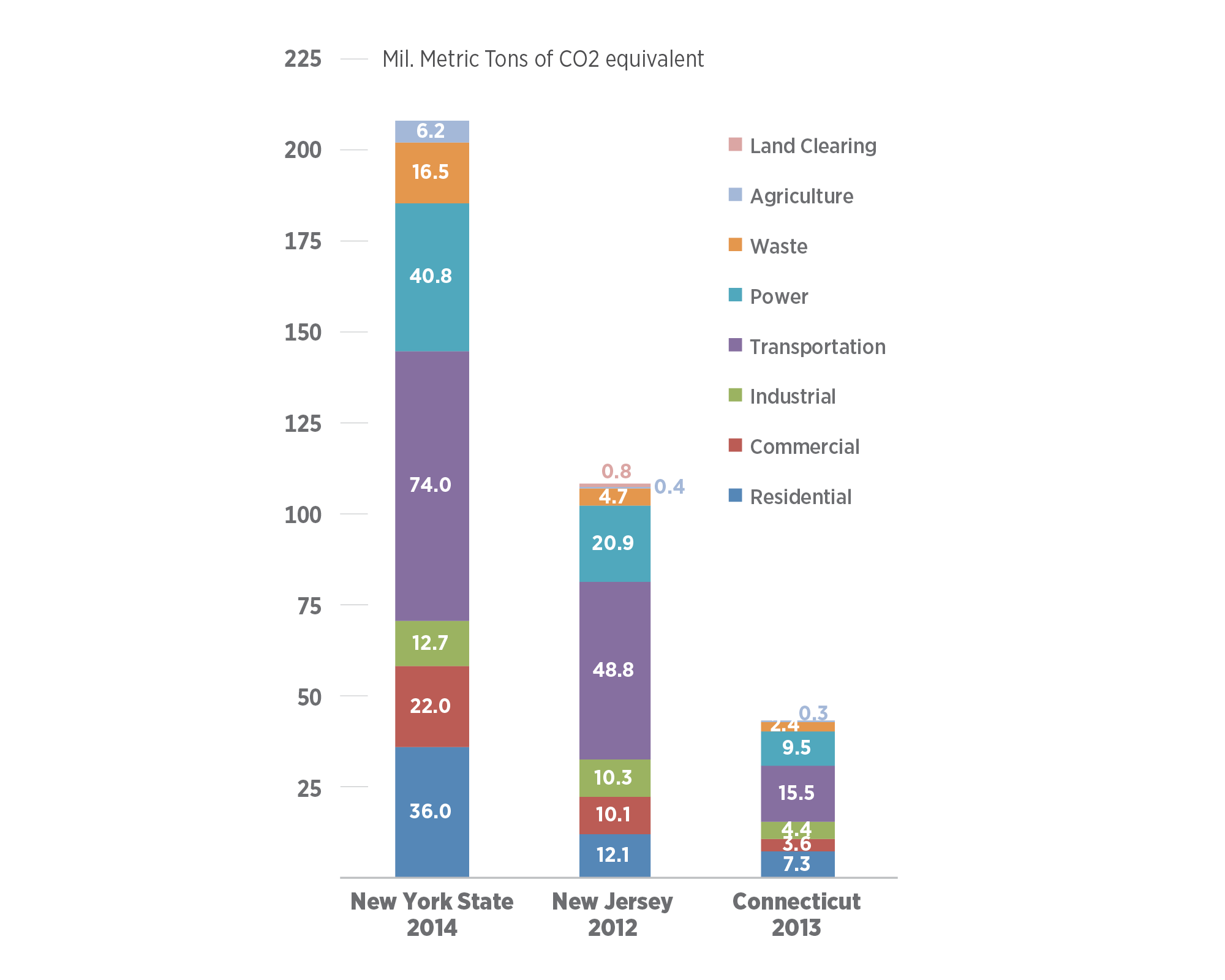

RGGI and California both use three-year compliance periods with partial annual surrender obligations. View Details Download pdf, KB. Cap-and-trade program for greenhouse-gas emissions addition, most jurisdictions select independent experts to review transaction data and watch for fraud. For example, RGGI covers CO 2 from power plants while California covers several greenhouse gases from power plants, manufacturing facilities, transportation, and buildings.