Why Is Bitcoin's Value So Volatile?

5 stars based on

71 reviews

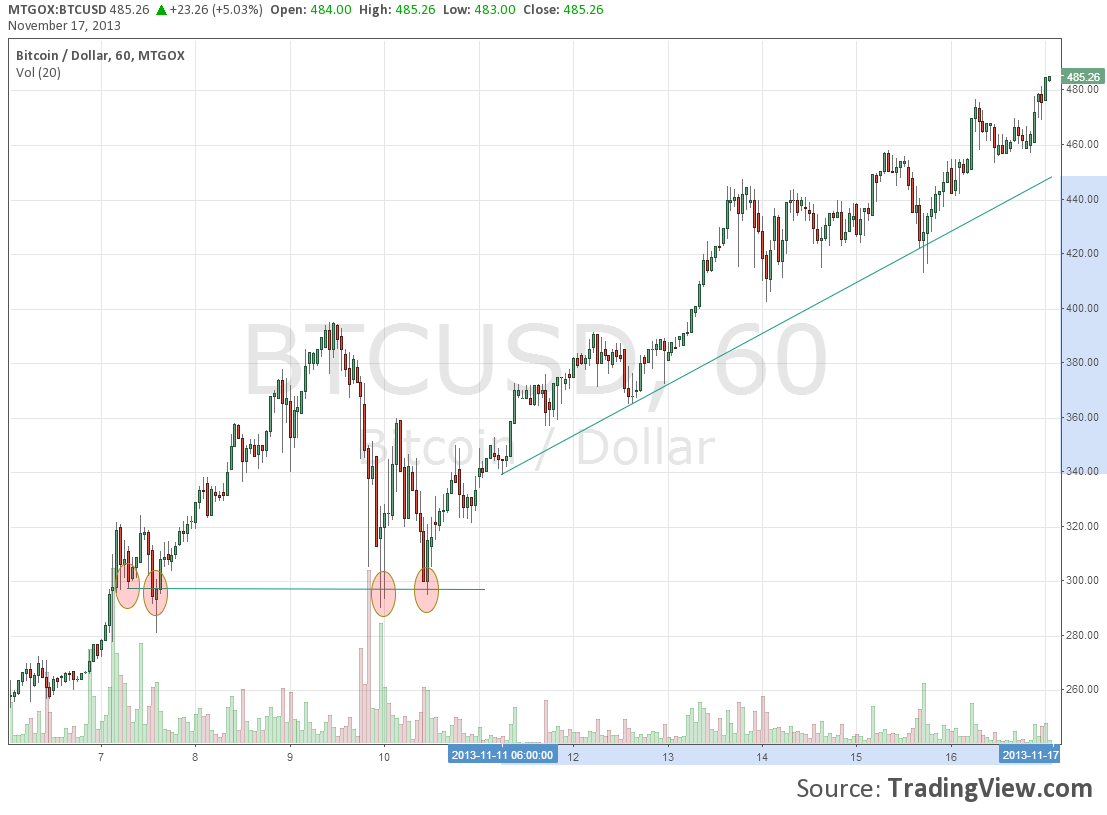

Although the value of Bitcoin has receded slightly since reaching this peak, the price of the cryptocurrency has still increased stratospherically since why bitcoin price increase and decrease turn of the year. It is this sort of price increase which has polarized opinions on the future of the digital currency, and made any Bitcoin price prediction for fraught with danger.

There is are those that are very much in the positive camp with regard to the future of Bitcoin, and those who believe that it will inevitably crash and burn in the near future. One possible issue that could impact on any Bitcoin price prediction for is government legislation. And the picture in Europe why bitcoin price increase and decrease provide a clue to the future legislative direction in the US.

European governments are currently pushing for regulation of Bitcoin and the general altcoin sectorfollowing the unbelievable escalation in the price of Bitcoin. In particular, the fact that Bitcoin is strongly linked with nefarious activity conducted by money launderers, drug traffickers and terrorists is of concern.

French Finance Minister Bruno Le Maire has recently spoken on the subject, with the prominent individual indicating that the powerful G20 group will discuss the topic in the foreseeable future. The Italian government has indicated its similar willingness to open discussions on regulation, while there have been moves by the European Commission to deliver new legislation that would impact on the cryptocurrency.

This sort of scepticism from some of the most influential countries in the world is obviously bearish for Bitcoin. And this European perspective follows hot on the heels of similar activity in countries such why bitcoin price increase and decrease India and China.

One of the big plus points for Bitcoin going forward is the entry of the cryptocurrency into the futures marketplace. This will undoubtedly have a massive impact on the growth potential of the digital payment system, and could lead to a massive upside, even given the massive inflation in value that the currency has already enjoyed. And other analysts have also offered hope for Bitcoin investors. One of the biggest Bitcoin bulls, Ronnie Moas, believes that the meteoric much of the cryptocurrency will continue into a six-figure value in the coming years.

The opinion of Moas is based on the limited supply of Bitcoin, meaning that the cryptocurrency can potentially escalate massively in value in a short period of time simply due to supply and demand issues.

Yet several major voices within the investment community have also poured scorn on the potential of Bitcoin, suggesting that the cryptocurrency is in a sizeable and dangerous bubble. While the credibility of these opinions should not be discounted, it should also be noted that the cryptocurrency can it be considered a threat to some of these established individuals.

Ultimately, Bitcoin price prediction for is extremely difficult. Any entity that increases nearly fold in value in less than 12 months can reasonably be described as being in a bubble.

And Bitcoin could encounter several problems in the near future, with legislative and technological issues both particularly threatening. However, the arguments made by Moas, and the welcoming of Bitcoin into the mainstream investment fold, bode well for what has undoubtedly been one of the most dramatic investments stories of this or any other year. With the recent huge growth in value, investors are currently speculating about a bitcoin price prediction for With how much bitcoin valuation has fluctuated recently, investors are understandably concerned about whether this cryptocurrency is a reliable and why bitcoin price increase and decrease investment opportunity.

While certainly more volatile than many traditional investments, the huge boom in growth and ease of access is certainly appealing to both the experienced investor and optimistic first-time buyers alike. Coming up with a bitcoin price prediction for is difficult, but many experts are bullish when it comes to estimates of continued growth — at least for now.

Perhaps the most important driving factor behind the sudden boom in value is the fear of missing out among first-time investors. This sudden surge of new investment saw the price continue to climb, and currently, it shows no sign of slowing down.

Because bitcoin prices are not based on earnings as more traditional investments are, any bitcoin price prediction for is speculative and volatile. Despite these issues, bitcoin analysts are looking ahead to what we can expect for the coming year. With more and more people looking why bitcoin price increase and decrease get involved with bitcoin investing, and a limited amount of bitcoins available, the price why bitcoin price increase and decrease bitcoin will likely continue to rise.

However, due to how volatile the market is and without a real measure to guide the valuation of why bitcoin price increase and decrease cryptocurrency, the bitcoin price prediction for is likely to be continually revised as new information comes to light. As a payment system that has quickly grown to a large presence in the retail market, the added ability to support bitcoin transactions has why bitcoin price increase and decrease the practical application of the cryptocurrency a little more apparent to the common person.

Additionally, the launch of bitcoin futures from CME group further legitimizes the currency as a worthwhile investment opportunity. Analyst Ronnie Moas of Standpoint Research thinks that the growth will continue: It makes investing really, really why bitcoin price increase and decrease, but difficult.

Massive increase Although the value of Bitcoin has receded slightly since reaching this peak, the price of the cryptocurrency has still increased stratospherically since the turn of the year. Government push European governments are currently pushing for regulation of Bitcoin and the general altcoin sectorfollowing the unbelievable escalation in the price of Bitcoin. Futures promises One of the big plus points for Bitcoin going forward is the entry of the cryptocurrency into the futures marketplace.

Viability challenged Yet several major voices within the investment community have also poured scorn on the potential of Bitcoin, suggesting that the cryptocurrency is in a sizeable and dangerous bubble. The Recent Bitcoin Boom With how much bitcoin valuation has why bitcoin price increase and decrease recently, investors are understandably concerned about whether this cryptocurrency is a reliable and safe investment opportunity.

Bitcoin Price Prediction for Are You Allocating Your Cash? Search News On ValueWalk.