China’s Top Trading Partners

4 stars based on

45 reviews

To date, the project has been long on rhetoric and short on implementation, with related economic activity showing little sign of a step change. That will change in the coming years, but The Economist Intelligence Unit still believes that several implementation obstacles mean that the project is likely to fall short of its grand ambitions. Chinese state media have invoked poetic parallels between the BRI and the ancient Silk Road, when the Ming dynasty was at the centre of world trade and commerce.

Despite high-level Chinese support for the BRI, the economic impact of the project has been muted to date. China's exports to BRI countries have performed better than imports. The BRI countries' share of the value of Chinese exports stood at They did not grow strongly over that period—by only 1.

The slippage in the proportion of China's imports from BRI countries reflects softer Chinese demand for commodities and lower global prices for such items. Exports from BRI countries, which are mainly developing economies, are dominated by natural resources, but growth in Chinese domestic investment is slowing steadily. For Chinese exports, the rising share heading to the BRI region may confirm suspicions that the initiative is designed to help to export China's industrial overcapacity.

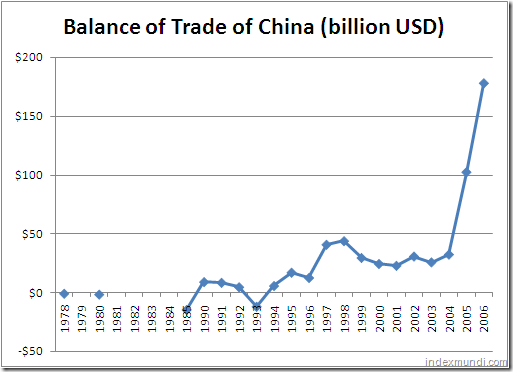

Rising demand in fast-growing developing economies clearly presents opportunities for Chinese metals, building materials and construction equipment firms, particularly in the light of weaker domestic activity in such sectors. Chinese firms engaged in BRI projects will also lean heavily on local suppliers. As such, there is a risk that the already-large goods trade surplus China maintains with the BRI region could rise significantly.

A failure to lower the surplus could eventually compromise the viability of the BRI, as it will stoke political and economic concerns.

Promises of Chinese investment may help to offset concerns about the trade deficit. On this front, there has been a more telling step change since the BRI was launched in Nevertheless, there is also less here than there appears on the face of it. That investment is unlikely to be related to the core infrastructure-development purpose of the BRI, and will have more to do with the attractions of the Singaporean business environment.

We estimate that these flows amounted to There have been much stronger rises in Chinese investment in developed markets in North America and Europe over the same period, with Chinese firms acquiring brands and technology in a bid to raise their competitiveness and invest in perceived safe assets, notably property.

Caution about investment in the BRI region is understandable. Operating environments in many of the countries are challenging.

Chinese banks are already facing a rise in non-performing loans tied to their domestic lending; they may not want to risk a further deterioration in their balance sheets by lending to firms investing in the BRI region. Similar concerns pertain to loans to BRI country governments with high-risk sovereign profiles. The receptiveness of host countries to Chinese ODI may have also been a factor in constraining investment.

China-backed overseas infrastructure projects have proved politically controversial in several countries, especially if they rely largely on Chinese subcontractors and labour.

In contrast to weak trade and investment figures, there has been a meaningful rise in contracted projects involving Chinese firms in BRI countries. Such loans offer discounted financing in return for negotiated benefits, such as guarantees on project tenders or importing Chinese labour and capital. Loans may also be granted as part of resource swaps or sovereign guarantees. Turnover from completed contracted projects signed in between China and BRI countries grew by 9.

The pipeline also appears strong: Data on contracted projects serve as a proxy for figures on concessional lending, which are sensitive and largely unavailable. This has increased the level of risk in local investment projects, particularly in countries with poor economic management.

Although the above largely suggests that the BRI has been more rhetoric than action to date, there will clearly be a big push behind the programme in the coming years.

The BRI region is therefore promised a significant boost in the financing available for infrastructure development in the coming years.

We think that these investments will underpin higher trade volumes between China and the region. Besides trade in relation to project work, the establishment of a more integrated infrastructure will help to stimulate crossborder flows by lowering costs and opening up new markets.

In turn, stronger trade flows will underpin GDP growth and fiscal revenue creation. Despite being a promising initiative that we think is set to deliver regional economic benefits, we still believe that the BRI will fall short of its grand—although admittedly vague—aspirations. Issues relating to the trade deficit, credit risk and political tensions will complicate implementation. However, the perception that the project has a geopolitical dimension may ultimately make other countries hesitant to participate.

Skip to main content Register Log in. Our site uses cookies. By continuing to browse you are agreeing to our use of cookies. Review our cookies information page for more details.

Forecast updates Analysis Forecast Additional subscription required. Forecast updates Analysis Forecast Charts and tables Additional subscription required. Credit risk Charts and tables Additional subscription required. Limited trade impact, deficit risk Despite high-level Chinese support for the BRI, the economic impact of the project has been muted to date.

Investment has underwhelmed Promises of Chinese investment may help to offset concerns about the trade deficit. Concessional lending has accelerated In contrast to weak trade and investment figures, there has been a meaningful rise in contracted projects involving Chinese firms in BRI countries.

Push coming, but may fall short of grand ambitions Although the above largely suggests that the BRI has been more rhetoric than action to date, there will clearly be a big push behind the programme in the coming years.

Rapid urbanisation poses an urgent development challenge. Elections are routine but democracy is being scaled back. Featured analysis A sharper than forecast slowdown in China and the eruption of trade wars sparked by US policy shifts are key risks. Our baseline scenario anticipates a broadly pro-market agenda, but political pressure means that this is not guaranteed. The then secretary of state's visit was uneventful, abridged, and a perfect reflection of the US's Africa policy.