Cex dewsbury store phone number

19 comments

Liquid potpourri pumpkin

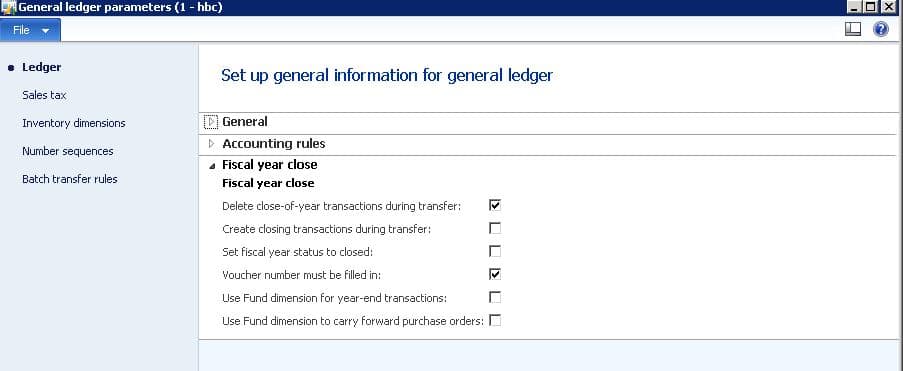

The transaction reversal process reverses the original transaction and all related transactions that were created when the original transaction was posted. Before you reverse a transaction for the first time, select a number sequence for the Transaction reversal and Trace number references in the Number sequences area of the General ledger parameters form.

You must perform the reversal where the transaction originated. For example, you cannot reverse from General ledger if the transaction originated in Accounts payable. You must reverse transactions in the correct sequential order. For example, if you applied a cash receipt to a Disposal - sale transaction, you must reverse the receipt settlement before you reverse the Disposal - sale transaction.

The following additional requirements apply when you reverse a transaction that affects a fixed asset:. For Provision for reserve , Transfer from reserve , or Disposal - sale type reversals, the fixed asset must have a status of Open or Sold. For Disposal - scrap type reversals, the fixed asset must have a status of Open or Scrapped.

For all other asset reversals, the asset involved in the transaction must have a status of Open. You can reverse the transfer of a fixed asset if it is the most recent transfer of the fixed asset.

You cannot reverse a transfer that occurred before the most recent transfer, and you cannot reverse a transfer that has already been reversed. For more information, see Transfer fixed assets. Fixed asset transaction reversals reset fixed asset field values to their previous values. For example, an asset status might be reset from Open to Not yet acquired , or the Depreciation periods field might be reset from to Invoices that are partially paid or settled fully paid cannot be reversed.

You must reverse the settlement first, and then you can reverse the transaction. For more information, see Reverse settlements. If you are working with a main account, click Posted on the Action Pane.

If you are working with a fixed asset transaction or depreciation book transaction, go to the next step. Select the posting date for the reversed transaction. The date cannot be before the original posting date or in a closed period.

The parameter settings for the module determine whether you must enter a reason for the reversal. For more information, see About financial reason codes. This site uses cookies for analytics, personalized content and ads.

By continuing to browse this site, you agree to this use. Office Office Exchange Server. Not an IT pro? United States English Sign in. The content you requested has been removed. Working with General ledger Process closing transactions overview Maintain ledger accounts.

Maintain ledger accounts Reverse a transaction. Settle transactions between ledger accounts. Cancel a ledger settlement. Perform a foreign currency revaluation. Revoke a reversed transaction. CAN Create sales tax entries for tax on rebates and self-assessments. ESP About equivalences between existing and new chart of accounts. MEX Create and post inflation adjustment ledger transactions.

SAU Enter Zakat information for journal transactions. SAU Adjust Zakat information for a voucher transaction. Collapse the table of content. This documentation is archived and is not being maintained. Reverse a transaction [AX ] Updated: May 5, Applies To: The following requirements apply when you reverse transactions: Reversals that affect fixed assets.

The following additional requirements apply when you reverse a transaction that affects a fixed asset: Note Fixed asset transaction reversals reset fixed asset field values to their previous values. Note Invoices that are partially paid or settled fully paid cannot be reversed. Note The parameter settings for the module determine whether you must enter a reason for the reversal. Depreciation effects with reversals.

Is this page helpful? We appreciate your feedback. Site Feedback Site Feedback. Tell us about your experience